Put an end to “Doomsday” meetings.

Budgeting with a spouse or partner? Is there anything more fraught? No one likes to face the limits of their money and doing so with someone else is as treacherous as crossing “No Man’s Land” in 1918.

But Weekly can help. In fact, budgeting with a spouse is a core part of Weekly’s origin story. As the story goes, Dan was budgeting with his wife Anna. Like a lot of couples, they tried different apps and spreadsheets or the classic “ignoring-it-all-together” but nothing seemed to make it better. At the end of each month, Dan and Anna would sit down and review their spending and it was painful. They started calling it “Doomsday”.

At the end of another dismal doomsday, Anna said to Dan, “What do you expect me to do with all this information? I still don’t know what I can spend right now.” That’s when he realized he was approaching budgeting all wrong.

That is how the concept behind Weekly was born: focus on a week’s time frame, stop over-categorizing, track a simple Safe-To-Spend, and sync with financial institutions in real-time.

But what are the actual mechanics behind making Weekly work for you and your spouse? This article describes how to set up Weekly to share with a spouse or partner and avoid your own personal Doomsday meetings.

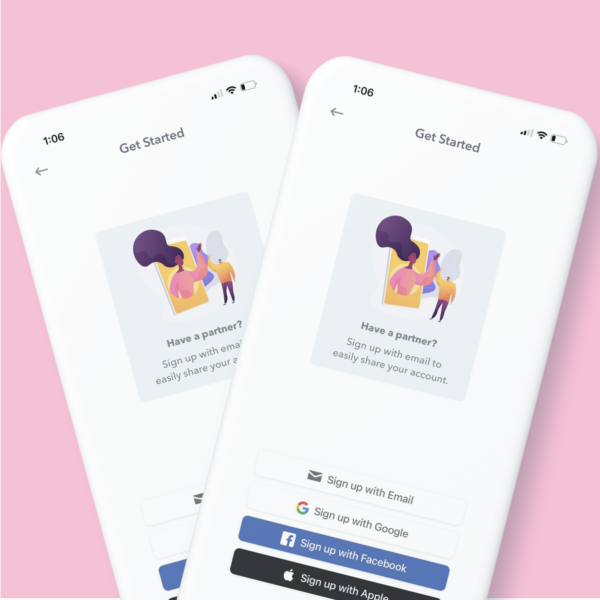

Create Your Account Using a Login You Can Share

With one subscription, you can install and login on multiple devices, but you will need to share a login.

For Accounts created using an email login

If you have created your account using and email address, then simple share your email address and password with your partner. (The password you set does not have to be the same as your actual email password.)

For accounts that use Google, Facebook, Apple ids to login

With the social logins (Google, Facebook and Apple) it can be harder to share those so we have a feature that allows you to add an email address to your account which you can then share with your partner or spouse to allow them access to Weekly.

Here’s how to do it.

- Sign in with your social login (Google, Facebook or Apple)

- Go to “More” on the bottom navigation.

- Tap the circle on the top right with a letter in it to bring up your profile.

- Tap the button that says “Add Email Login”. From there you can add an email and password.

- A success message will be displayed. Clicking “Done” shows the Profile page, the email icon next to the original social icon.

- You can login using the new email/password combination. Send this login to your partner or spouse.

