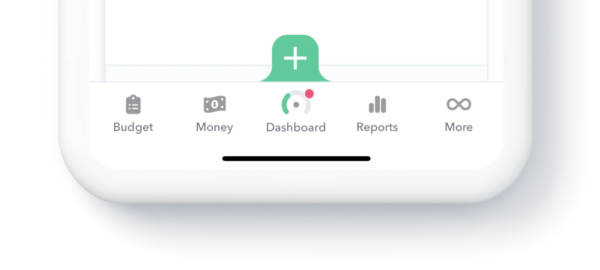

We have launched a new navigation that puts all of the functionality of Weekly closer to your fingertips.

A new bottom navigation divides the functionality of Weekly into 5 areas: Budget, Money, Dashboard, Reports and More.

We also introduced new tab navigation under “Money” and “Reports”.

Here’s a breakdown of the new navigation.

New bottom navigation bar

Now in Weekly there is a bottom navigation bar for getting to the different functionality in the app.

The sections are

- Budget – This is where you can see, add and edit the regular income and recurring expenses that are used to calculate your Weekly Spending Limit.

- Money – Within Money, there are two tabs: “Accounts” and “Funds”. Under the “Accounts” tab, you can see the balances of any a bank or credit card accounts you have connected to Weekly. Under the “Funds” tab you can see the value of any Funds you have setup.

- Dashboard – This is where you can add and review transactions inside of Weekly as well as see a summary snapshot of information in the other areas of the app.

- Reports – You can find spending trends and cash balance histories under “Reports”.

- More – Adjust your app settings, search the knowledge base or contact support under “More”.

Here’s a deeper breakdown of each section.

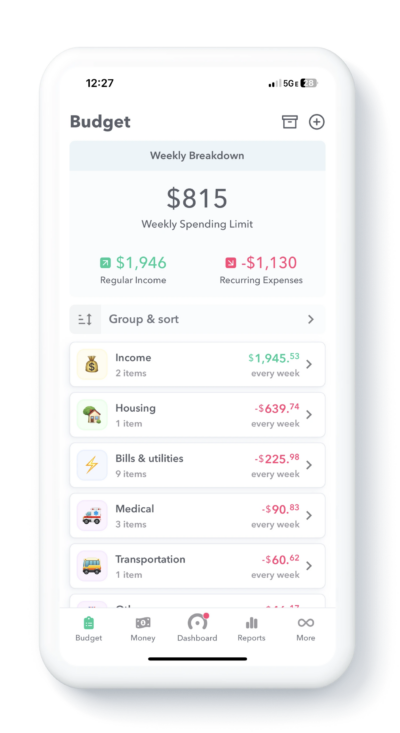

Budget

Under “Budget” on the far left is where you can review and edit your regular income and recurring expenses. When you first get onboarded, we guide you through a walk thru that sets up your budget and at any time you can add, edit or review your recurring income and expenses under Budget.

Prominent on the budget page is your Weekly Spending Limit which is generated from subtracting your recurring expenses from your regular income. On the budget page, you can add new recurring income or expenses (which we call “Budget Items”) by tapping on the (+) symbol. You can also see all previous transactions associated with any budget item and a cool bar graph of them by tapping on the budget item. You can also edit or archive any budget item on the budget page.

Money

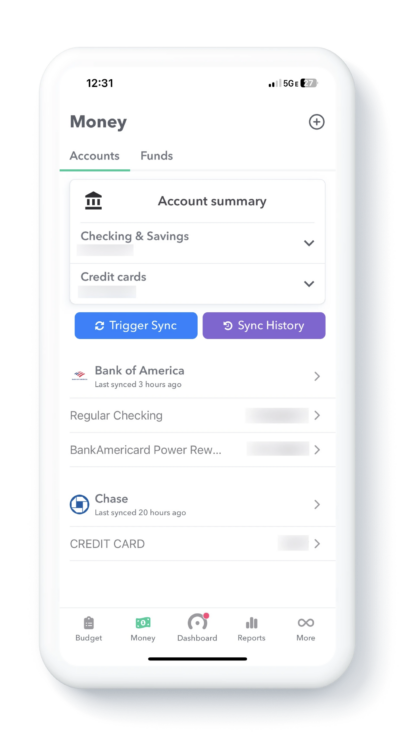

Under “Money” we have introduced new tab level navigation: “Accounts” and “Funds”.

Accounts

Accounts is where you will find the balance of any bank accounts or credit cards you have connected to Weekly. You can also check your sync history, trigger a sync or purchase new sync credits.

