How to Build an Emergency Fund Without Feeling Behind

You know you need an emergency fund. Every personal finance article, podcast, and well-meaning family member has told you that. But here's what they don't tell you: starting from [...]

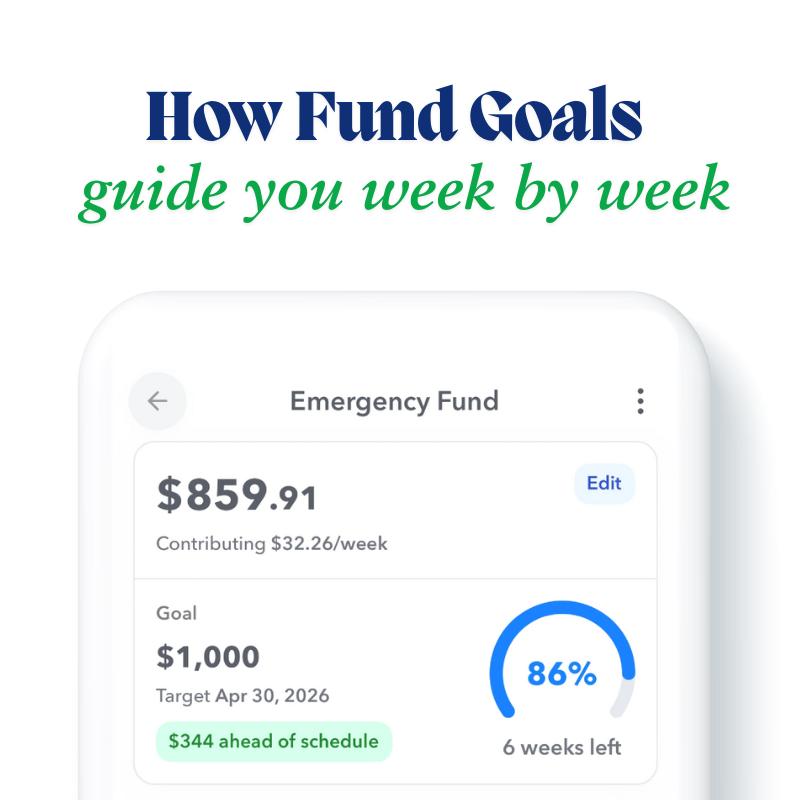

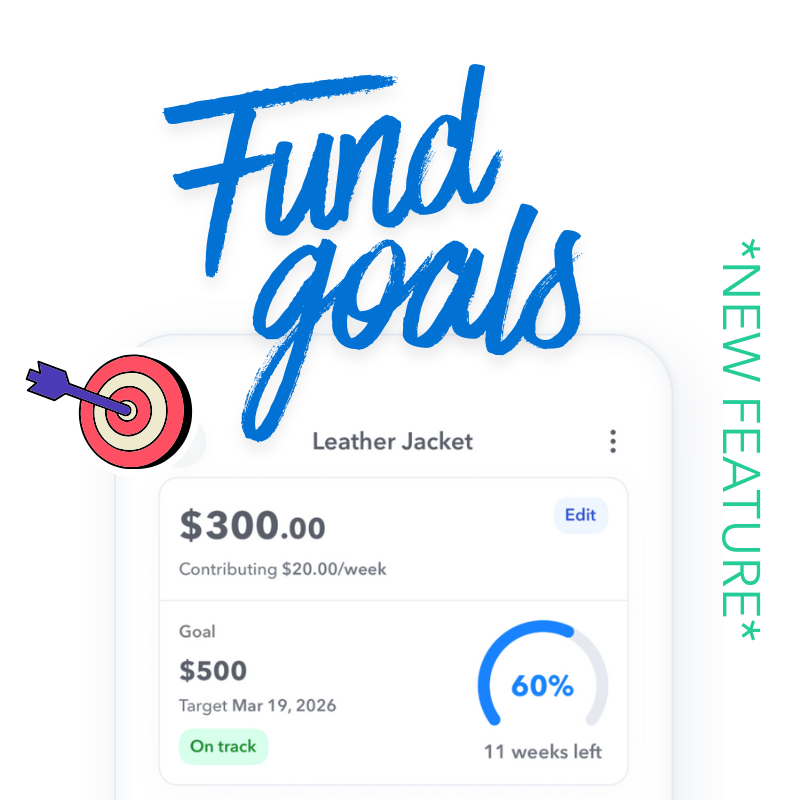

How Fund Goals guide you week by week

Saving for something important shouldn't feel like wandering in the dark. That's why we built Fund Goals—to give you a clear path from where you are today to where [...]

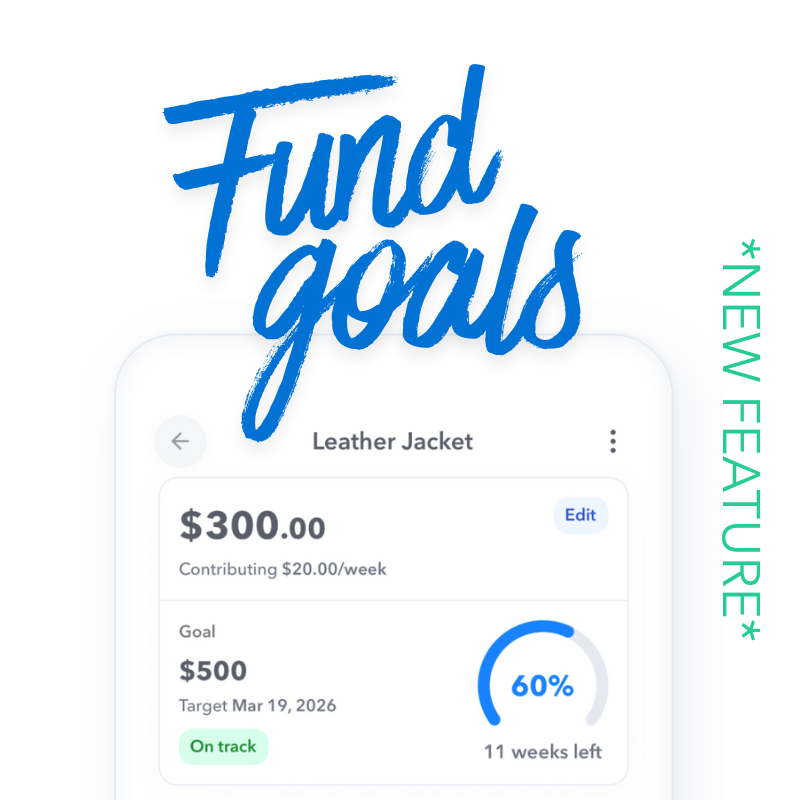

Set (and Hit) Your Savings Targets in 2026 with Fund Goals *NEW*

We have some exciting news to share with you as we head into the new year: Fund Goals are here! If you've ever wondered "When will I actually have [...]

🚀 Introducing Streaks — Stay Motivated Week After Week

We’re excited to launch Streaks, a fun new way to stay consistent with your budgeting habits in Weekly! 🔥 See Your Streak: Every week you track with Weekly adds [...]

