There are a variety of reasons people want to set aside money. Many people are trying to save up money for an emergency fund. Some people are saving for a big one-time item like a downpayment on a home or for big events like Christmas or a vacation. But there can be other reasons people set aside money that have to do with day-to-day management. For example, some couples may want to set aside money into separate fun money accounts so they can keep track of their individual spending separately. Finally some people like to set aside part of the Safe-to-Spend specifically for gas or groceries.

In Weekly we created the concept of Funds to help you reserve money for specific purposes. Funds are very flexible and can be used for all these various purposes outlined above.

In this article, I will describe how you can use Funds to manage different personal finances scenarios.

Related Articles |

Creating an Emergency Fund

It is a great idea to have some money put away for emergencies. You can use Funds is to create an emergency fund to have a little money in the account in case unplanned expenses come up.

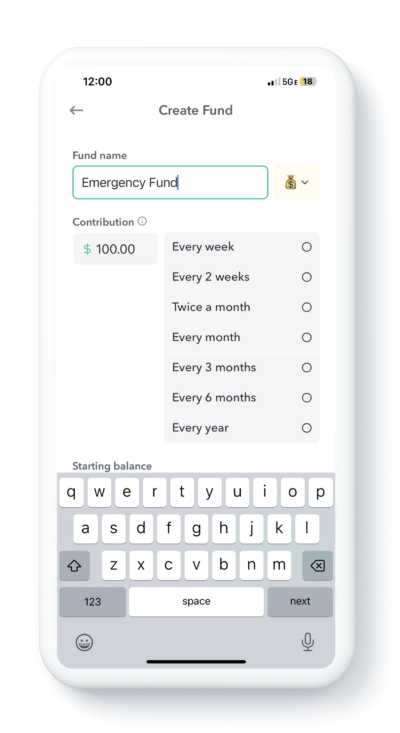

To set up an emergency fund, the first step is to decide how much you want in the fund, and then how much you can afford to contribute and how often you can contribute it. So if you wanted to save up $1,000 emergency fund and you could afford to contribute $100 a month to it to build it up, you would tap on (+) to create the fund and then put in $100 every month.

Whatever interval you choose, Weekly will figure its corresponding weekly amount and deduct this contribution amount from you weekly spending limit before putting money into your weekly Safe-to-Spend.

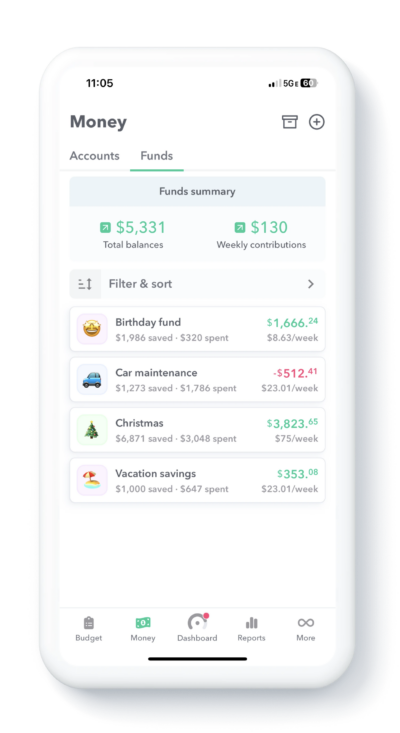

After you have set up the fund and contribution amount, you can monitor it on the Funds screen. (To see the full list of Funds, tap “Money” in the bottom navigation and the “Funds” tab.)

Once you hit the $1,000 you edit the fund and set your contribution amount to $0 which will stop your contributions and boost your Safe-to-Spend.

