The fun of budgeting is to see your funds grow and feeling more confident and secure in your spending habits and lifestyle. As you move through your weeks you may want to transfer between Funds, out of your Safe-to-Spend to a Fund or from a Fund to your Safe-to-Spend to keep everything in order. You can do that with Weekly’s transfer functionality.

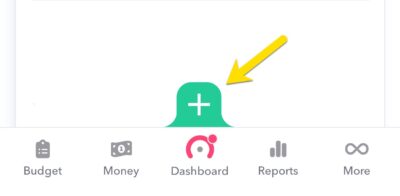

To find the transfer money functionality go to the Dashboard then hit the plus sign in (+) button at the bottom of the dashboard.

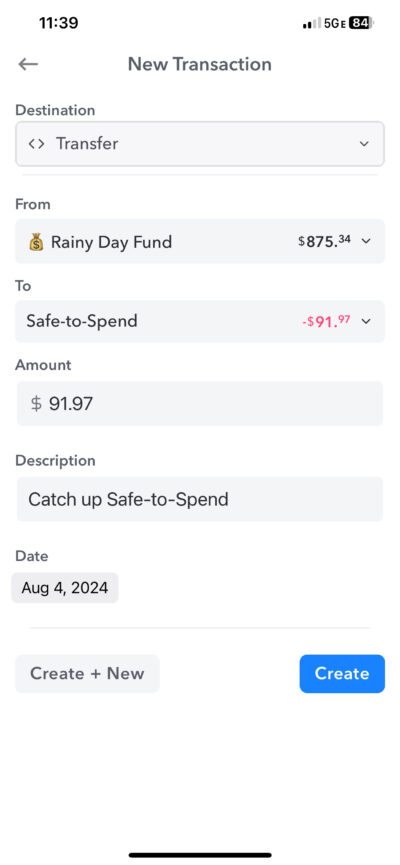

On the next screen select “Transfer”.

Let’s examine three use cases for using transferring: transferring from fund to fund, transferring from Safe-to-Spend to a Fund, and then transferring from a Fund to your Safe-to-Spend.

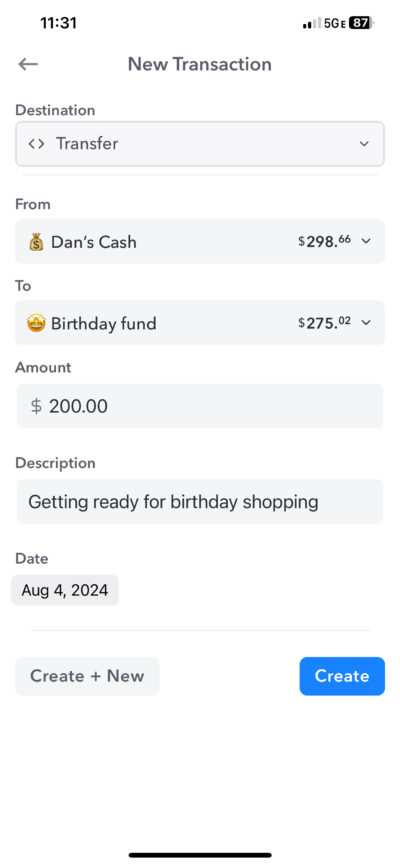

Fund to Fund Transfer

Transferring money from one Fund to another can be useful if you find you have saved enough in one fund and want to add extra money into another. For example, let’s say you had $298.66 saved up in a fund called “Dan’s cash” and $275.02 in a fund called “Birthday party” but wanted to add an additional $200 from your cash to pay for the party. You could do that. You would go to the main Dashboard screen and tap (+) sign at the bottom of the dashboard, then select transfer at the top of the next screen. Enter in the “From” (which in this case is “Dan’s cash”) and the “To” (which in this case is “Birthday party”) and the amount you want to transfer and tap “Create”.

After the transfer. the balance in the Birthday Party fund would be $475.02 and the balance in Dan’s cash would be $98.66.

