Sometimes a bank transaction includes multiple charges that you want to categorize separately. Weekly supports splitting transactions so you can categorize them accurately. The split feature supports:

- Splitting a transactions as many times as you’d like

- Assigning each transaction to any destination (Safe-to-Spend, Fund, Recurring, or even Ignored)

- Each split transaction will show in the proper reports and search results

- Editing and deleting split transactions

Splitting transactions can be useful when:

- You have a single purchase with items that you’d like to categorize separately

- A charge includes multiple subscriptions (i.e. Apple often bills for multiple subscriptions in a single transaction)

- You have extra income on a regular income payment that you want to assign to a fund

How To Split a Transaction

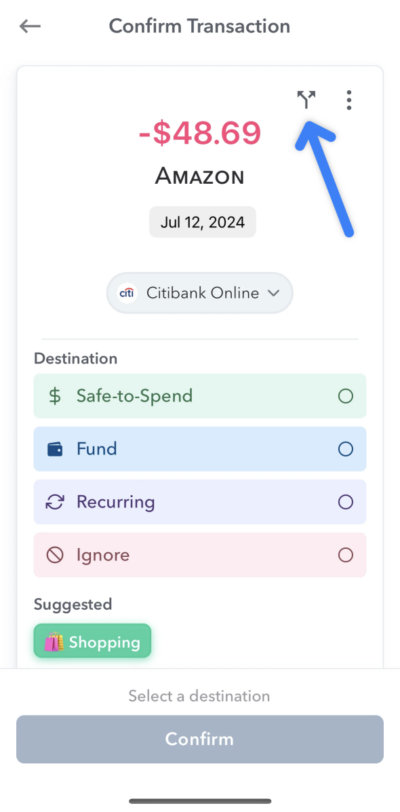

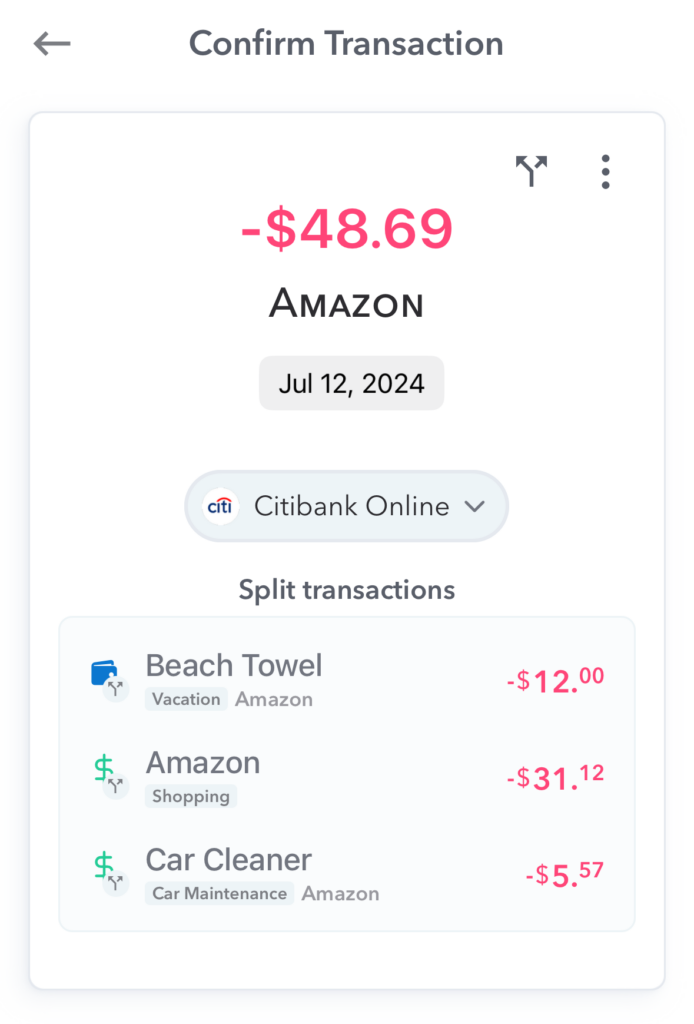

When looking at a bank transaction detail page there’s a split icon on the top right. Tap this icon to open the split transaction screen.

