When new transactions happen and are downloaded into your bank, the next step is review them so that you can keep know where you are at in your weekly and monthly spending.

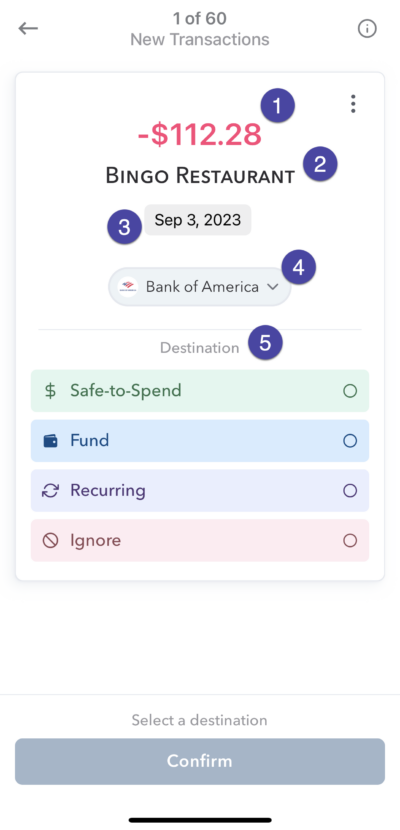

The process to review transactions starts with the transaction view.

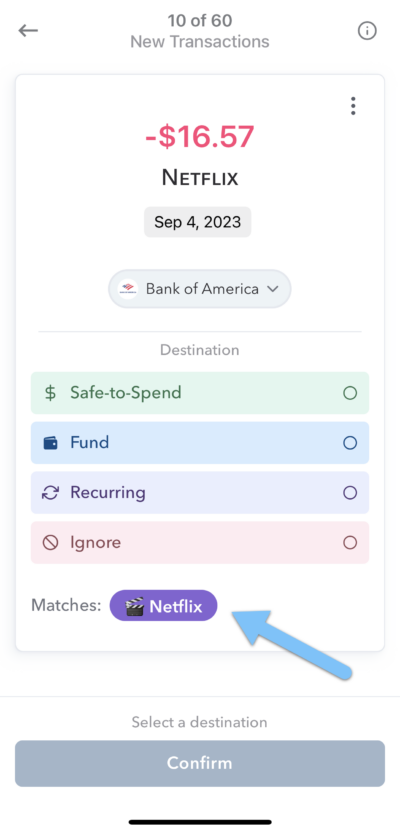

The transaction view show you details about your transactions and allows you to “file” it in the right place. Here’s is a breakdown of the screen.

1. Amount – This is the amount of the transaction.

2. Description – This is who you paid the money to.

3. Date – The date of the transaction

4. Bank or Credit Card – Where they money was spent from. If you tap on this, you will see a full description of the transaction data as received from your bank.

5. Destination – This is how you want to classify the transaction in Weekly.

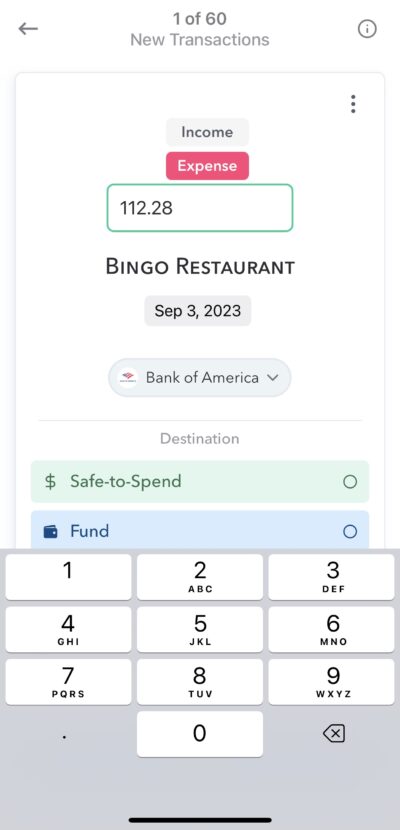

Advanced note: It may not be a common occurrence but if you ever wanted to change the amount, the description or the date of the transaction, you can by tapping any of those and and it will bring up the editing interface.

Now, we will go through the classification options in detail.

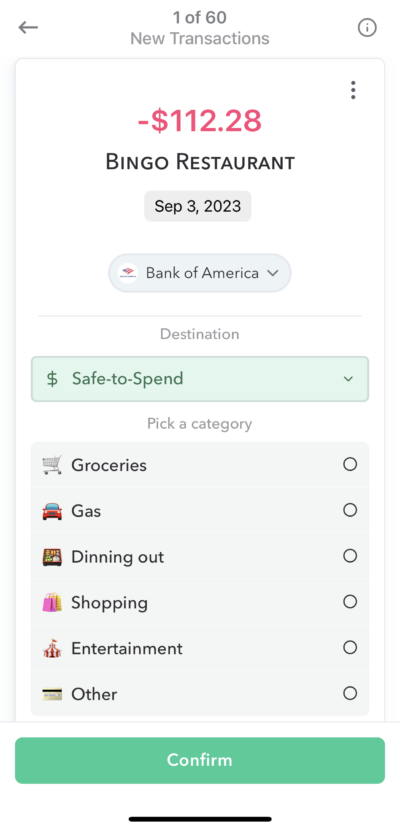

Destination – Safe-to-Spend

If this is a day-to-day transaction and not a recurring (aka committed) expense, then you will probably want to take this from your Safe-to-Spend balance (or a fund … more on that later).