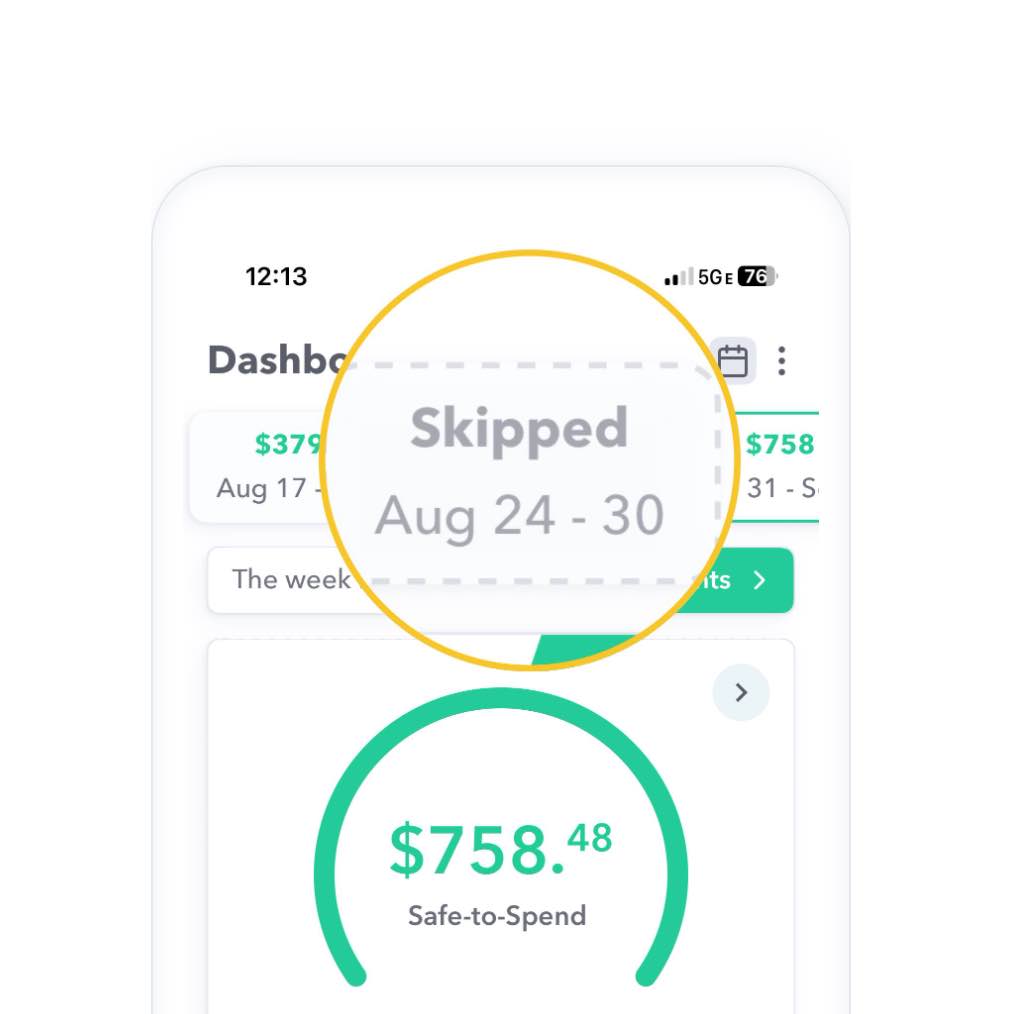

Fill in Skipped Weeks for a Complete Budget History

Budgeting isn’t always perfect. Vacations happen. Life gets busy. Sometimes we forget to track spending for a week (or two). Until now, that meant a gap in your Weekly [...]

How I Paid Off $7,000 in 10 Months—Without Feeling Deprived

Paying off debt doesn’t have to feel like punishment. For me, it actually felt empowering—and it all started with one simple shift: tracking my spending weekly. In just 10 [...]

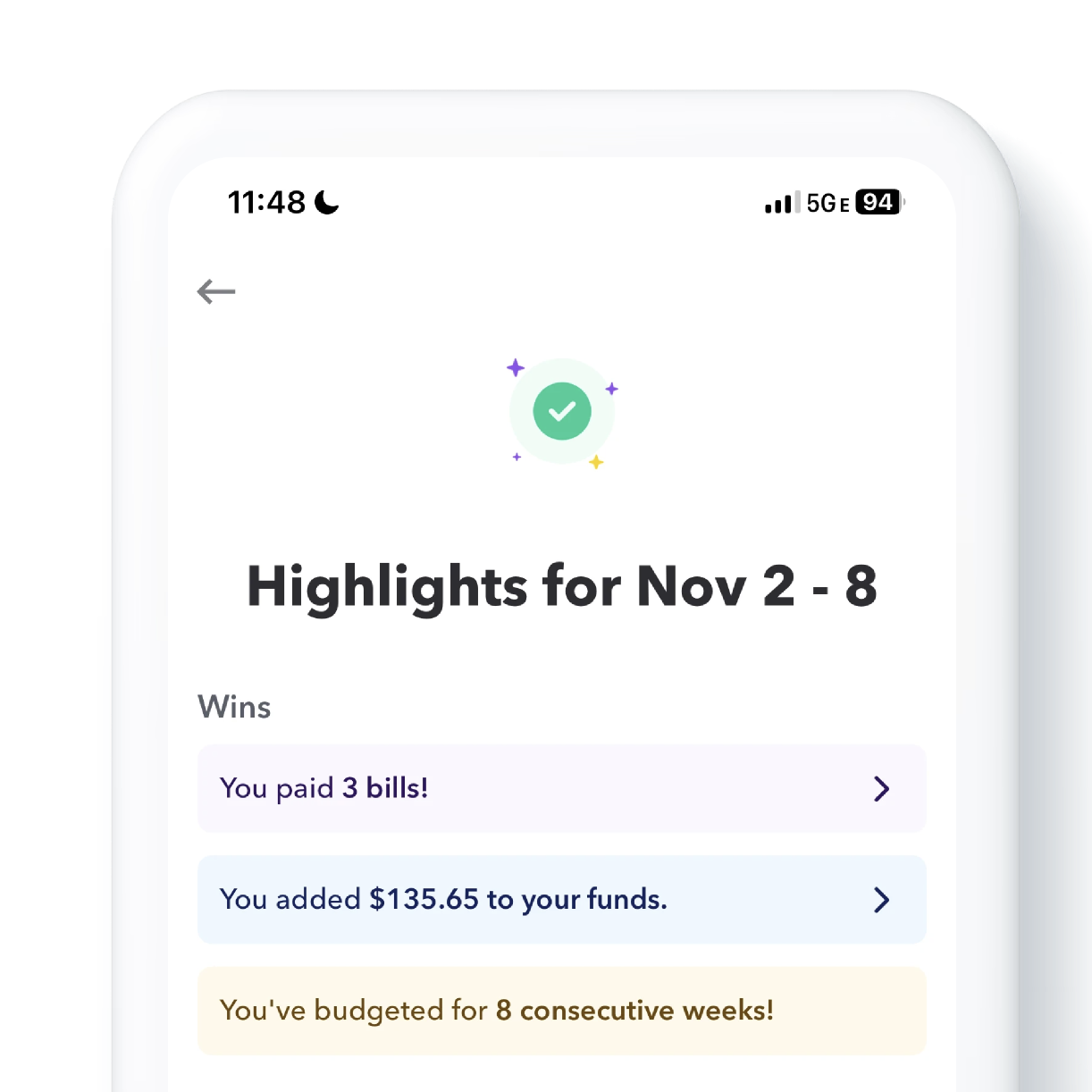

NEW FEATURE: Week In Review

At Weekly, we know that staying on top of your budget isn’t just about setting numbers—it’s about reflecting, learning, and celebrating your progress. That’s why we’re excited to introduce [...]

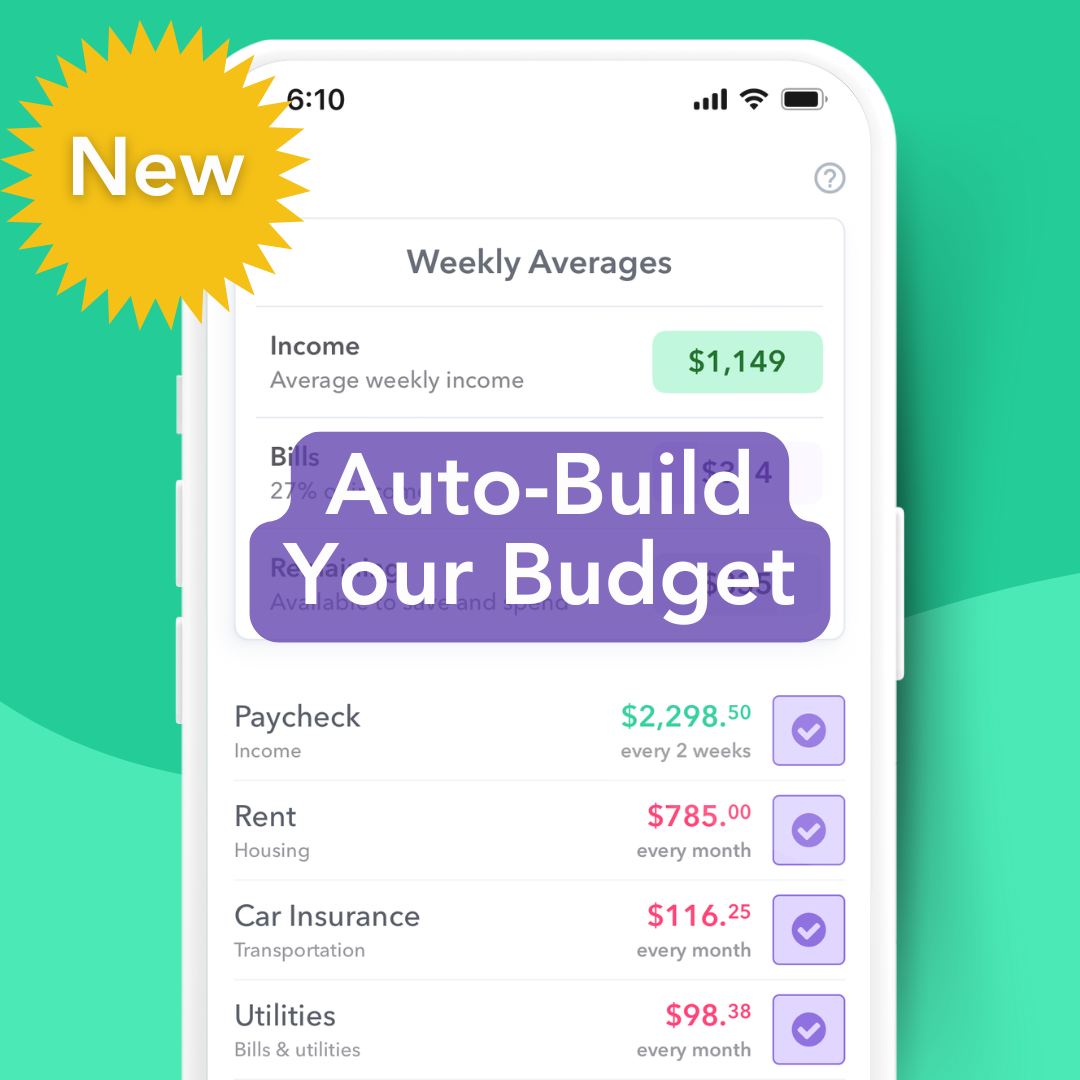

Weekly’s Auto-Build Budget Tool Makes Setting Up Your Budget Accurate and Easy

Weekly’s new auto-build budget tool makes it easy to build a sustainable, realistic budget based on your current life. Previously, when setting up a budget, you had manually input [...]

