When setting up your budget, you may want to set aside money for an emergency, a holiday, a vacation or to purchase something big like a home. With Weekly, you can track the money you have set aside for these purchases using funds. Funds allow you to put money away automatically and check your progress over time. When the time comes to use your savings, you use purchase items directly out of your fund – keeping your Safe-To-Spend for day-to-day purchases separate.

Here’s how Funds work and how to set them up.

Create a Fund

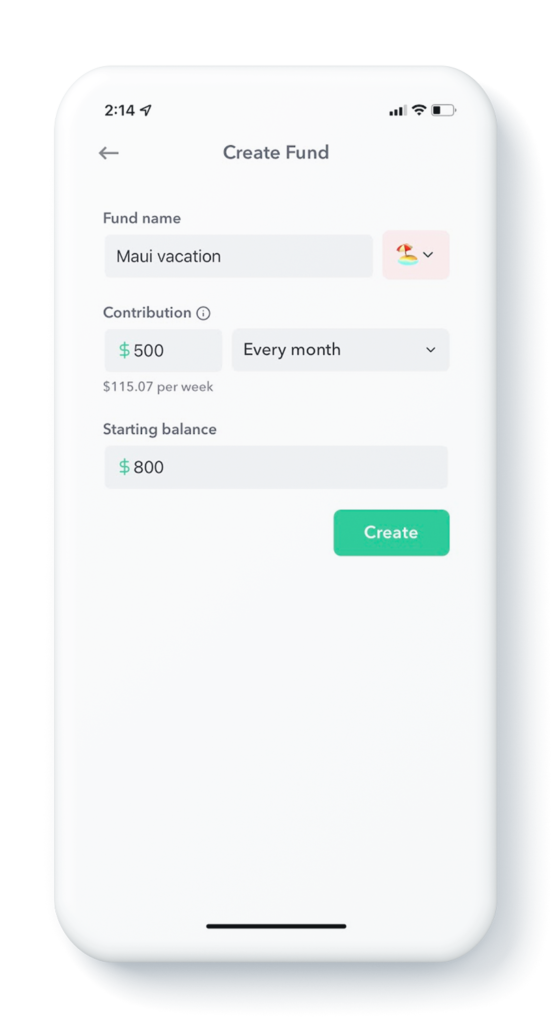

You can think of a fund as a bucket of money that you save to and spend from. You can define how much money you want to add and how often. Weekly will convert this into a weekly amount and automatically add money into that fund each week.

So for example, you were planning a trip to Maui for vacation and you wanted to establish a vacation fund and you wanted to contribute $500 every month to the fund. You would create a fund called “Maui vacation” and set the Contribution to “$500” and the interval to “Every Month”. Weekly will automatically convert this into the equivalent weekly amount of $115.07 and at the start of your week Weekly will automatically take this out of your Safe-To-Spend and build up your fund!

If you are coming into Weekly having already saved some money toward a goal, you can start your fund with the amount you have already saved. You would add this amount into your “Starting Balance”. So, using the example above, let’s say you came into Weekly having already saved $800 in your vacation fund, you would simply input $800 into your “Starting Balance”.

Note: you can set up multiple funds to save for multiple things. So for example, you can save for an emergency fund and a birthday at the same time.

For more information, see our guide on “How to create a fund”.