Car Repairs and Medical Expenses

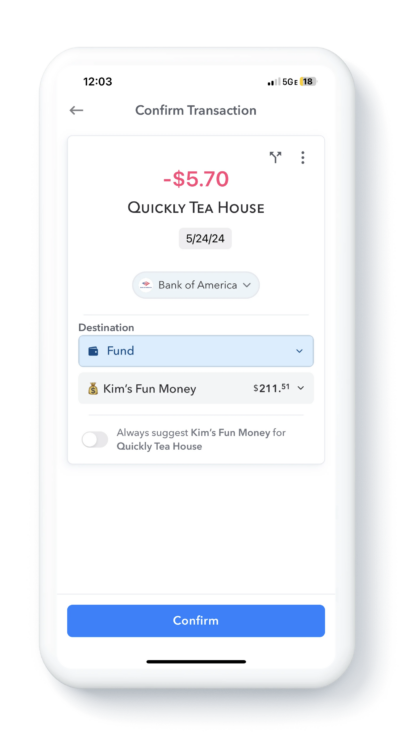

You can use this concept to create other kinds of funds that are for other types of one-off kind of emergency one-time expenses – like car repairs or medical bills. You can follow the same process to setup the fund – decide how much you want to save up and how much time you want to save it in and then divide them and create contribution amount that matches the two. If you ever had an expense related to these funds, when the transaction happens you can expense it to the fund then gradually “fill up the fund” again by editing the contribution amount or contribute to the fund with a transfer, such as transfering in a future positive end-of-week Safe-to-Spend balance.

Separating Fun money between you and your partner

You may share a budget with a partner but want to keep track of “fun money” separately. You can do this by creating a fund and then contributing part of your income to it and then when the fun money comes in you can take it from the appropriate account so you can each see how much you have spent or have left to spend having fun.

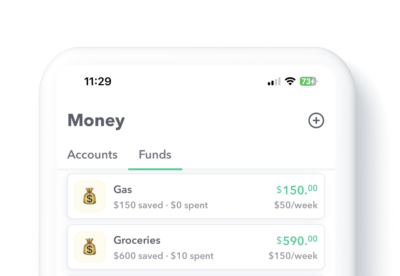

Tracking Gas and Groceries separately from your Safe-to-Spend

You can track Gas and Groceries in separate funds to make sure that money is set aside for them. So, for example, if you had a $600 weekly spending limit and wanted to make sure that you had at least $150 a week to spend on groceries, you could create a fund called “Groceries” and set a $150 a week. Then when you go to the grocery store you can take the expenses from your fund instead of your Safe-to-Spend. You can keep track of your grocery fund balances on the Funds page or the Dashboard under Recently Used Funds (if you have used them recently). Your fund will have a rolling balance, meaning you have money left over in gas or groceries at the end of the week, the next week’s contribution will be added to that left over balance the next week. Likewise if you overspent gas groceries next week’s deposit will be added to the previous week’s deficit making the starting total for the week lower.

Saving for a Vacation

So you may be saving for a goal for the future, like saving for a vacation or for a downpayment on a car or home. The process is similar for saving up for an emergency fund or a car repair fund, decide how much you want to save, what date you want to save it by and then figure out the contribution amount. So if you want to save $3,000 for a vacation in 6 months, you can set your contribution to be $500 a month. Once you hit the $3,000 or can set you contribution amount to $0 and then your weekly spending limit will be increased. If you already have something saved for vacation you can add that in as the “Starting Balance“.

Saving for Christmas

You can create a fund for Christmas and set the contribution amounts to a year. So if you want to have $3,000 set aside for Christmas each year, create a “Christmas” fund and set the contribution amount to $3,000 a year and it will change it to its corresponding weekly amount ($57.53 / week). But make sure to account for any time that has passed. So if it is June and you want to save $3,000 for Christmas, make sure to set aside $3,000 every 6 months. Then you will have $3,000 for Christmas when Christmas rolls around. Then when the new year starts, change it to $3,000 a year for the next year.

Tracking Allowance for Kids

Another creative use of funds is to track kids allowance. You can contribute to it automatically out of your weekly spending limit or if you want you can transfer money to it from your Safe-to-Spend when certain chores are done. When the kids want to use the money you can use your normal credit card and assign the transactions to their fund — and if their purchase was part of a larger shopping transaction, say a toy was added to your trip to Walmart, you can use a split transaction to take their item from their allowance while taking the rest from your Safe-to-Spend.

If you want to give cash allowance, you can take the cash from the bank and then when the expense comes in you would take it from their allowance fund.

Conclusion

At its core, Funds are a way to set aside money for a specific purpose and track spending against that purpose. Funds can be used for diverse purposes – from saving for emergencies, to making sure there is enough money for important day-to-day expenses like gas and groceries. Take advantage of Funds to get your household budget in order or save for your personal goals.