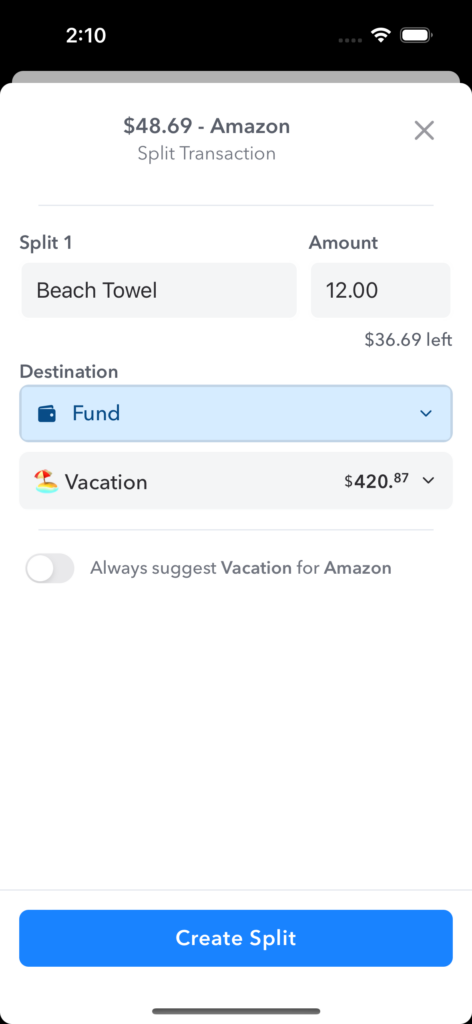

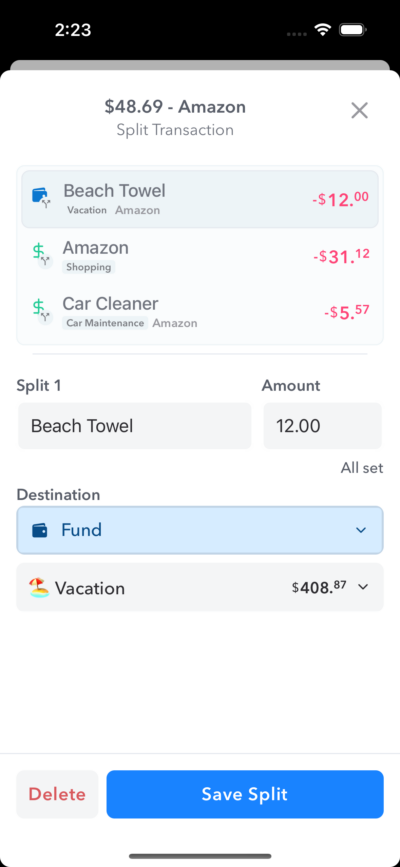

From the split screen you can define an amount and optional name for each split. There’s a prompt below the amount input that indicates how much of the total is left. After setting the amount pick the destination you want and tap “Create Split”.

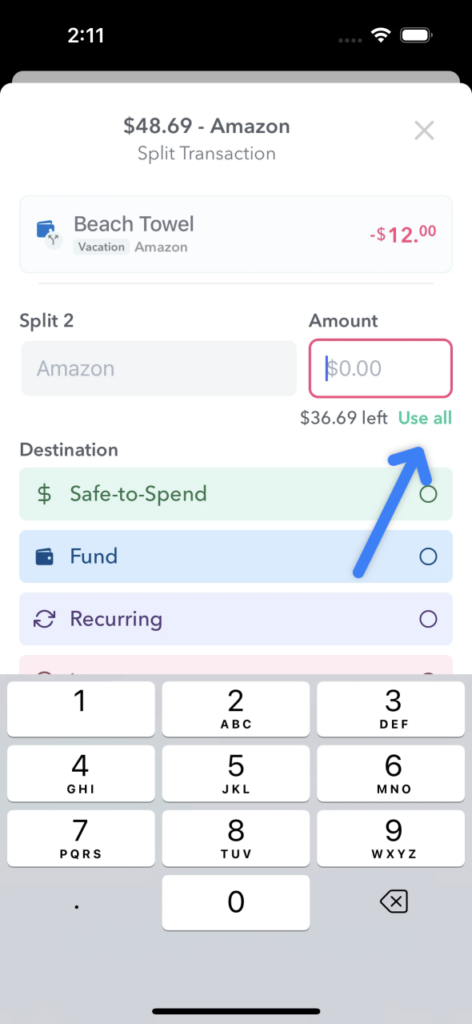

On subsequent splits you’ll have an option to “Use all” of the remaining amount. Simply tap the link to use the balance of the transaction.

You can split the transaction as many times as you like until the entire transaction amount has been used. If you need to edit a split, just tap it from the list above, make changes, and tap “Save Split”.

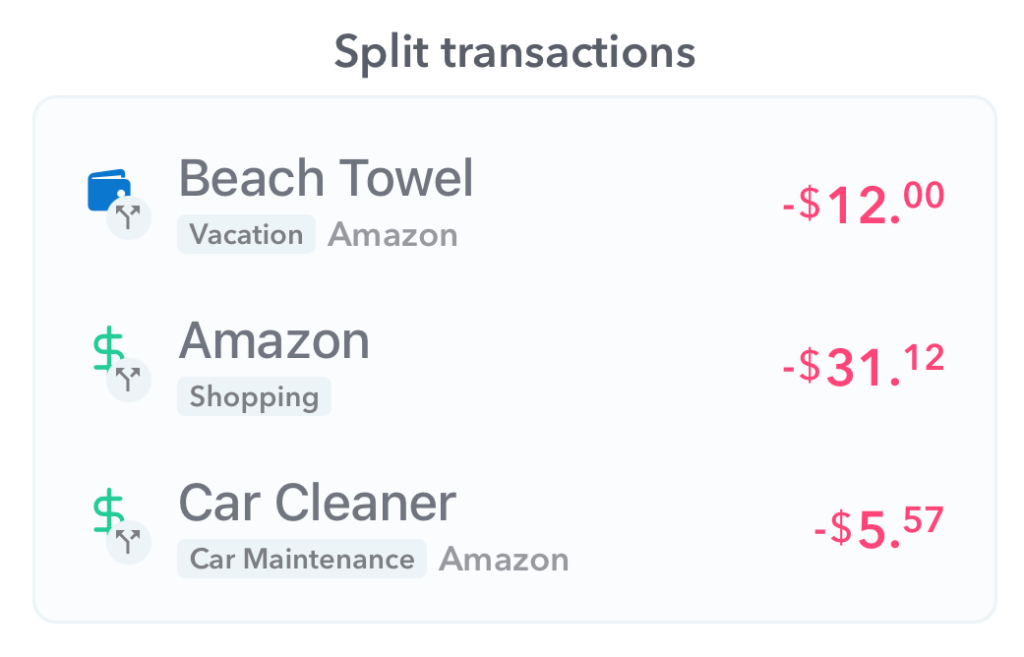

Once you’ve used the entire split and saved, the split modal will dismiss and you’ll see the original transaction information with all the splits below it.

Conclusion

Split transaction helps you deal with real-life transaction scenarios and organize them in Weekly to make your reporting and tracking more accurate.