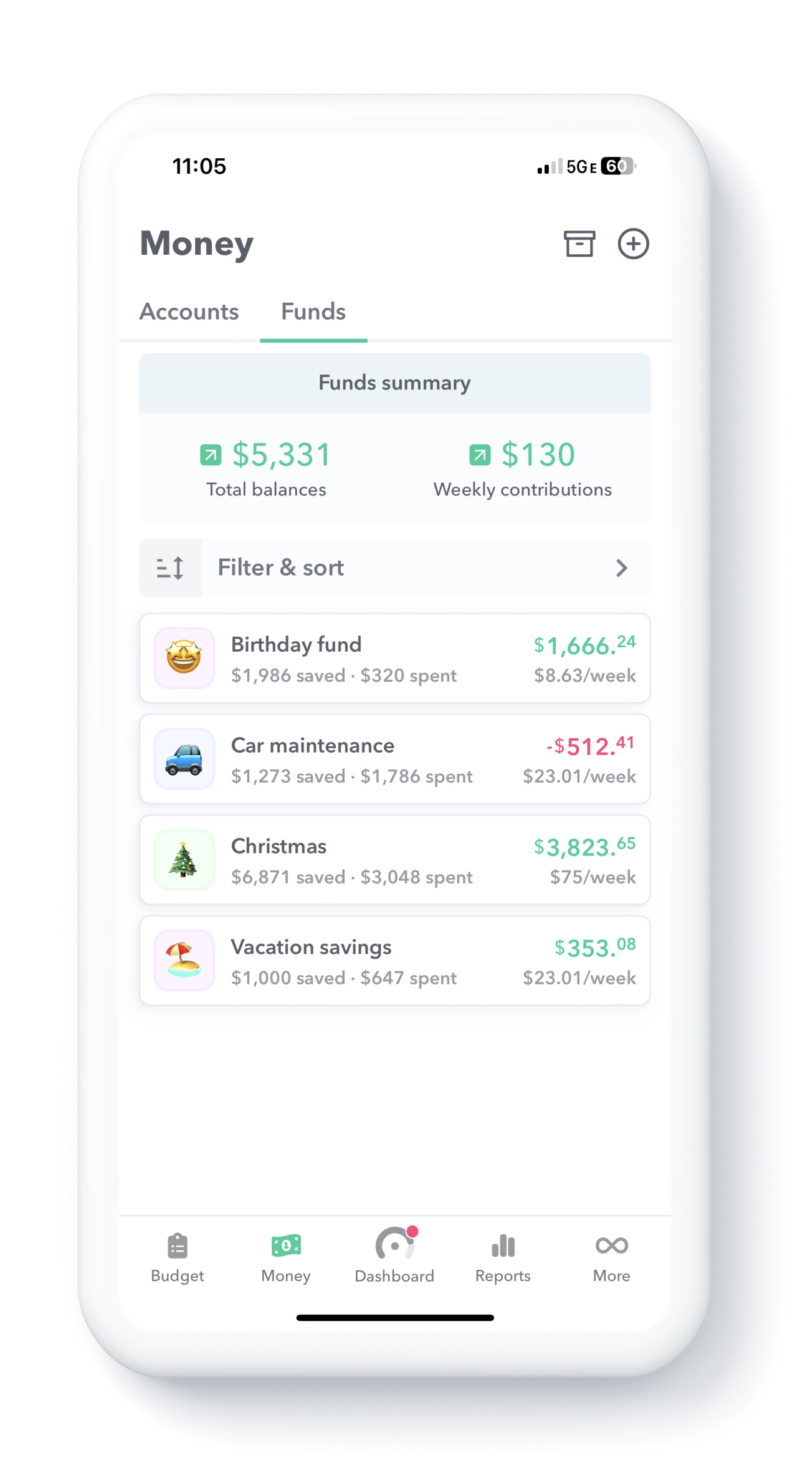

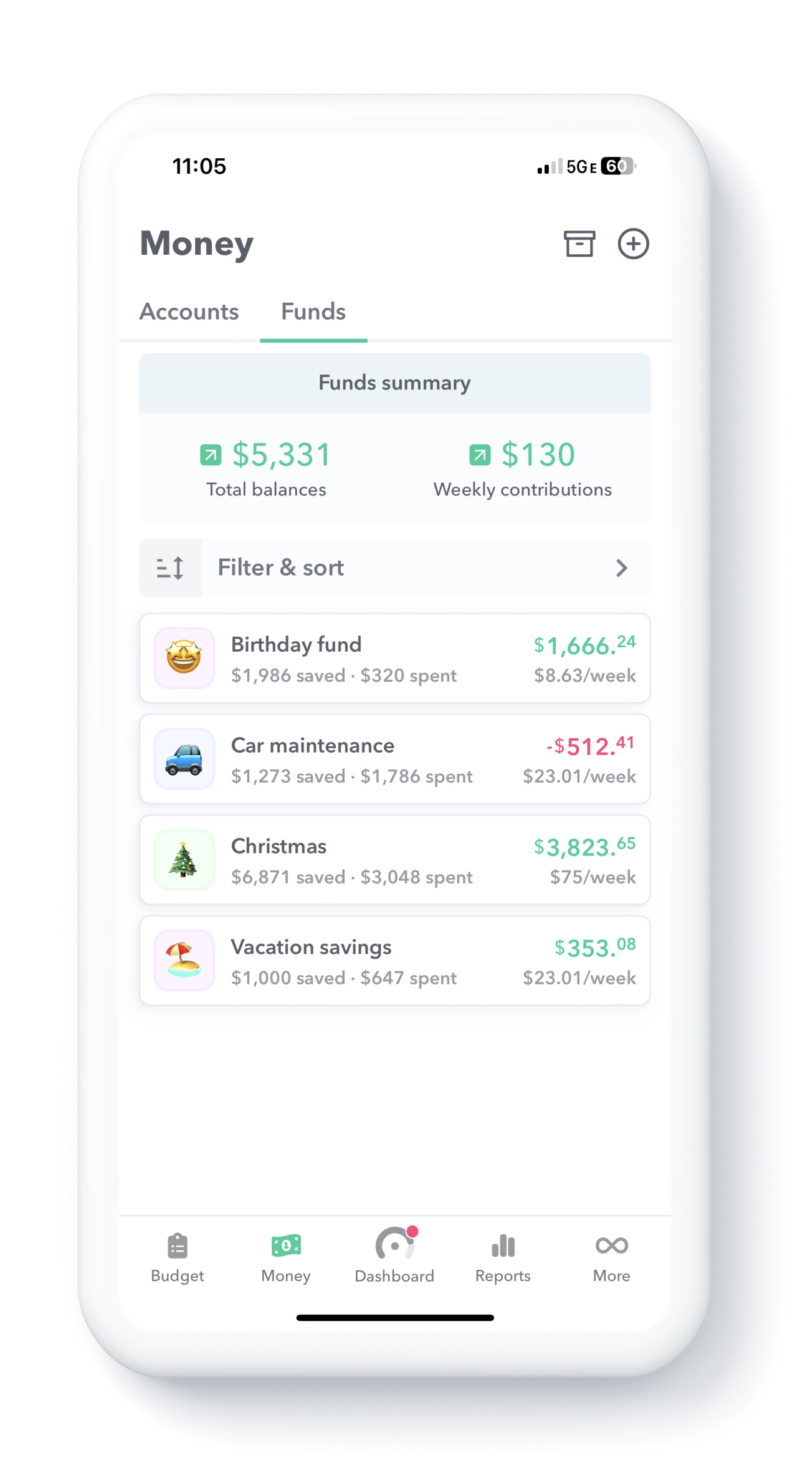

Track Progress on Funds Overview Screen

Once you have set up your Funds, you can track how much you have saved on the Funds Overview screen. (To find this screen, swipe right on the Tracker page and hit “Funds”.)

The Funds Overview screen shows you the name of the fund, the current balance of money in the fund, the amount you have saved in the fund over time, how much you have spent out of the fund and how much is being contributed to the fund each week.

All your funds will be listed on this screen along with the total amount you are saving in all your funds.

For example, on this fund screen you can see this person is saving $8.63 a week into a “Birthday fund” and they have saved $228.63 to date and nothing has been spent out of a fund yet. Also take a look at the Christmas fund. This screen shows this user has saved $1,968 but spent $2,412 so this fund is running a deficit of $-453.23.

For more information, see “How do I see all my funds?”.

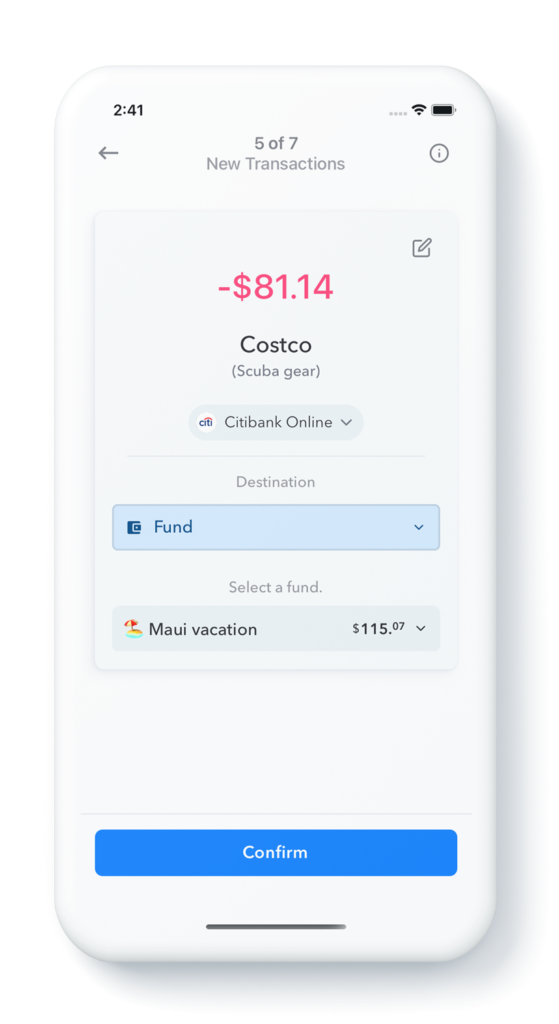

Spend Out of a Fund

When the time comes to use the money in the fund to purchase the thing you have been saving for, you can do so on the purchase review screen. Instead of paying for the item out of your Safe-To-Spend, you choose the fund you want to spend out of. This reduces the amount in the fund but allows you to keep spending for day-to-day expenses out of your Safe-To-Spend.

Using our “Maui vacation” example, let’s pretend you bought some scuba gear in preparation for your trip from Costco. When that transaction came in you would select “Fund” from Destination and then select the “Maui vacation” fund. This withdraws the money from the fund and keeps the money for the scuba gear from being withdrawn from that week’s Safe-To-Spend.

For more information, see “How to use the funds for purchases”.

Note to Current Users: Converting Savings Goals to Funds

If you have previously set up saving goals, Weekly will prompt you to migrate these to funds. The difference between creating a savings goal recurring expense (the old way) and a fund (the new way) is that in the old way, the money that was going into the savings goal was not tracked in Weekly and if an expenses came through related to something you had already saved for, you would just ignore that expense. The amount you had saved for your goal would essentially have to be tracked outside of Weekly. Now with funds, you can track your savings and inside of Weekly, see exactly how much you have saved, and when the expenses come through you can subtract it from the fund.

Conclusion

Funds are a way to save for multiple types of savings goals. It puts money aside automatically on a weekly basis. You can track how much money you have saved. When the time comes to purchase items that you have been saving for, Weekly allows you to withdraw from the fund to pay for these items, keeping you Safe-To-Spend free to be spent on your day-to-day expenses. This keeps how much money you have to spend clear and increases your peace-of-mind.