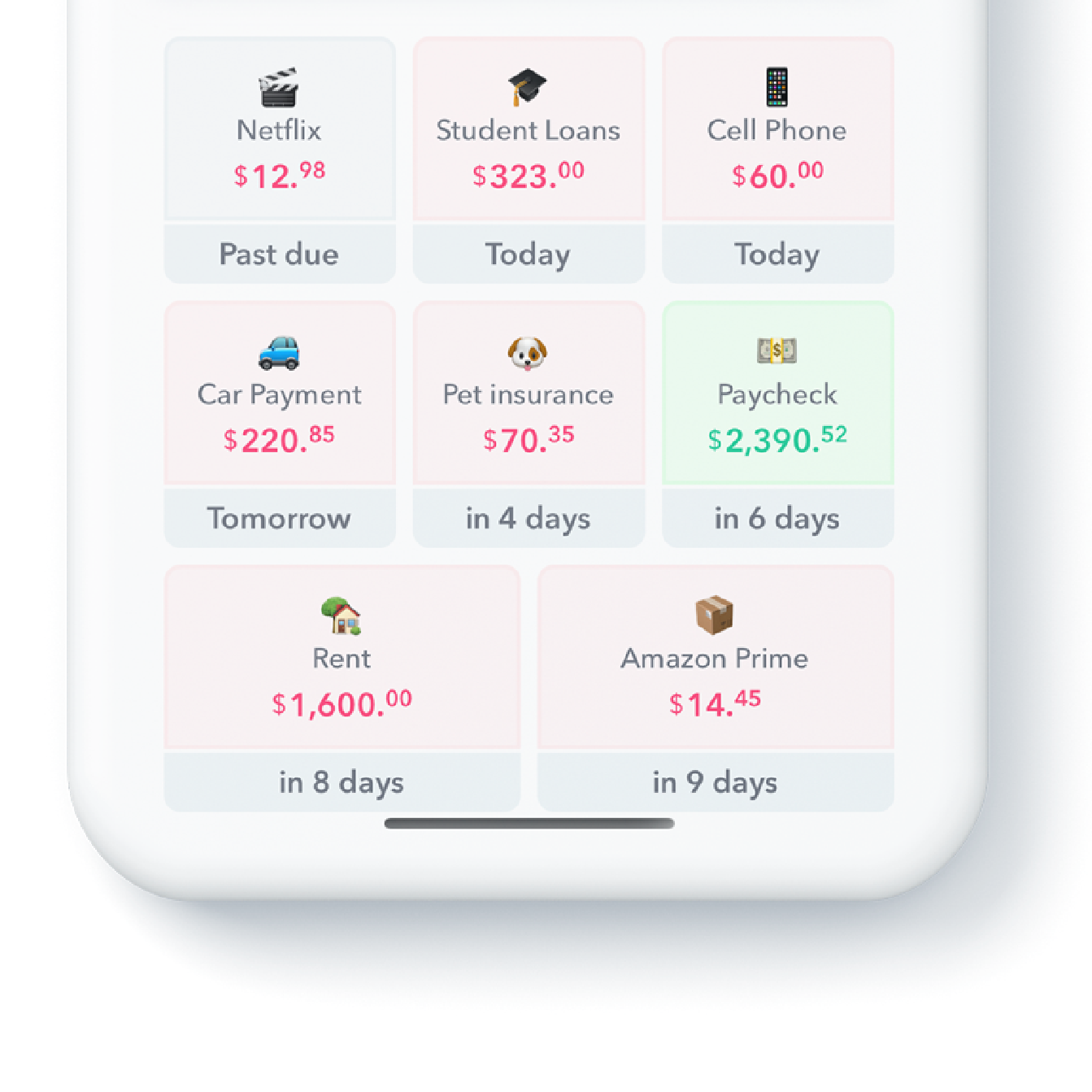

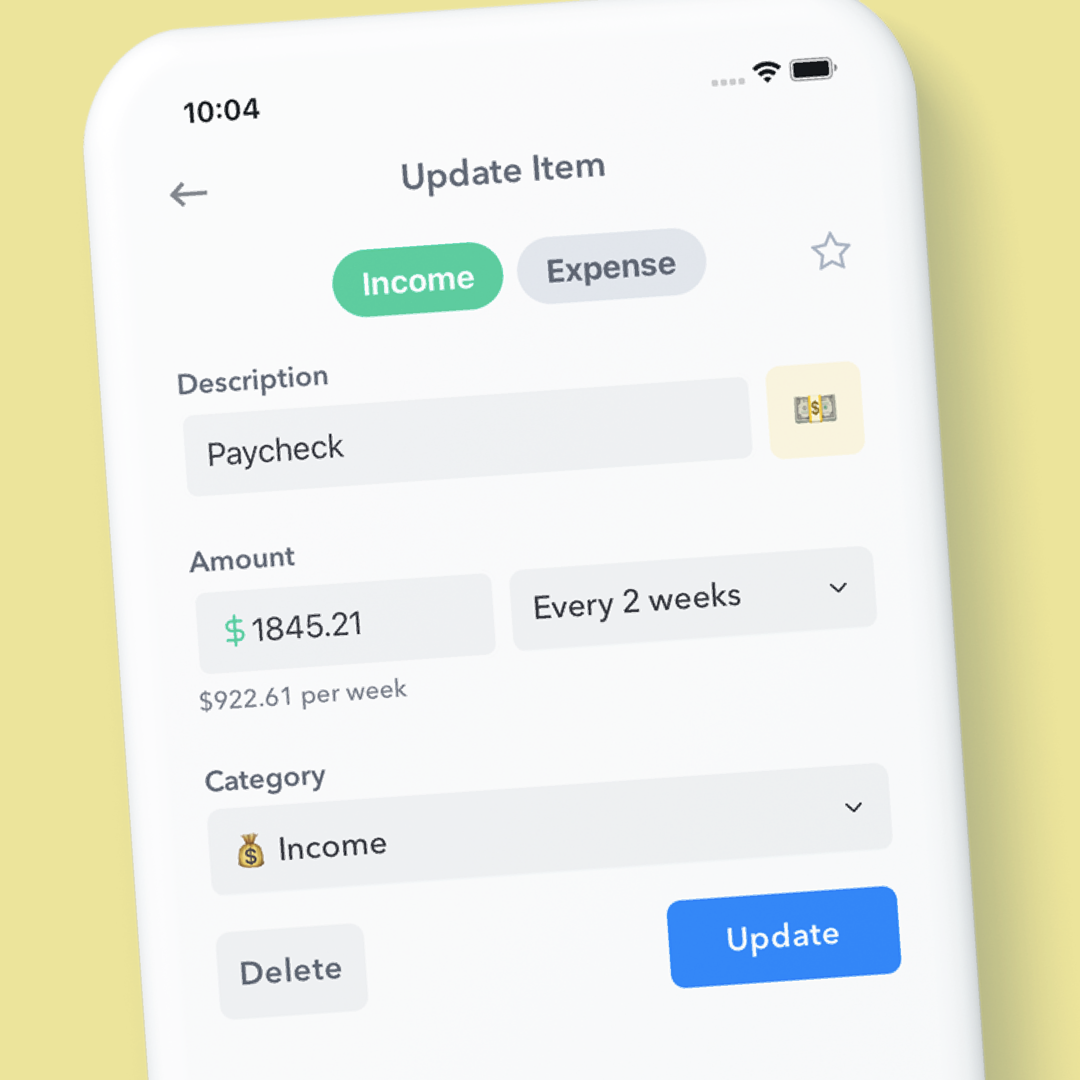

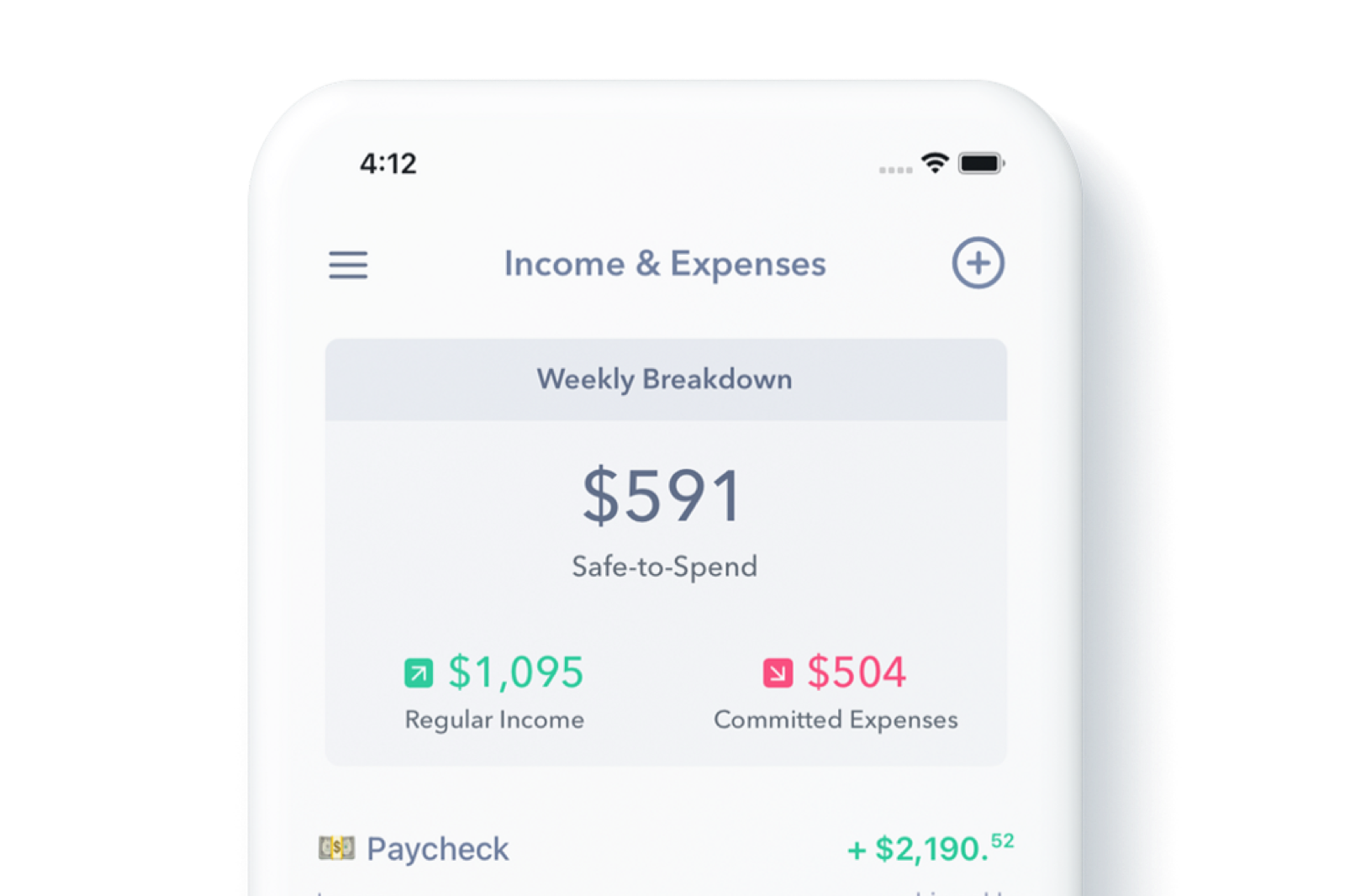

Improvements to Income and Bills screen

One of the best things about Weekly is how it helps you keep track of your bills. We have tried to make that process even easier with our new release. [...]

How to build a budget for the first time budgeter

