Suggestion rules drive how Weekly recommends where to categorize transactions when reviewing them. This article describes how the logic behind how the suggestion rules work.

How Weekly’s Suggestions show up

All transactions that come into Weekly confirmed to one of four destinations.

- Safe-to-Spend – A transaction whose amount should be taken from the week’s Safe-to-Spend.

- Recurring – A transaction that is for a recurring expense that has already been setup as a budget item.

- Fund – A transaction whose amount should be taken from a Fund.

- Ignore – A transaction that should be ignored.

To speed up the transaction review process, Weekly will suggest how to categorize these transactions.

Weekly’s suggestions show up in two places – the individual transaction review and the bulk transaction review.

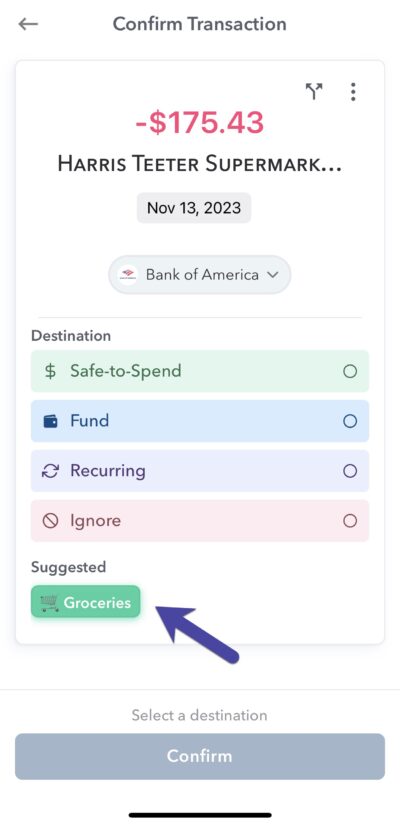

Individual Transaction Review

When reviewing a transaction individually the suggestions appear underneath the destination options. Tapping on the suggestion will chose the destination and the associated category, recurring item, or fund.

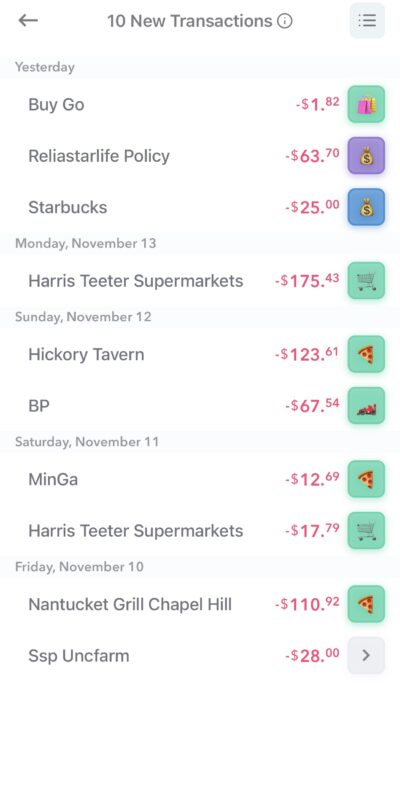

Transaction Review List Screen

The primary suggestion rule for a transaction will be listed on the Bulk Transaction Review screen.

The color will indicate the destination (Safe-to-Spend, recurring, fund, or ignore) and the icon represents the category, recurring item, or fund. Here’s an example of the “Eating Out” Safe-to-Spend category.

How Weekly makes its suggestions

Weekly uses several rules to determine what to recommend. They’re outlines in priority order below.

- Manual transaction match – If you have manually entered a transaction whose amount and date match a bank transaction, this will be our top suggestion.

- User-defined Vendor Rules – If you’ve defined a rule to always match a vendor to a specific destination, that will be used next.

- Recurring item matches – Weekly will look for transactions that seem to match recurring items based on the vendor, transaction date, and amount.

- Bank suggested category to Weekly category based on customer mapping on the Category screen.

- Ignore Transfers and Credit Card Payments – Weekly will recommend ignoring transfers and credit card payments if no other rule applies.

Let’s go into a little more detail on each priority step.

Manual transactions

To keep Weekly up-to-date, you may have put in a manual transaction to keep your Safe-to-Spend accurate while you are waiting for transactions to sync. If you have done this. based on the transaction amount, Weekly will first suggest mapping a download transaction to a manual transaction of the same value.

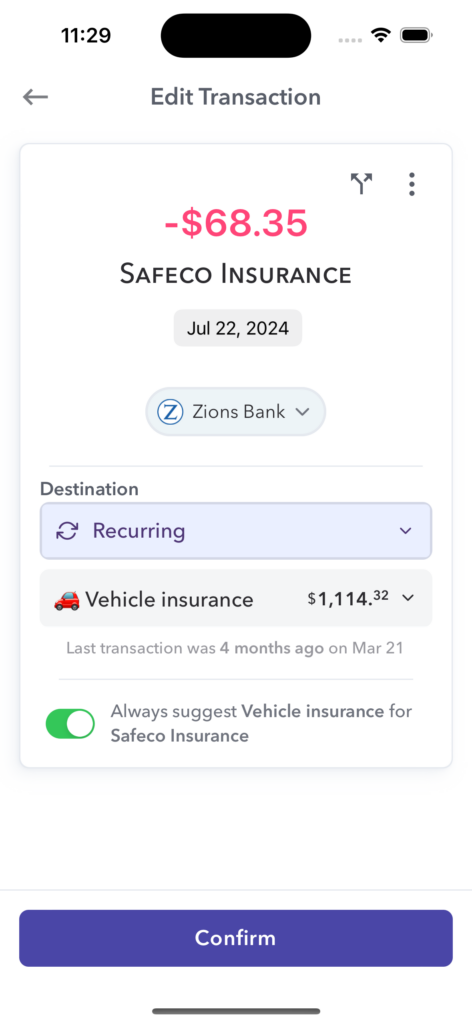

User-defined vendor

When approving transaction, Weekly will show you a “Always Suggest” dialog for that vendor. So for example, if a charge for your power bill always comes from a vendor called “Dominion Energy” you can choose to “Always suggest” that the transactions from “Dominion Energy” be mapped to your “Power” recurring budget item. Similarly, you can choose to “Always suggest” certain vendors for Safe-to-Spend categories or specific Funds.

If you have any of these “Always Suggest” rules set up for a particular vendor, then when a transaction comes through, these rules are given second priority after manual transactions.

Pricing and Vendor matching to Recurring charge

If a charge from a vendor comes through and it matches the amount, the vendor name, and/or the next transaction date for a recurring expense, Weekly will recommend this mapping even if a user defined rule has not been created.

Bank category

When transactions are downloaded from the bank, the bank has already defined a category for that transaction. We have mapped these categories to our default active and inactive categories. These suggestion rules are very helpful when first starting Weekly or when you purchase from vendors that Weekly has not seen before.

Transfers and credit card payments are suggested to Ignore (if no other rule applies)

Since there is no actual spending happening, transfers and credit card payments are default suggested to “Ignore”.

Two suggestions

Based on the rules above, Weekly may have two suggestions. In this case the highest priority suggestion will be listed on the left and the next will be listed on the right.

Conclusion

Based on these priority rules, Weekly will decide what to suggest in the individual and bulk transaction review screens. These suggestions make the transaction review process quick (and fun!) keeping you in touch with where you are at with your spending on a weekly basis.