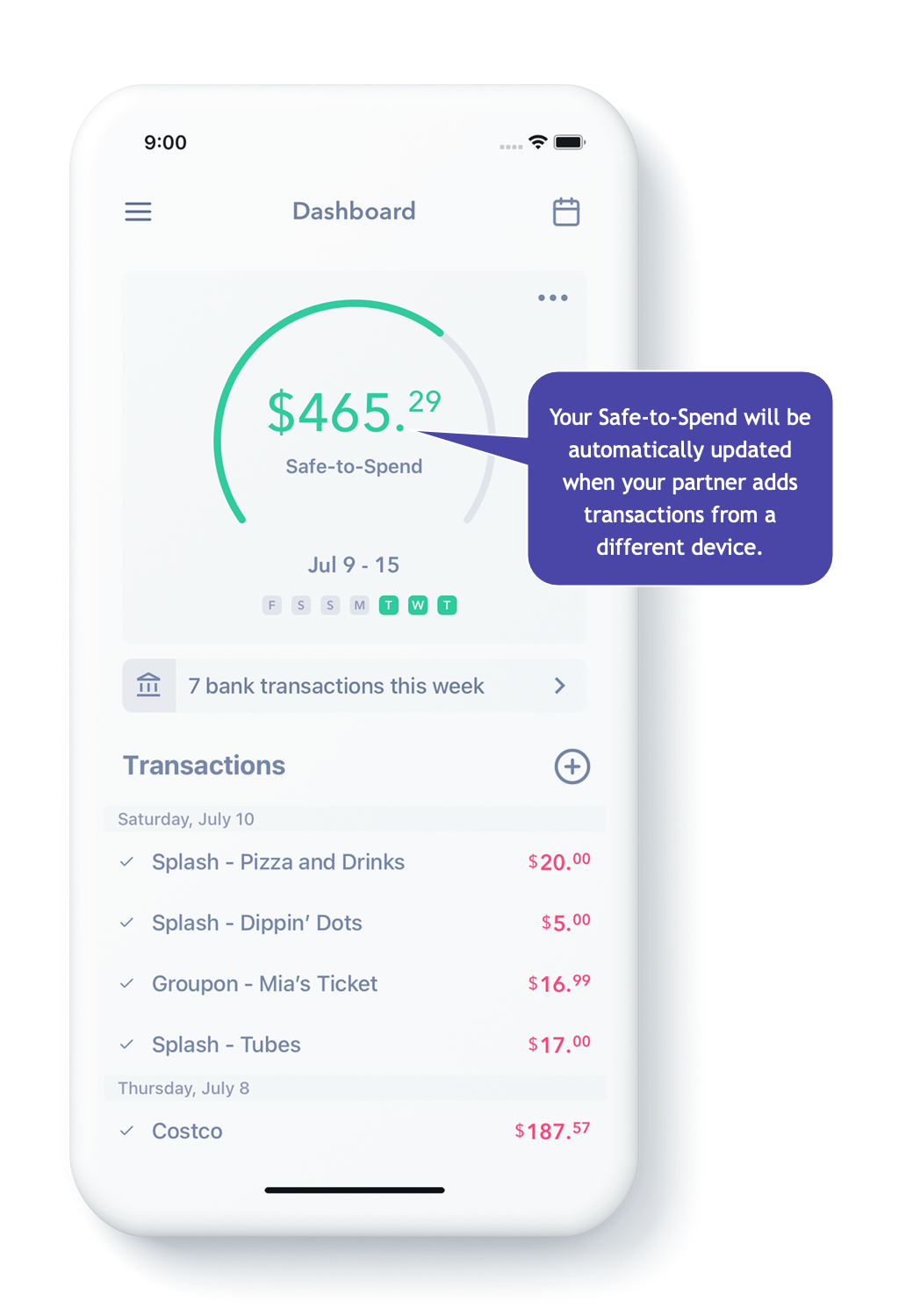

Seeing Your Safe-to-Spend Together

Now when you login to your account from either your or your partner’s device you can see how much is left in your Safe-to-Spend as well as all the other details like how much is in each of the funds you have set up. As your partner reconciles transactions into your account, you will see the Safe-To-Spend or fund balances updated automatically.

Congratulations! You now are in sync with your partner.

This is a huge win for people, you are now on the same page on exactly where you are at with your day-to-day expenses. You can wait for transactions to be imported into the app from your financial institution or if you want more immediacy you can add them in manually; either way your spouse’s view into how much money is left will be updated.

Setting Up Funds to Keep Track of Individual Expenses (Optional)

So now that you have access to the numbers, if you want to, you can set up funds for yourself and your partner for individual spending.

So let’s say for example, there is a couple named Kim and John using Weekly to budget. And let’s say Kim and John allow themselves $250 a month of “fun money” to spend on their own. You can manage this with Weekly by setting up a fund called “Kim’s Fun Money” and a separate one for John called “John’s Fun Money” and set the contribution to be $250 per month into each fund which Weekly will convert to the weekly amount of $58.14.

Then as transactions come in that are spent by Kim and John on their individual fun, instead of being withdrawn from the regular “Safe-to-Spend” both John and Kim can map these expenses to their own fun money fund. This way they can keep track of their individual spending separate from their collective spending.

Conclusion

Weekly was started as a tool to help two people keep in sync with where they were at with their spending and it’s one of its key benefits. And with the Funds, spouses can also track individual spending and keep it separate from the spending they are doing together.

By giving both partners access to the Safe-to-Spend number, Weekly can eliminate the “Doomsday” meetings and keep couples happier with their money.