Building a budget for the first time may feel daunting but it can actually be an exciting experience of focusing your money in direction that brings meaning and joy [...]

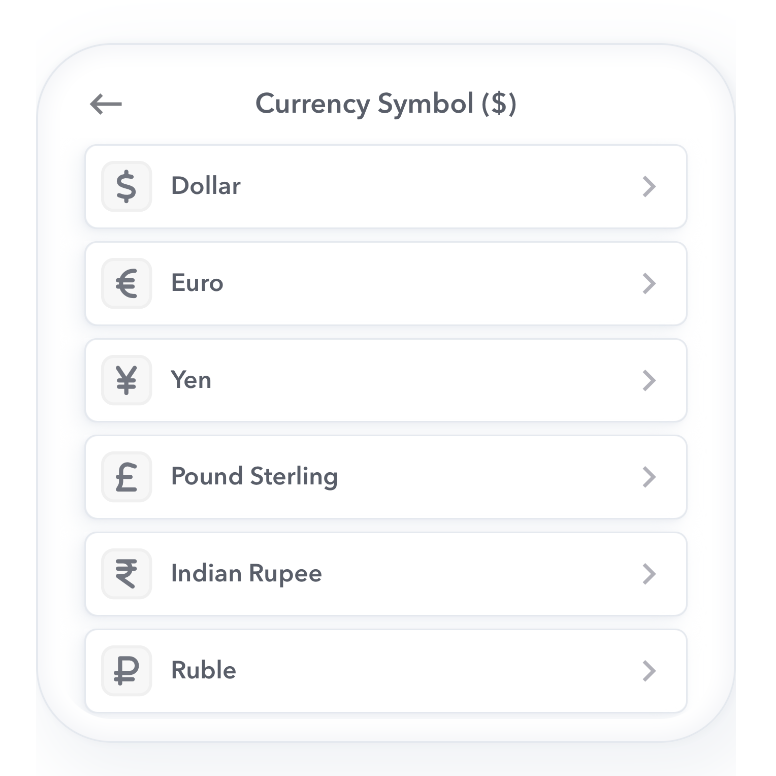

JUST ADDED: Change Your Currency Symbol

If you are using something other than dollars to manage your budget, we have good news. Weekly has added the ability to change your currency symbol in the app. [...]