To map a transaction to your Safe-to-Spend simply tap Safe-to-Spend. If you want to assign a category to the transaction so that you can see how you have been spending in different categories over time, you can next choose the category for the spending and then tap “Confirm”.

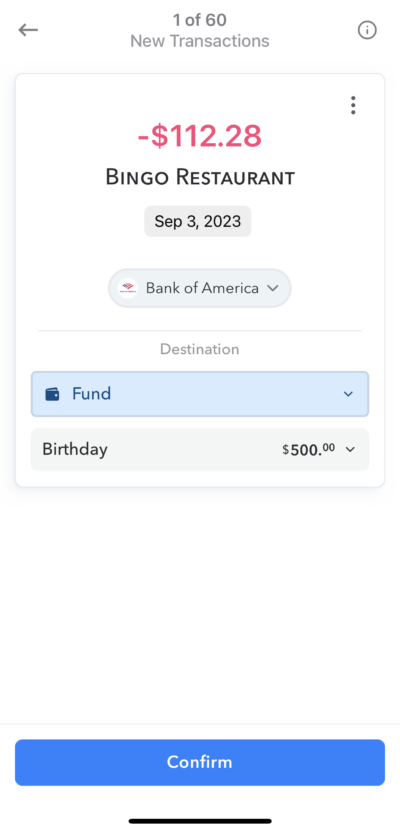

Destination – Fund

If this transaction is related to something you have saved up for in a fund, you can chose “Fund” as the Destination and then choose which fund to “pull” the money from.

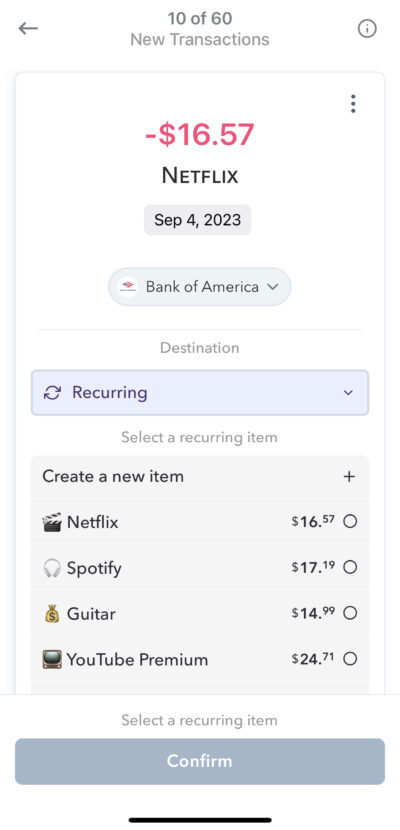

Destination – Recurring

If this transaction is related to a recurring (aka committed) expense that is already in your account as a budget item, select “Recurring” and then choose the Recurring budget expense that it matches.

Sometimes Weekly will attempt to match up the transaction to a recurring expense for you and will show a purple “pill” at the bottom that shows what Weekly thinks it is for. Tapping that pill will automatically select Recurring and the recurring items it is for.

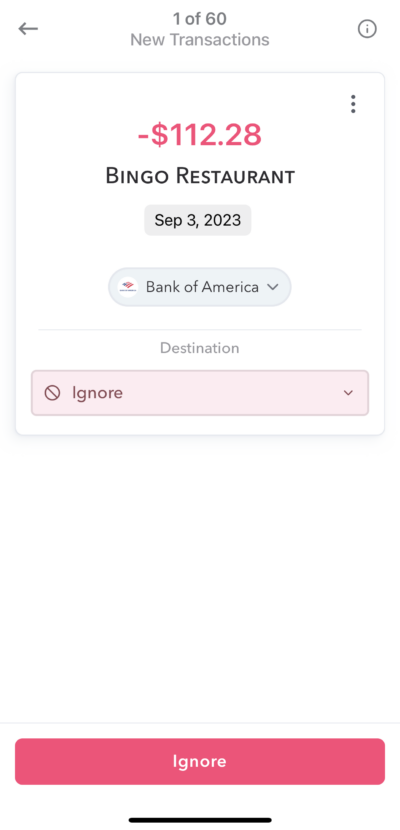

Destination – Ignore

Finally, if you want to ignore this transaction so that it doesn’t get taken from your Safe-to-Spend, a fund or mapped to a recurring expense, choose Ignore. We will keep store this transaction if you ever need to change its destination but if its in ignored status, it will not be used in any of the calculations in Weekly.

Conclusion

Reviewing transaction is vital part of keeping tabs on your spending. Weekly makes the process of reviewing transaction easy while at the same time making sure you know what’s happening in your budget.