We are excited to announce that we have just added category tracking for your Safe-to-Spend purchases. You can now see how much you are spending in for items like “Gas” and “Groceries” (and any other category you’d like) inside of your Safe-to-Spend and also see how your current week’s spending compares to your averages.

In addition we have added new suggestion rules and a transaction review list to make confirming transactions a breeze. And you can add and create your own custom categories. Read on for a brief description of the new features and you can check out our knowledge base for in-depth details.

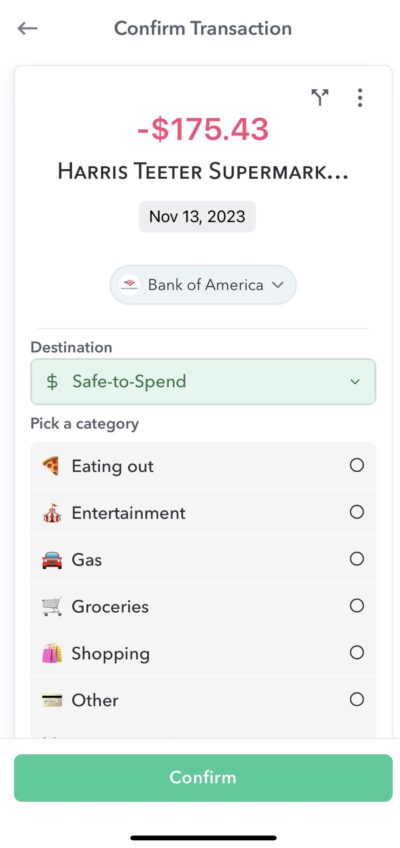

Categorizing Safe-to-Spend transactions

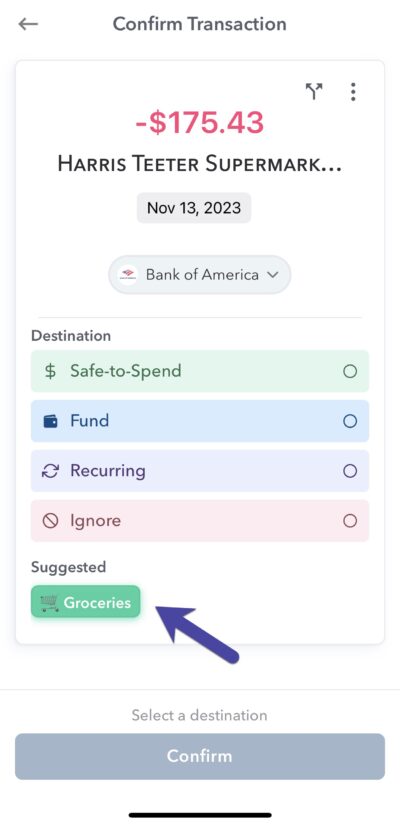

On the individual transaction review screen, you can categorize transactions. When you tap on “Safe-to-Spend” then a list of categories will appear in the dropdown. To assign a category to a transaction, tap on the category you’d like to associated with your Safe-to-Spend transaction and tap “Confirm”.

To make the confirmation process as fast as possible, Weekly may offer you suggested categorization. These suggestion are based on Vendor-to-Category rules you set or the category of the transaction that comes from the bank. You can quickly accept the suggestions by tapping on them.

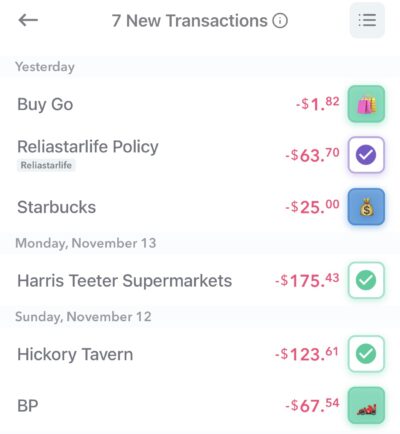

Transaction Review List

In addition to categories for Safe-to-Spend transactions, we have also added a transaction review list screen that allows users to quickly review and approve transactions with a single tap using new square icons. This screen not only allows you to approve Safe-to-Spend transaction and their categories, you can also quick approve Recurring and Fund transactions.