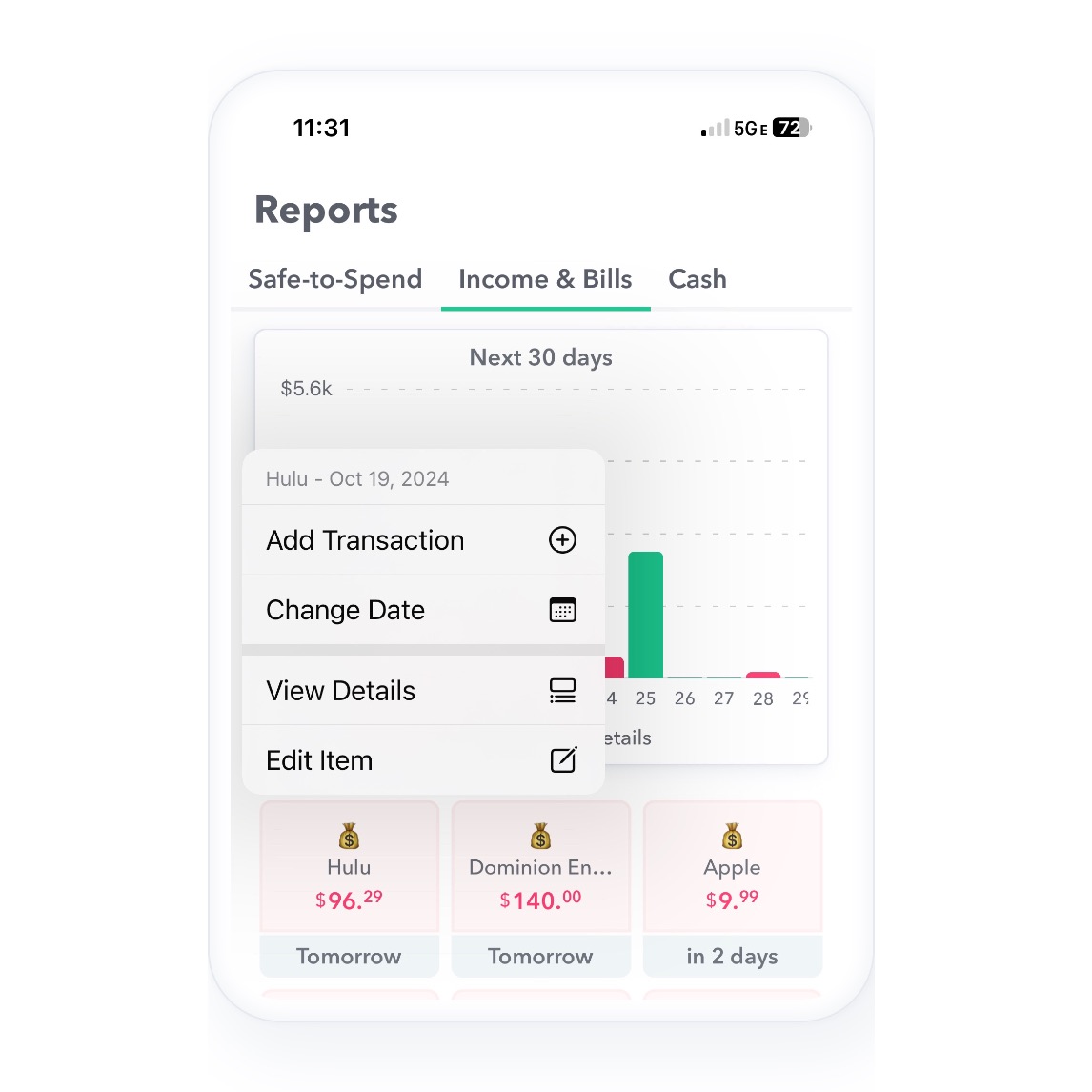

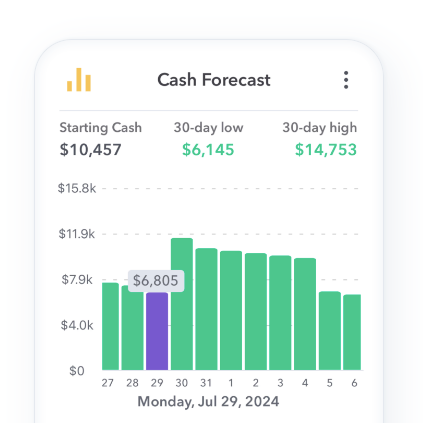

NEW RELEASE – Cash Forecast Report out of BETA, Bulk Edit Next Transaction Dates

We’re excited to announce the latest update for Weekly! Cash Forecast Report with Notifications Our new cash forecast report is now out of BETA! The Cash Forecast Reports allows [...]

New Budget Summary View and Other Changes

The latest release of Weekly brings some changes including a new budget summary and the context menus to organize page options. Read below for details. A New Budget Summary [...]

Notification Enhancements: Bill Reminders + Daily Transaction Nudges

The latest update brings enhanced notifications. Weekly can now send you bill reminders and, for customers without a bank connection, daily nudges to add in expense and income transactions. [...]

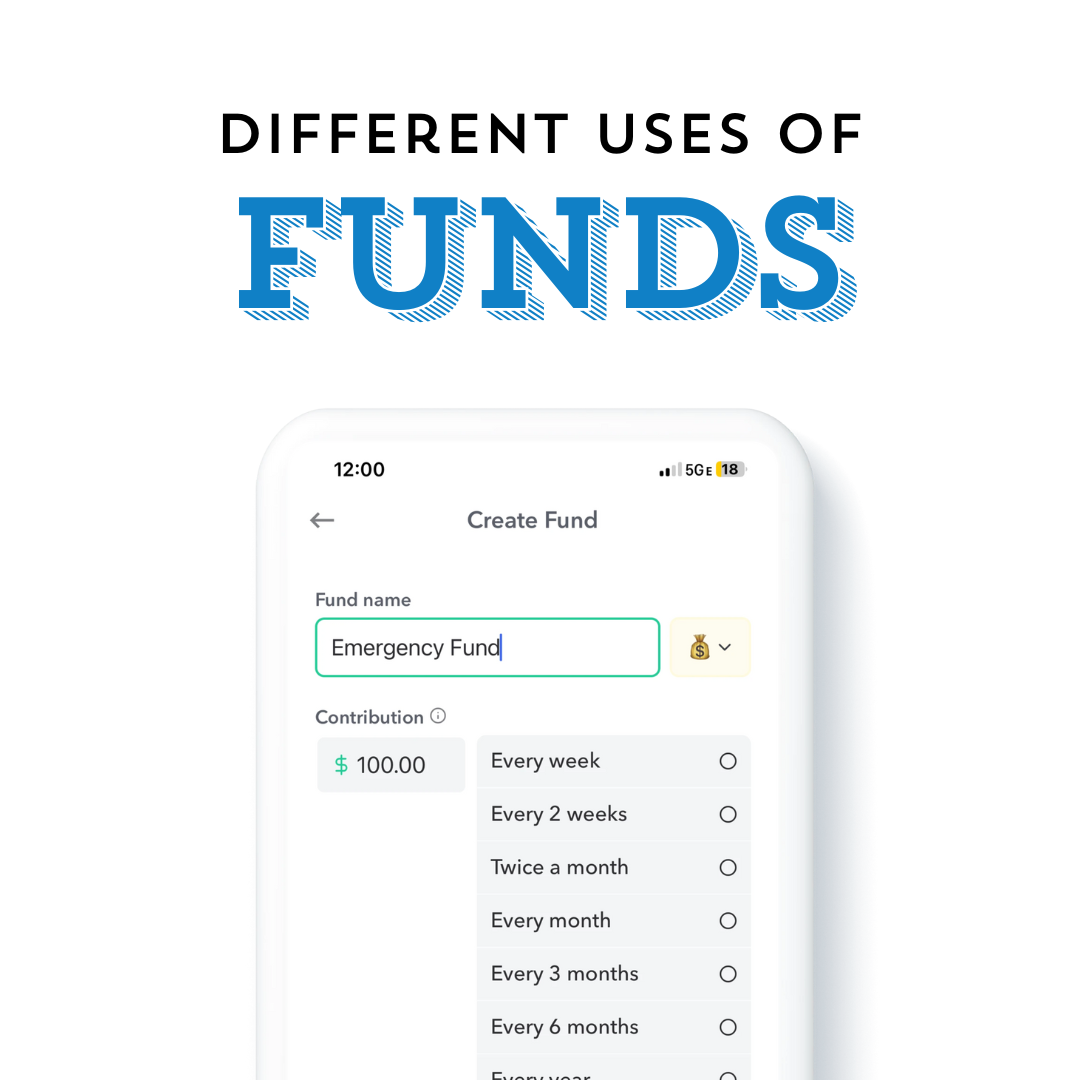

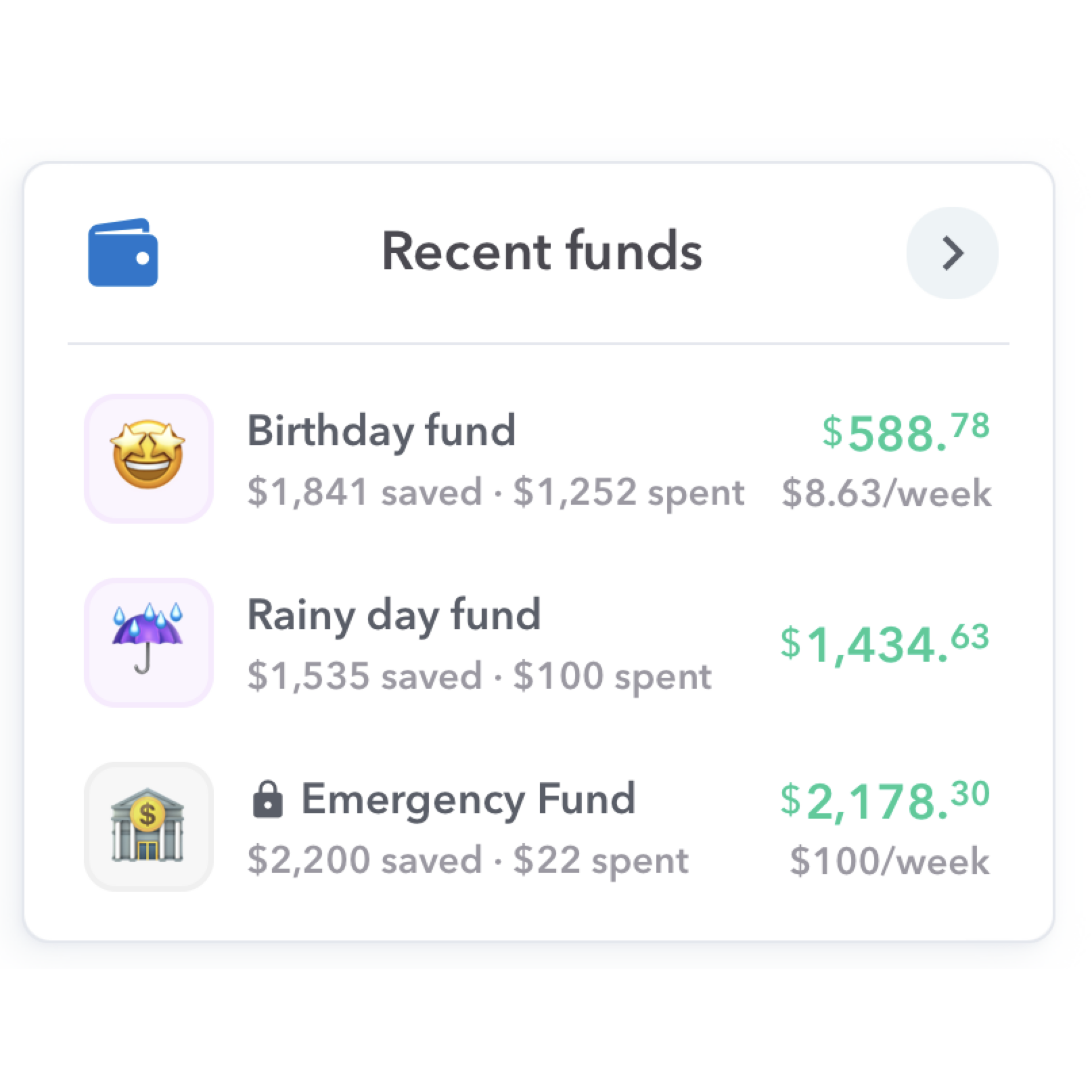

Different Uses of Funds

There are a variety of reasons people want to set aside money. Many people are trying to save up money for an emergency fund. Some people are saving for [...]