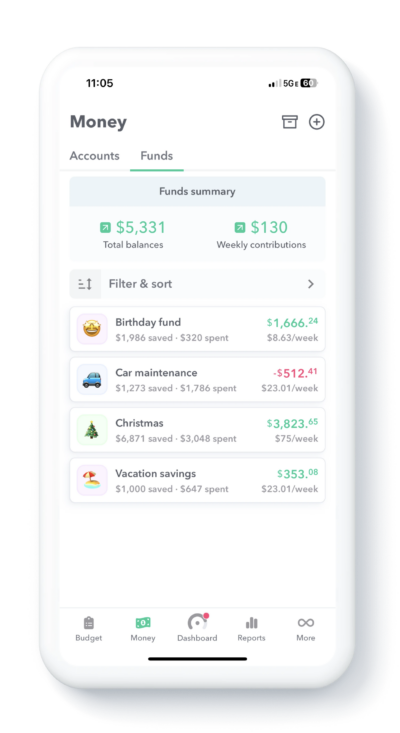

Funds

Under the “Funds “tab is where you see the funds you have created as well as their current balances. In addition to add or editing funds, you can also check all the transactions that are in a fund by tapping on the fund name.

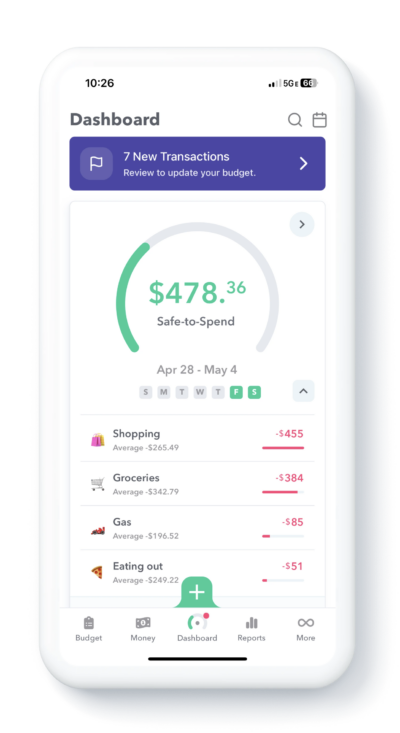

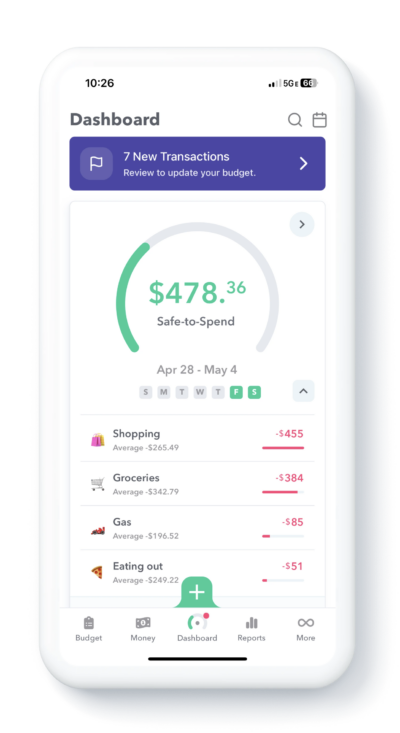

Dashboard

The Dashboard is where you can add and review your day-to-day transactions, see your current Safe-to-Spend balance and see a summary of all your important financial numbers. At the top of the Dashboard there is the Safe-to-Spend gauge that tells you how much is left in your Safe-to-Spend as well as giving you a breakdown of how your current money has been spent and how many days are left in your week. The navigation to add new manual transaction has moved and is at the bottom of the screen with in the green (+) button.

Just like the older interface, if you have connected a bank account, you will see notices at the top of the screen that tell you there are new items to review.

Also, when its time to start a new week you will also see notices there.

Scrolling down on the Dashboard you will see additional cards. The additional cards available on the dashboard are:

- Recent Funds – This is the last three funds that have transactions associated with them along with their current balances. Tap on any Fund and see transactions associated with that fund.

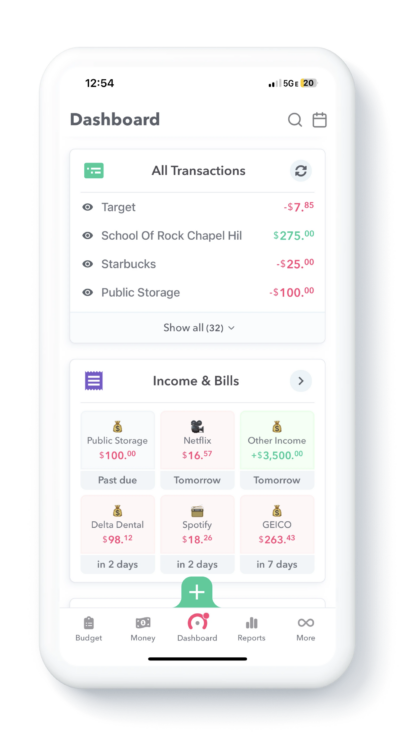

- All Transactions – This is all transactions that have been entered into Weekly including those associated with recurring budget items or Safe-to-spend transactions.

