Many people have income who’s amounts vary but they still want to feel confident in having a set amount to spend each week knowing that their main bills are covered. Or they may get additional income they want to save or have for extra spending money during the week. Here are some questions we have seen from our users.

- “What do you suggest we do with random check deposits such as side money deposits?”

- “Just curious on best practices to handle intermittent income (I sell products online and the income amount swings wildly) – but I also have a steady payroll deposit.”

- “I am a 1099 commission based real estate agent. How can I enter commissions?”

- “My husband works irregular hours. I put in a recurring income for him of $240 but his check yesterday was for $300. Is there anyway to reflect that extra $60 in our safe to spend?”

These are all examples of irregular or intermittent income.

Irregular or variable income can include:

- Non-salaried wages – If your primary source of income is hourly wages, the amount of your check can vary based on scheduling.

- Overtime hours – You may work overtime hours at your non-salaried job that provides extra money

- Side hustles or “gig economy” work – Uber, Instacart and the like or selling things online.

- Bonuses – You may receive bonuses at work

- Passive Income – If you have passive income streams such as rental income or dividends or interest.

Here’s how you can handle irregular or variable income in Weekly.

How to handle irregular income

Step 1 – Use a Guestimate to Create an Income Budget Item

If you are counting variable income for your monthly bills or day-to-day spending, the first step to incorporate it into your budget is to create a budget item based on an estimate of what your income from that source will be but estimate low. A good way to do this is take the average of your last 4 – 6 transactions and then reduce that amount by some percentage based on your comfort level – say like 10 – 15%- and then add that amount as an income budget item.

So if you averaged weekly income from your hourly wage job was $525, then set up an income recurring budget item $446.

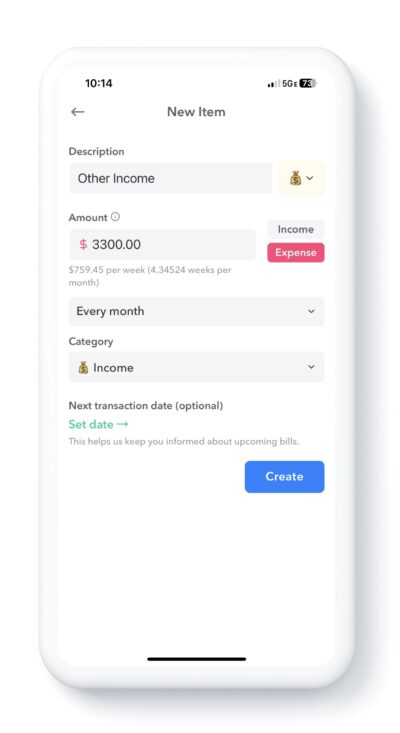

In the example pictured, we are creating a budget item for $3300 of monthly income which was slightly less than the estimated amount.

Step 2 – Create an Adjustment Transaction

When the actual transaction comes in, then use Weekly to create an adjustment for the difference. If the income is more than what you expected, you can add the extra to your Safe-to-Spend your you can apply it to a Fund balance if you want to set it aside for future use.

If the amount is less than your guesstimate, you will need to take the money you are short from your Safe-to-Spend or a fund.

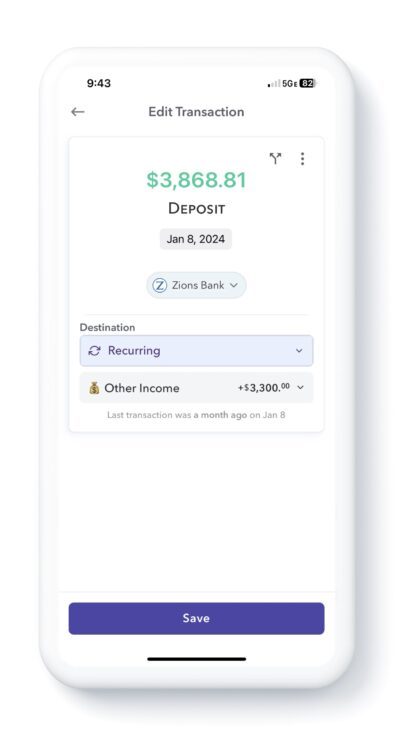

In this picture, the transaction that came in for the income item budgeted for $3000,00 was $3,868.81. There is a positive difference of $568.81.

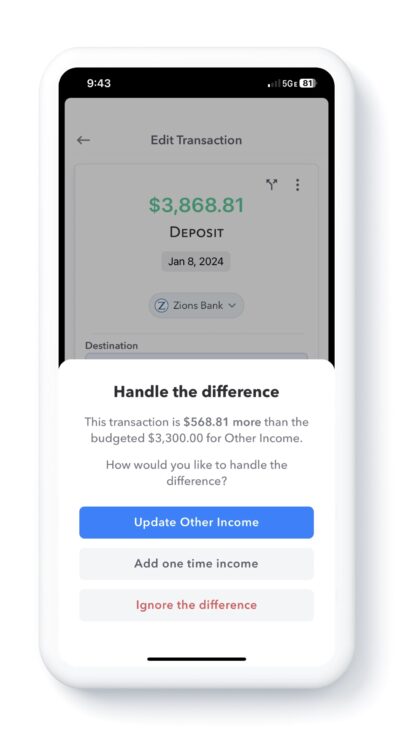

Weekly prompts you to handle the difference between these transactions.

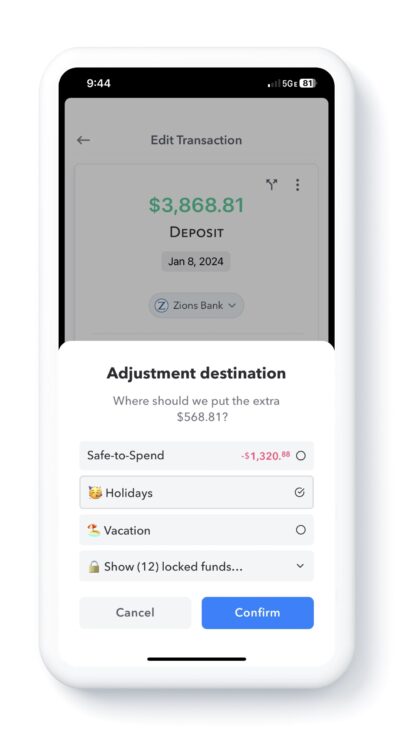

Then you can choose where to put the money – ie: what the adjustment destination should be. You can add it to your Safe-to-Spend or put it into a Fund.

A Couple Special Notes

If you want to, you can adjust the amount of the budget item by tapping “Update Other Income” but this has the downside of adjusting next week’s Safe-to-Spend and if the next check is less than the current one, then your Safe-to-Spend will get decreased when the next check arrives making your Safe-to-Spend number a little less “safe”.

If you are not counting on this variable income to fund your monthly bills or weekly discretionary spending, you can treat everything that comes in from this income source as extra and choose the Destination as a Fund or put it in your Safe-to-Spend (or split it between Safe-to-Spend and Fund(s)). To handle the transaction this way you can just have no budget item for this extra income or, if you want to track income from the source, create a budget item but put the expected income as $0 so it doesn’t add to your Weekly Spending Limit and your Safe-to-Spend.

Conclusion

Weekly is equipped to help those with variable income keep a budget that smooths out the rollercoaster of budgeting and brings financial peace-of-mind.