New Navigation puts more of Weekly at Your Fingertips

We have launched a new navigation that puts all of the functionality of Weekly closer to your fingertips. A new bottom navigation divides the functionality of Weekly into 5 [...]

Why is my bank account balance less than my Safe-to-Spend balance?

When you are first starting out in Weekly, although it’s not typical, it’s possible that your Safe-to-Spend could be larger than your cash balance in the bank. Yikes! How can this [...]

How to Budget for Irregular Income

Many people have income who’s amounts vary but they still want to feel confident in having a set amount to spend each week knowing that their main bills are [...]

“Variable but Important” – How to Budget for Gas and Groceries

For many people keeping track of the gas and grocery budget is essential to making their financial weeks work. People may want to make sure there is enough money [...]

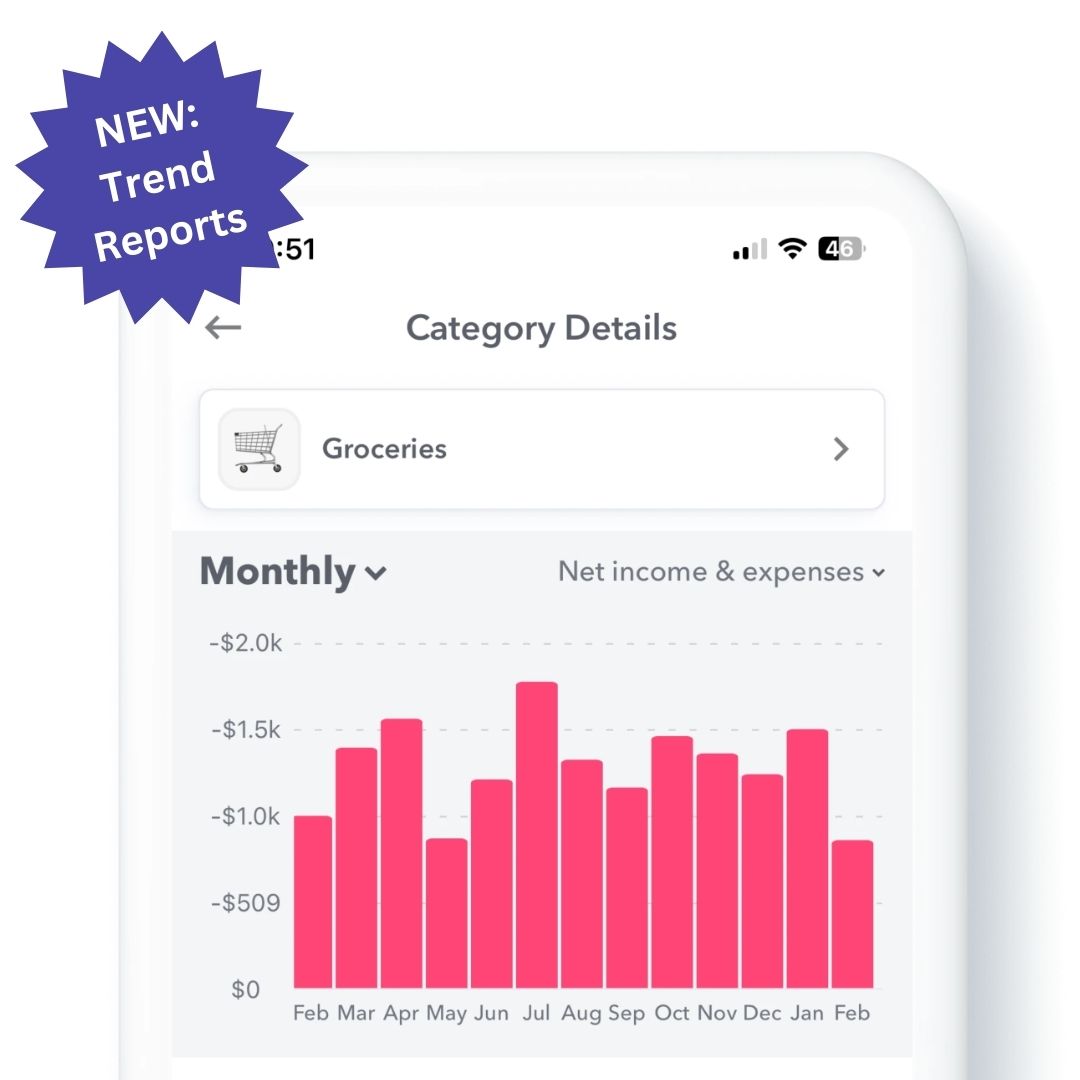

NEW RELEASE: Trend Reports and Adjustment Transactions

Our latest release (3.10) brings an all-new Trend Reports and better handling of recurring item transactions that don’t match the recurring item amount. The Trend Report is a [...]

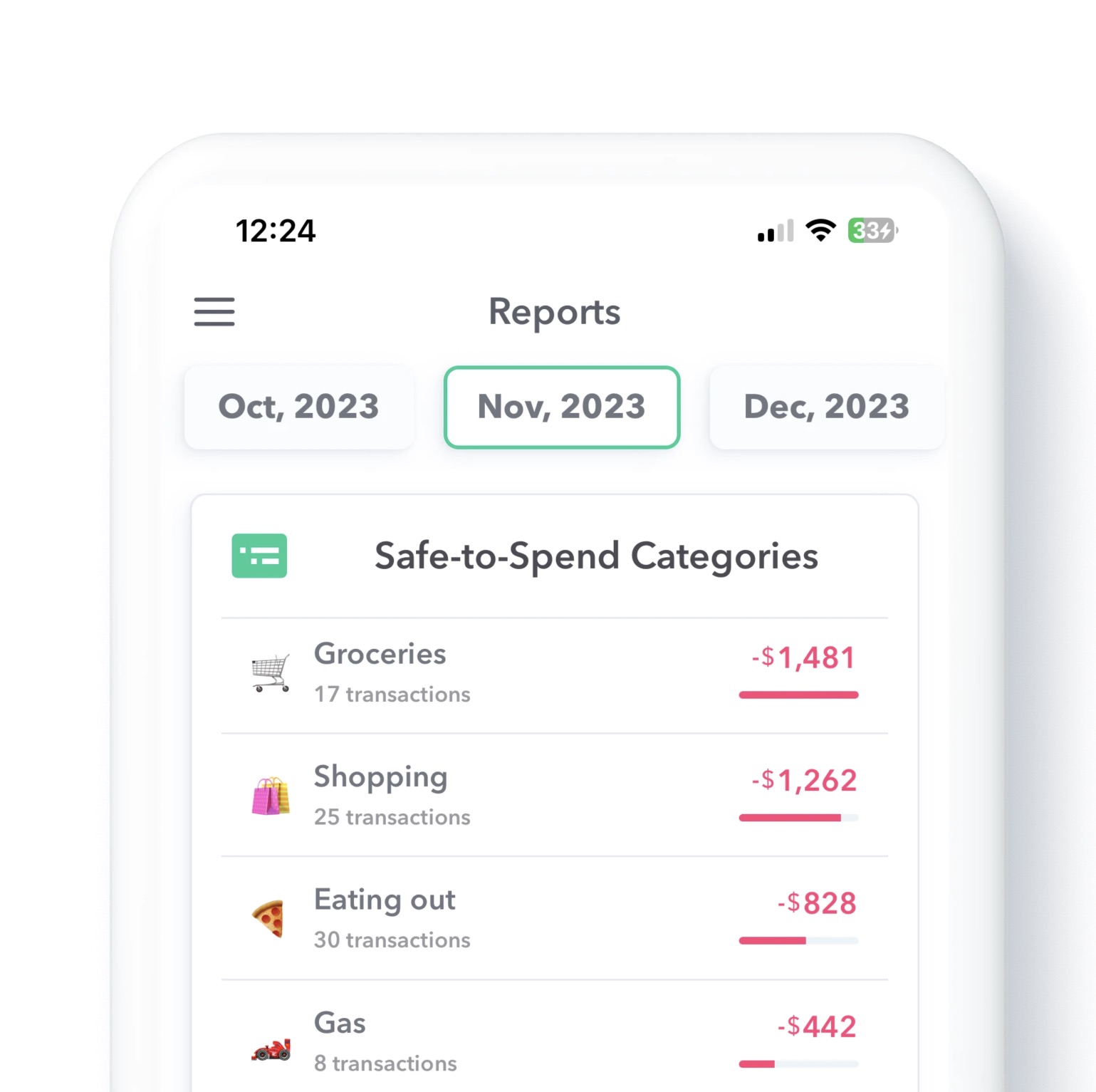

NEW FEATURE: Monthly Safe-to-Spend Category Report

Currently in your Dashboard you can see your current Safe-to-Spend transactions by category. It can useful though to "zoom out" and see your spending by category over a month's [...]