- Income & Bills – These are list of recurring expenses or income budget items that are going to happen in the near future.

- Account summary – A summary of the bank and credit card balances.

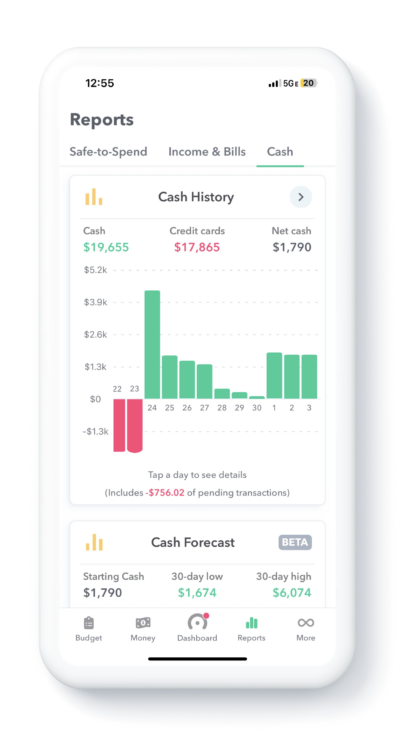

- Cash History – A look at net cash (cash minus debts) you have had in the bank over time.

- Cash Forecast (BETA) – A project of how much cash you will have in the future if current trends in your saving and spending continue.

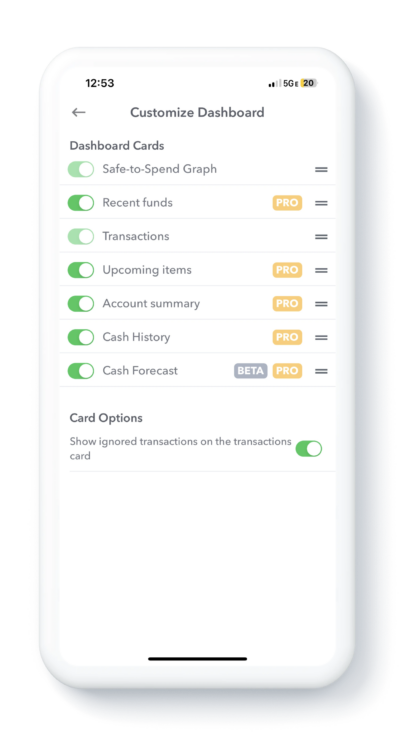

You can edit which cards show on the Dashboard or adjust the order they are in by scrolling down to the very bottom and tapping on “Customize”.

Reports

Tapping on the “Reports” section of the bottom navigation bar brings up the reports section of Weekly. There are three types of reports.

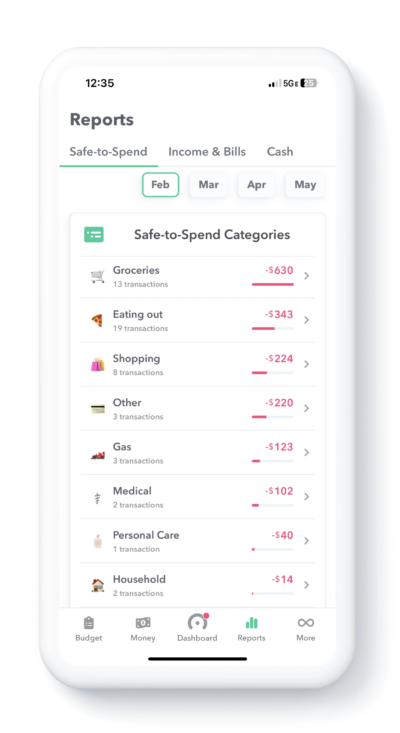

Safe-to-Spend

Under Safe-to-Spend you have two reports.

Safe-to-Spend by Month

On the Monthly Safe-to-Spend Report you can page through your months and look at your overall spending in all your Safe-to-Spend categories. All your category spending in that month will be listed. Tap on any category will bring you to the next report is Individual Category Spending by Month report.

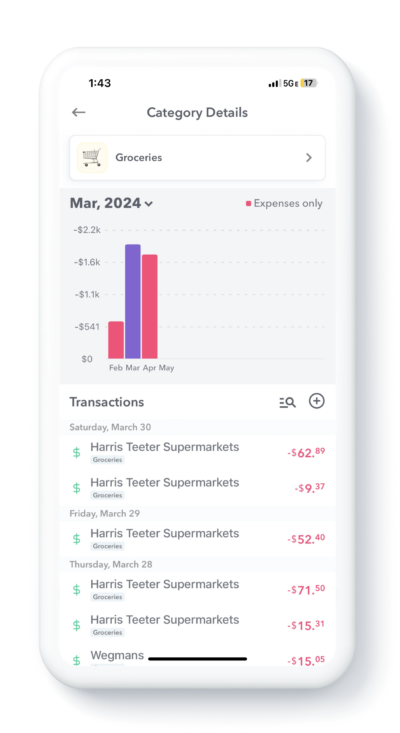

Category Trend Reports

The category trend report shows all the transactions in a specific category in a month. At the top of the page is a bar graph of all your transactions in that category. You can tap different months to see the spending in that particular month.

