Budgeting should be simple — just spend less than you earn, right? Unfortunately, most budgeting tools overcomplicate things and lose their focus on making things as easy as possible for you, the budgeter!

Weekly introduces an entirely new budgeting approach. It’s designed to help you understand what you can spend without drowning you unnecessary with extra tools and information. Here are a few ways we’re redefining budgeting.

Typical Approach to Budgeting

- Give every dollar a job

- Operate on a monthly basis

- Constantly shuffling money between categories

Weekly’s Approach to Budgeting

- Operate on a weekly basis

- Use a single weekly spending limit

- Categorizing transactions to see spending trends

Weekly introduces budgeters to an entirely new system with only two steps. First, enter your recurring income and expenses. Second, track your day-to-day spending. Let’s break those steps down to give some more color.

Recurring Income and Expenses

Recurring income and expenses are predictable. They tell you what money is coming in and what money has already been spent. These regular items all have a few things in common:

- They occur at regular intervals

- They generally have a consistent amount

- You may be using auto-pay to pay them

Some common examples of recurring expenses are mortgages and car payments. Weekly makes entering these items easy by guiding you through common expenses like housing costs and subscriptions. This helps ensure you’ve included all your recurring expenses. These regular expenses are subtracted from your regular income to determine your weekly spending limit.

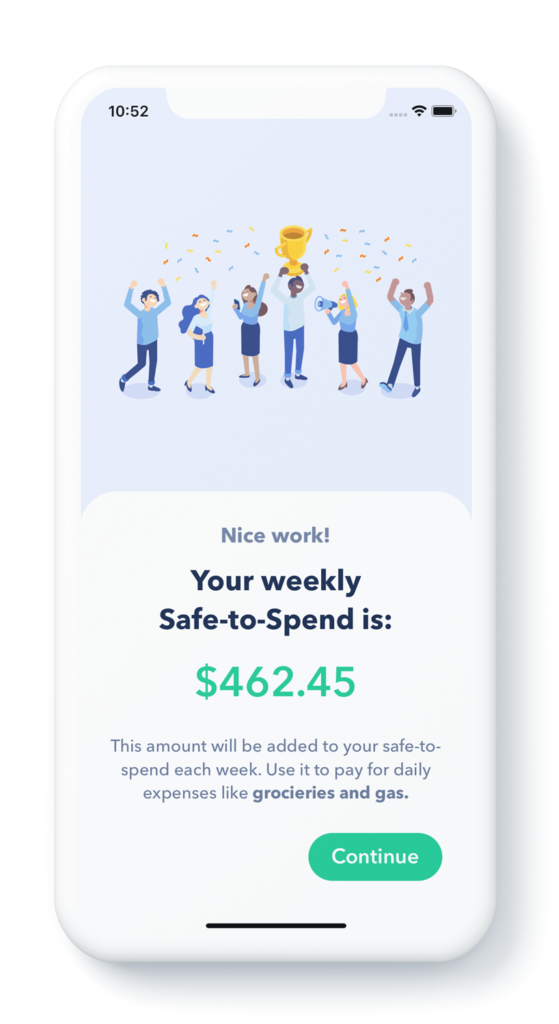

Your weekly spending limit is simply the weekly average of your recurring income minus your recurring expenses. This number is calculated for you once you’ve finished setting up within the Weekly app.

Track Your Day-to-day Expenses

Most budgeting tools give you a list of categories and ask you to determine how much you’re going to spend within each one during a month. We’ve all been there — trying to figure out how much we might spend on groceries or gas in a month. This process is both impossible and unnecessary.

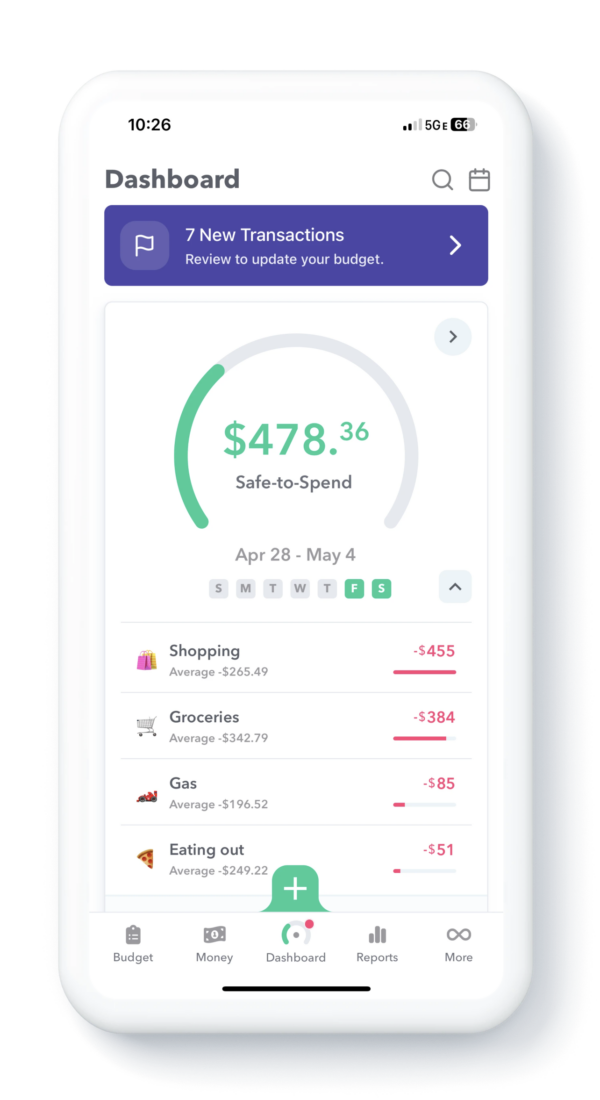

The beauty with Weekly is that once you’ve accounted for your recurring expenses you’re free to spend the rest of your money however you like. If you spend more money this week on eating out, and less on groceries and clothes, that’s totally fine — as long as don’t spend more than your weekly spending limit. However you can categorize your weekly spending if you like so that you can uncover spending trends. We make the categorization process painless and dare-we-say-it even fun!

You can track your daily spending directly in the Weekly app. Each purchase will decrease your Safe-to-Spend for that week. Any remainder (or deficit) at the end of the week can be rolled into the next week’s Safe-to-Spend. Unexpected income like birthday money or a bonus or non-recurring income like tips or commissions can also be added to your Safe-to-Spend.

Operating on a Weekly Basis

With a name like Weekly, it’s not surprising that our budgeting system uses weekly intervals. A week is short enough to make managing your money feasible. Knowing that you have a set amount to spend each week can help you decide if you would rather go out to the movies or buy some new clothes. With Weekly, you can see how much you have left for the week, so it’s easier to protect yourself from overspending.

Conclusion

When budgeting gets too complicated, the likelihood of failure increases. Most tools today make budgeting harder than it needs to be. By understanding what expenses you have already committed to, Weekly gives you a single weekly spending limit. This simple approach removes the noise and allows you to spend your money in a way that brings you joy. Weekly budgeting helps keep you on track and simplifies your life.