NEW FEATURE: Safe-to-Spend Categories

We are excited to announce that we have just added category tracking for your Safe-to-Spend purchases. You can now see how much you are spending in for items like [...]

Budgeting App for those with ADHD

For those that live with ADHD, it can be harder to budget using complex financial tools. Luckily, Weekly with it's easy-to-use interface, simple design and unique budgeting philosophy is [...]

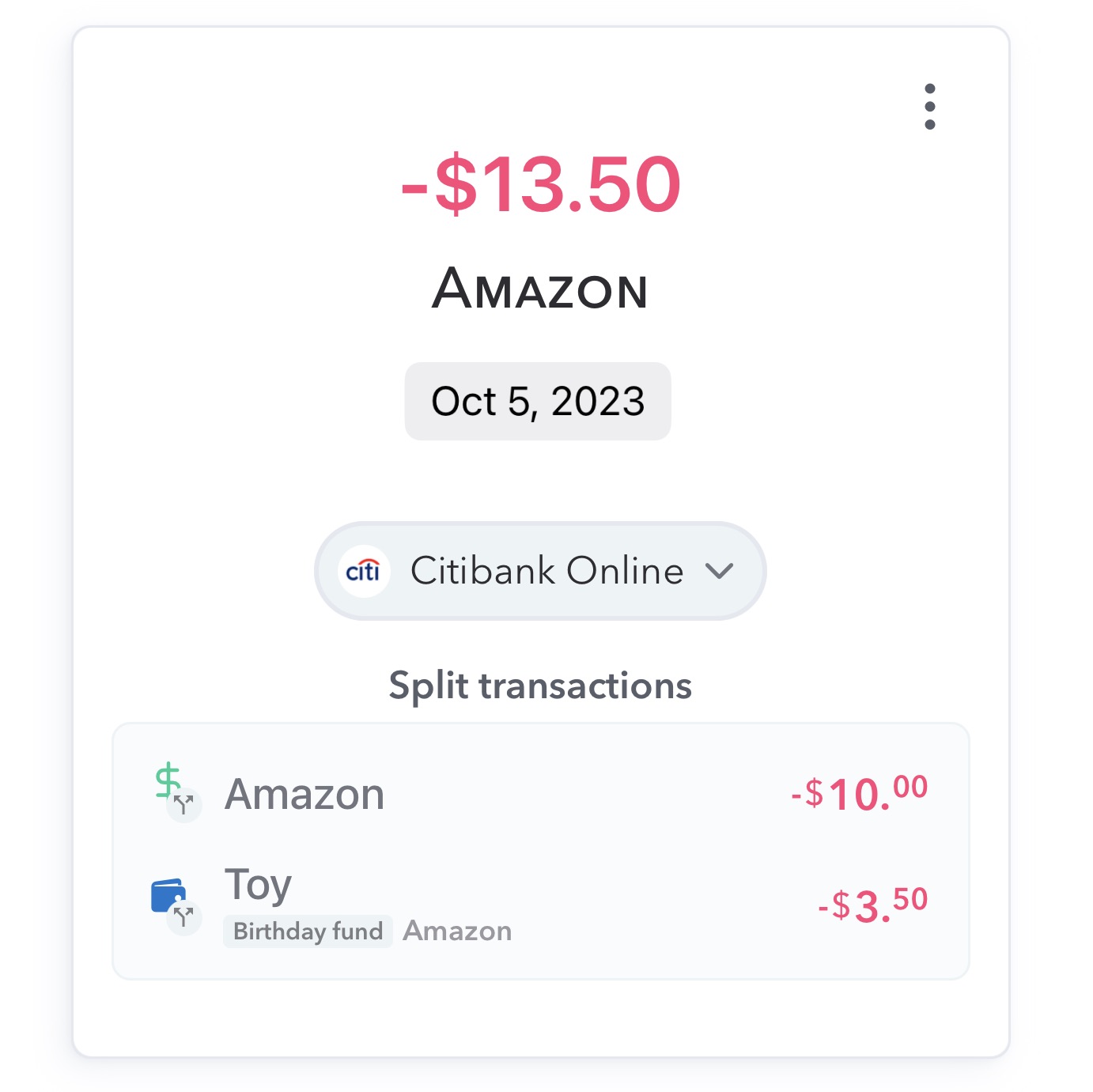

NEW FEATURE: Split Transactions

We have just launched a new feature in Weekly that allows you to split transactions so that separate parts of the transactions can be "mapped" to different destinations. This [...]

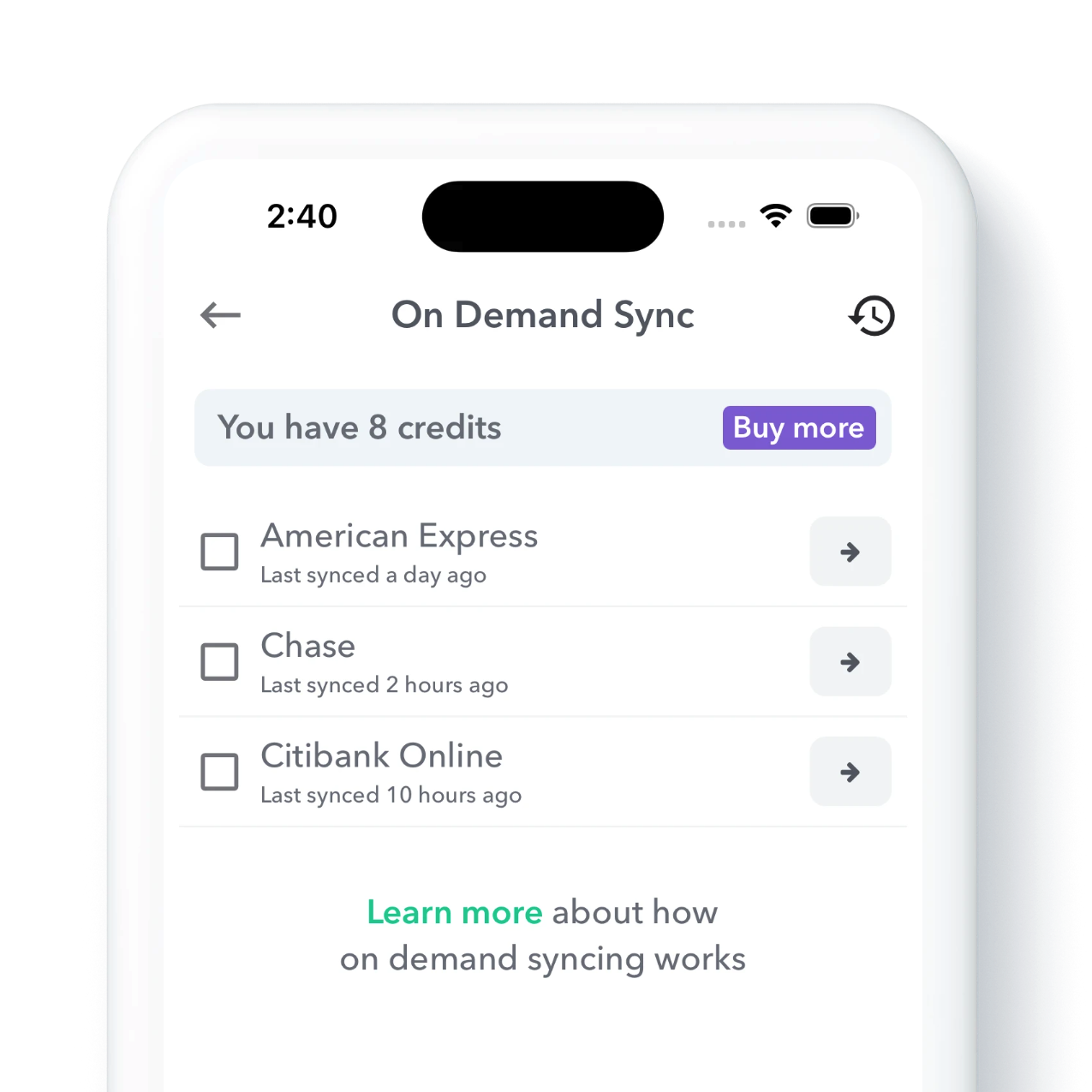

NEW FEATURE: On Demand Syncing and Sync History

Weekly budgeting is about staying in touch with your budget in a mindful way. This requires monitoring your day-to-day transactions to keep track of your Safe-to-Spend. To make this [...]