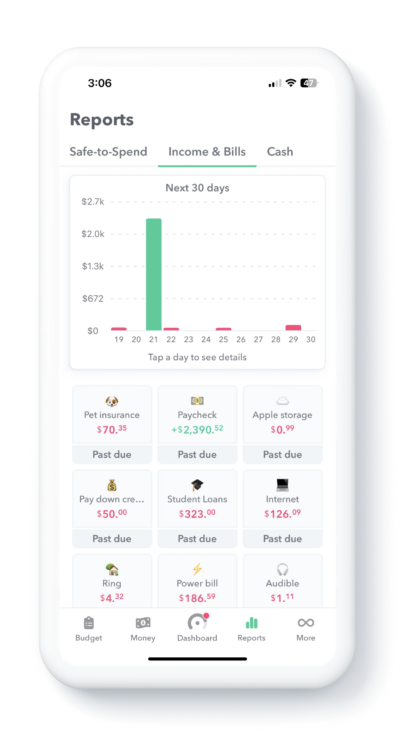

Bills

Tapping on Bills brings up a list of your upcoming bills and income budget items. You can see what is coming due next. Tap on any particular item and see a breakdown of the transactions associated with that item.

Cash

Cash tab has two different reports underneath it.

Cash History

Your cash is positive cash balances minus your negative debts. Your cash history is a graph of the level of cash you currently and in the past.

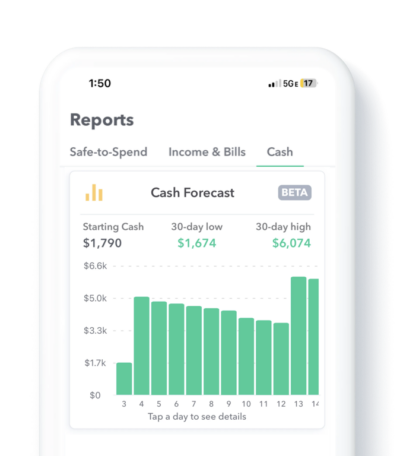

Cash Forecast (Beta)

Cash forecast report attempts to give you an idea of what you cash position will look like in the figure given your current income and expenses and daily spending habits.

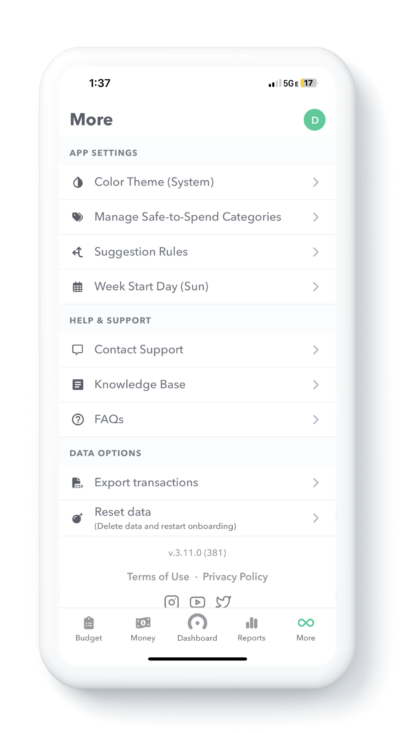

More

The more tab is where you set the setting of your app. Here are the options under “More”.

App Settings

Color Theme

Set the theme of the app to “Light”, “Dark” or “System” (which means to use the default setting in your iPhone).

Manage Safe-to-Spend Categories

Tap in to Manage Safe-to-Spend Categories to add or edit Safe-to-Spend categories.

Suggestion Rules

Suggestion rules help Weekly quickly categories your Safe-to-Spend and Recurring transactions. You can set them while you are reviewing your transactions and as you set them up you can always going to Suggestion Rules to review, edit or delete them.

Week Start Day

Change the day of the week that your week starts.

Help & Support

Contact Support

Contacting us through the app can be extra helpful because will get extra information that will help diagnose any problems.

Knowledge Base

Access all our help articles here. Search based on keyword.

FAQs

A link to a list of our frequently asked questions.

Data Options

Export Transactions

Export transactions allows you to download a list of your transactions along with how lots of useful data.

Reset Data

If you ever want to start fresh with Weekly, you can Reset Data here.

Conclusion

The new navigation in Weekly makes it easier and quicker to get to the data that is powering your personal finances. We hope the new interface is a joy to use. Please reach out to use with any comments, problems or suggestions you may have.