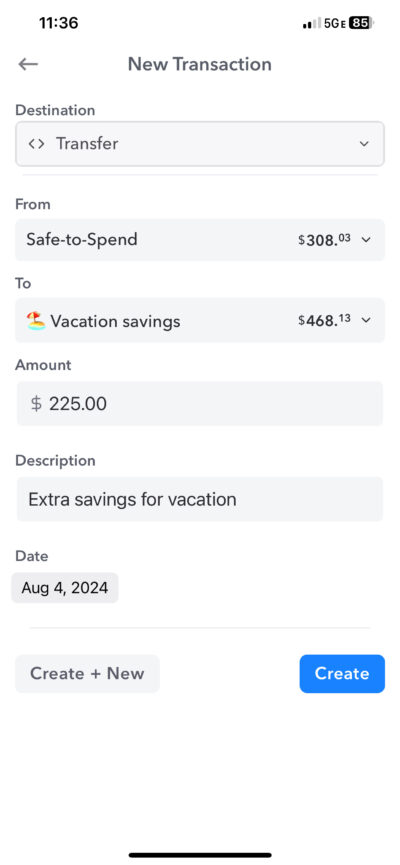

Safe-to-Spend to Fund Transfer

Sometimes you might be doing great in your Safe-to-Spend and want to make a one-time contribution to a fund. You don’t have to wait until the week ends; you can do this at any time using the same transfer method.

So let’s say it was a good week and you had $308.03 in your Safe-to-Spend and wanted to add $225 of that into a saving fund called “Vacation savings”. You could create a transfer transaction using the same method described above (hit + at the bottom of the dashboard and then select “Transfer” as your transaction type), select money from “Safe-to-Spend” to “Vacation savings” then put in the Amount ($225) and a description.

Fund to Safe-to-Spend Transfer

The final use case for transfers is to transfer from your Safe-to-Spend from a fund. So let’s say for example, you were negative in your Safe-to-Spend balance and wanted to zero out that negative balance using money from a rainy day fund you had created. You would create a transfer transaction but this time you would select from “Rainy Day Fund” and to “Safe-to-Spend”.

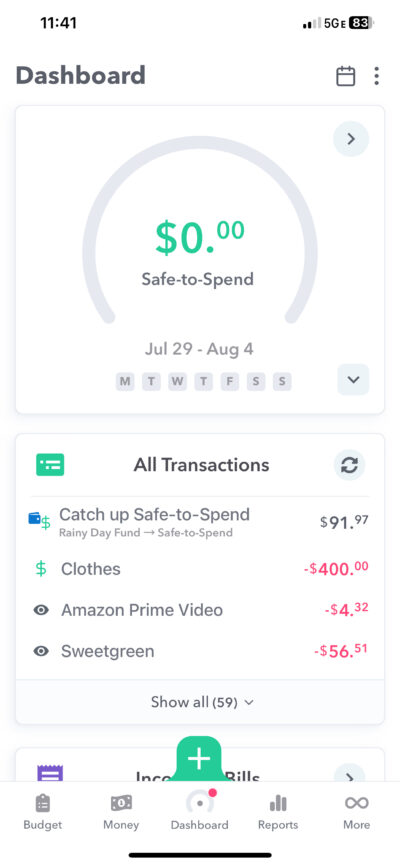

What transfers look like after they are added

Once a transfer is added to your account it will appear with a description and two icons representing the transaction. Funds are represented by a wallet and Safe-to-Spend by dollars sign. If you transferred from Fund to Safe-to-Spend you will see a wallet icon and a dollar icon. If you transferred between two funds you will see two wallet icons. Also the transfer will be described below the icons.

If you want, you can edit them after you make them my tapping on them and updating the transaction.

Summary

Transferring money between Funds and between your Safe-to-Spend and Funds allows you to adjust the balances in the app based on what is going on in your personal finances. Growing your Fund balances from positive Safe-to-Spend is one of the joys of budgeting but it can also be necessary sometime to adjust your Fund balances or cover Safe-to-Spend shortfalls. Using Weekly’s transfer functionality allows flexibility to adjust your balances to keep on top of your priorities.