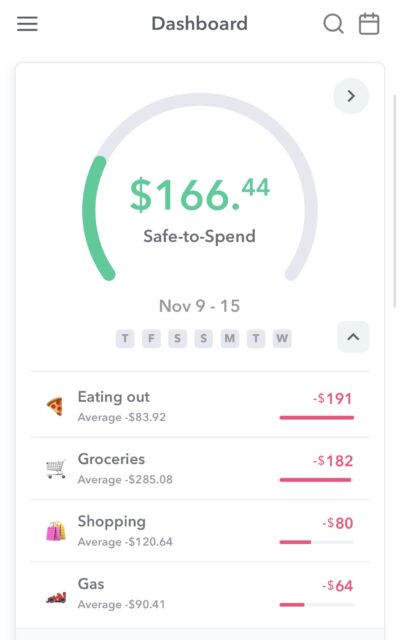

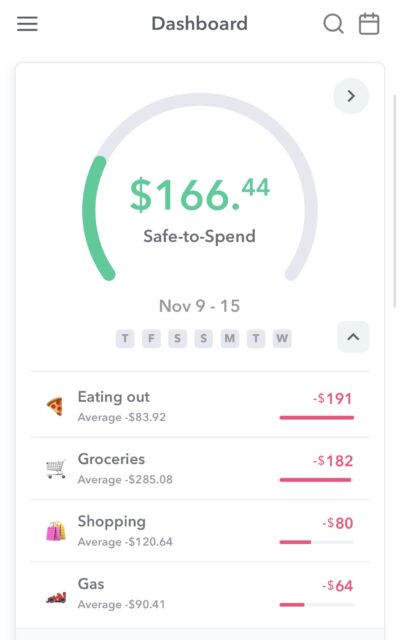

Spending by Category Chart

You can see your Safe-to-Spend spending by category on the main dashboard by tapping the arrow on the main Safe-to-Spend card.

Under this view you will see category, the current amount of spending in that category and the average spend in the category over the past weeks.

You can also see the transactions that are in each category by tapping on the category name and the list of transactions that are in that category will drop down.

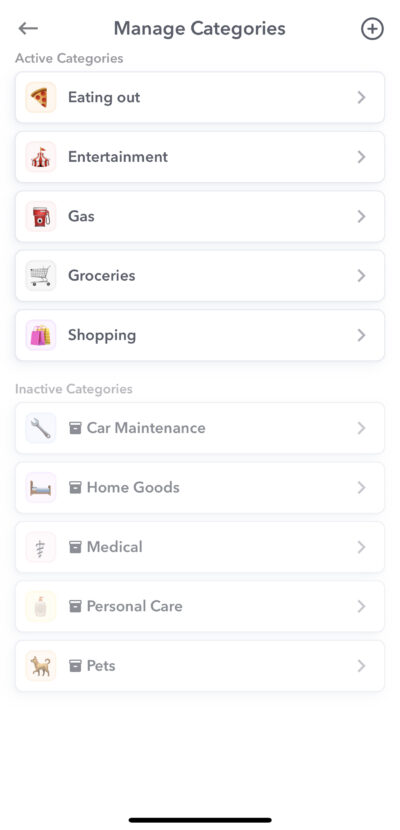

Adding Categories

Each user starts off with the following five active categories:

- Eating out

- Entertainment

- Gas

- Groceries

- Shopping

You can tap into any of these default categories and adjust the emojis or the category name. Pro users can also add new categories by tapping the (+) button on the top right of the screen.

Conclusion

Categorizing your Safe-to-Spend transactions allows you to see how much you are spending in different areas of your life (like “Gas” and “Groceries”) and also how your current behavior compares with your past behavior so you can adjust in real-time if need be. Weekly will suggest categories based on your personal Vendor-to-Category rules or bank rules to make confirming transactions quick and fun. We have also launched a new Transaction Review List screen so you can quickly tap many transactions to review and accept them.