Weekly’s new auto-build budget tool makes it easy to build a sustainable, realistic budget based on your current life.

Previously, when setting up a budget, you had manually input your regular income and recurring expenses by checking online bank statements or bills.

But now, when you are getting started during onboarding, Weekly simplifies the process by connecting to your bank to find your regular income and expenses automatically. This ensures your budget is accurate. You can review what Weekly has found, and with just one tap, add those items to your budget. Weekly also predicts your next transaction date and adds it to your bill calendar, so no more guesswork.

Here’s how it works.

#1 Connect Your Bank and Credit Card Accounts

The first step is to connect your bank accounts that receive your income or that you use to pay expenses. Weekly will find the expenses that you pay for on a regular basis and suggest them as recurring budget items.

Weekly will show you the number of recurring items it finds in each account.

Note: Don’t worry, Weekly is 100% secure and doesn’t store your bank username and passwords.

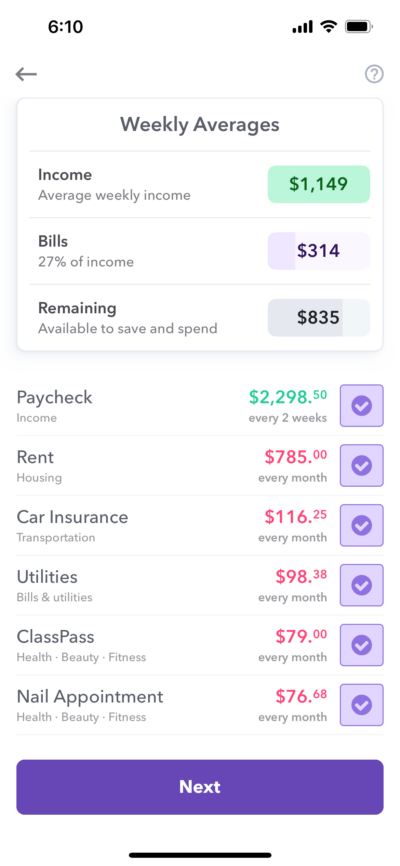

#2 Review and Tweak Your Expenses

Once you connect your bank accounts, Weekly will auto-populate recurring expenses. To make the most of your budget, take a moment to fine tune the items. By selecting the ‘+’ you can adjust:

- The name of the expense

- The amount (Weekly will calculate the average for you)

- The frequency

- The category

For example, if you send your roommate a payment via Zelle or Venmo to cover utilities, adjust the name of the expense to reflect that, something like ‘Utilities’ or ‘Power Bill.’ This will help you keep track of where your money is going and what it’s for.

Don’t forget to pick a fun emoji to match. After all, the more exciting your budget looks, the more likely you are to enjoy it!

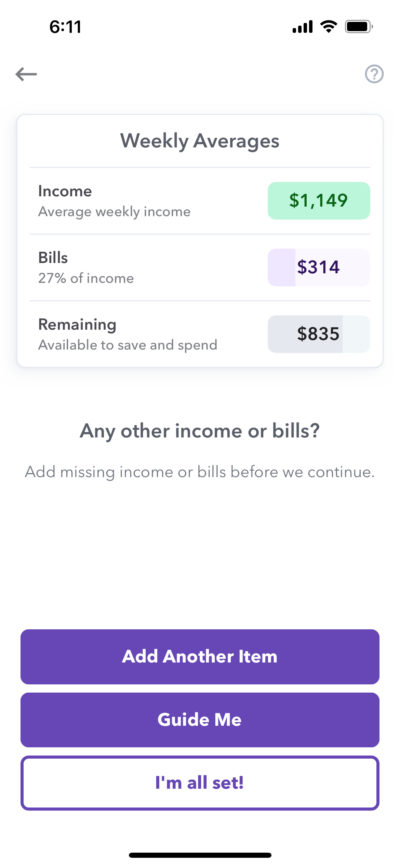

#3 Add Any Additional Income or Recurring Expenses

If auto-build didn’t catch a recurring payment, you can add it yourself. ‘Add Another Item’ allows you to manually create a budget item.

‘Guide Me’ is great for adding multiple items if you want to be prompted on common categories of expenses. If you have already added an item, it will show up in the guided walk through.

Tips to Making the Most of the Auto-Build Budget Feature

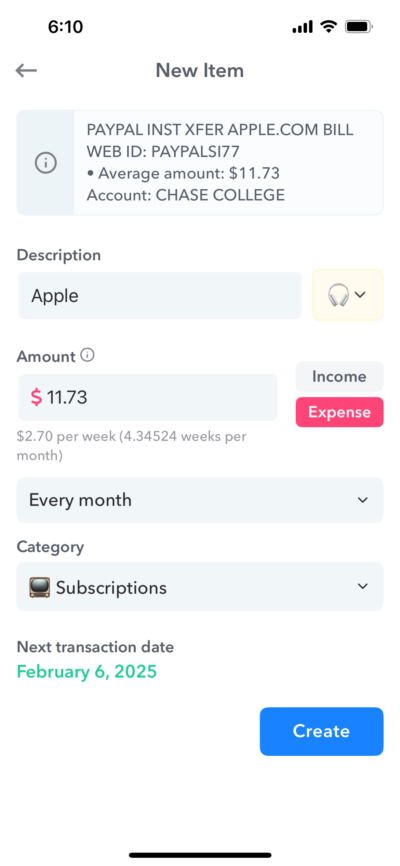

Connect All Your Bank Accounts

Make sure to connect all your accounts, even the ones that have the small expenses. The more connections, the more accurate Weekly can be.

For example, let’s say you have an account that has one small recurring monthly payment, like $11.73 to pay for Apple Music. You’re helping yourself by connecting that account to Weekly. Yes, one $11 payment isn’t a huge deal to omit, but $11 once a month for years can add up. Do yourself a favor and paint a clear picture of your financial situation by adding all your accounts.

Be Real with Yourself

We all have things we’d like to improve about our spending habits, but it’s important to add and not omit regularly occurring expenses based on what you spend currently, not what you’d like to spend in the future.

94% of users say Weekly has improved their finances. As you use the app, if your habits change, you can adjust your budget then. If a bill amount changes or is no longer necessary, you can always delete it later on.

Conclusion

Weekly’s auto-build tool is a great way to kickstart building your budget. You can use it to paint an accurate picture of what your recurring expenses are by connecting all your bank accounts, customizing budget items, adding all your expenses, and filling in any gaps.

Doing all these things sets you up for success. It gives you the most accurate ‘Safe-to-Spend’ amount, allowing you to confidently spend and stay within your budget.