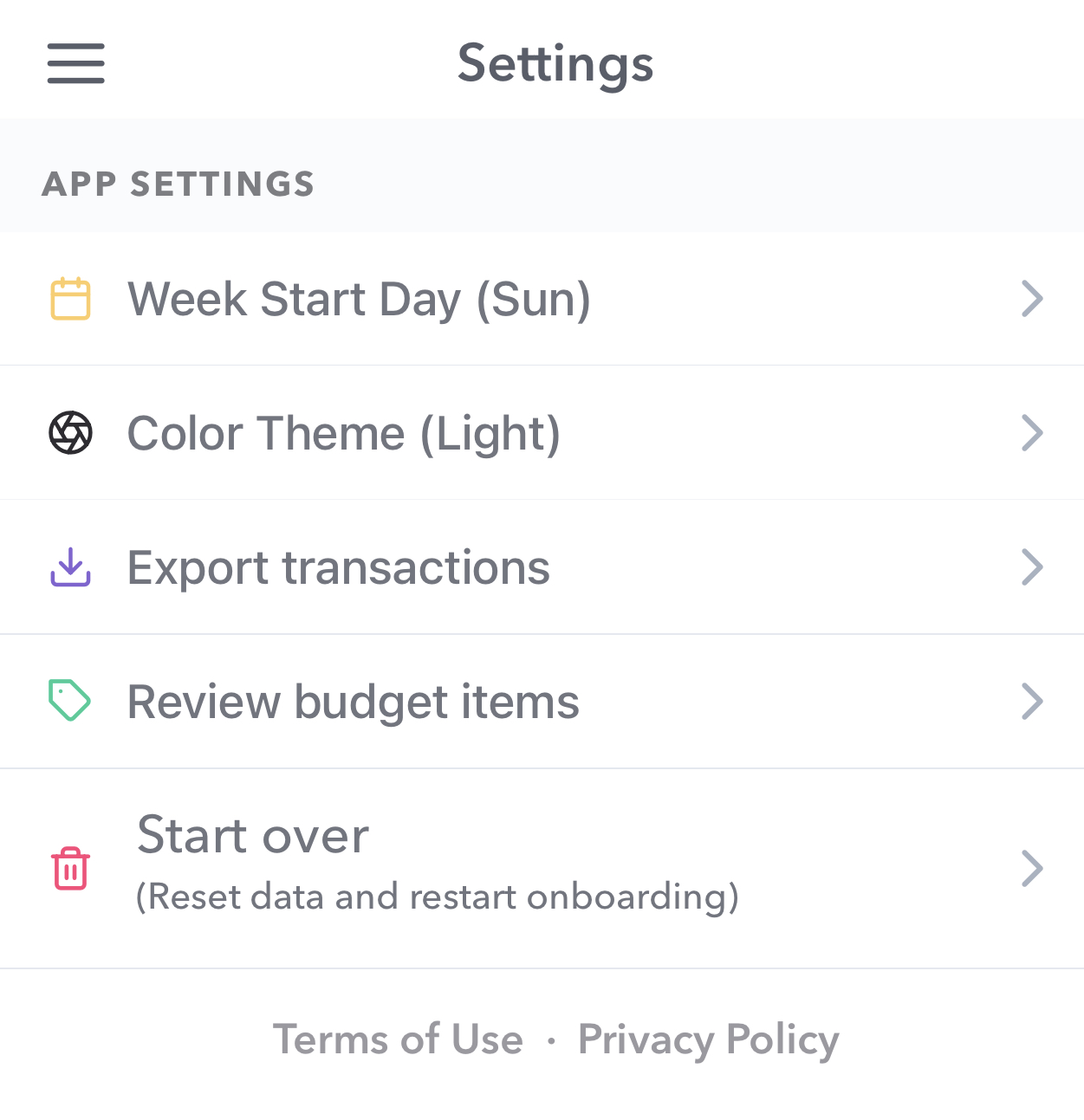

Reviewing Budget Items

When you first come to Weekly, you go through guided walk-through of putting in all your income, expenses and savings goals. Then at the end we calculate your Weekly [...]

Dan interviewed on the CFO At Home podcast

Dan Seethaler sat down with Vince Carter the host of the CFO at Home podcast to discuss all things weekly budgeting. In this conversation with Vince, Dan discussed [...]

Budgeting Systems – Which Is the Best Way to Budget For You?

So you want to get yourself on a budgeting plan! That’s great. So, what’s the first step? You may discover quickly there is no one way to do budget [...]

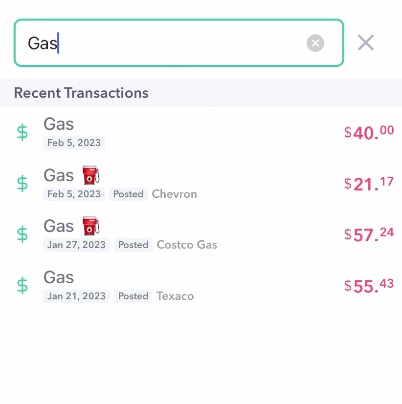

A Flurry of New Transaction Management Features

A big update has come to Weekly that changes how the app handles transactions. With this update you will have the ability edit transactions in past weeks, search for [...]

Sharing Weekly with A Partner

One of the problems couples can run into is conflict over how money is being spent. In fact the origin story of Weekly has roots in helping [...]

Instant View Into Your Upcoming Bills

Weekly can set your mind at ease by giving you a view into your upcoming bills and income in the Upcoming Items report. In this report, Weekly shows you [...]

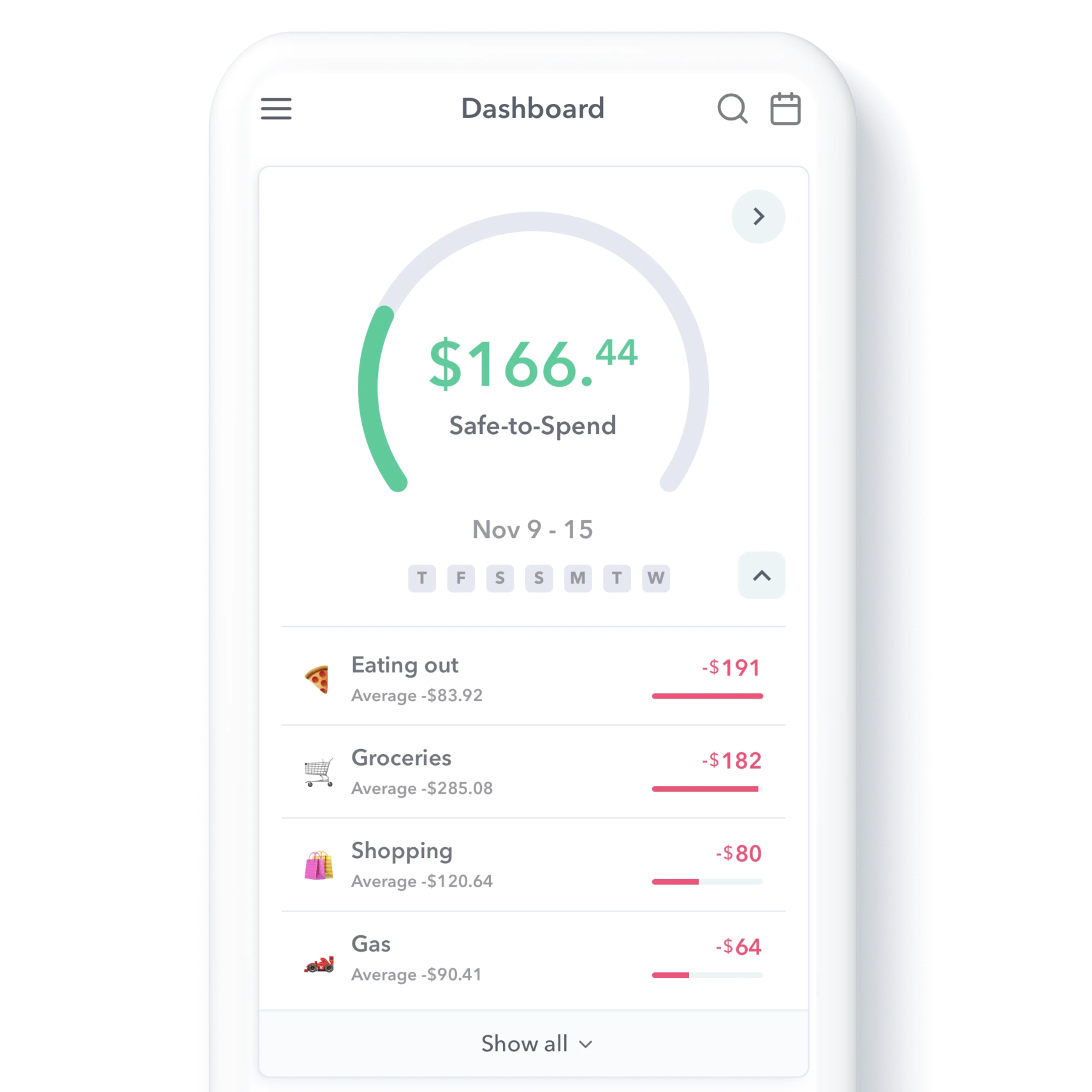

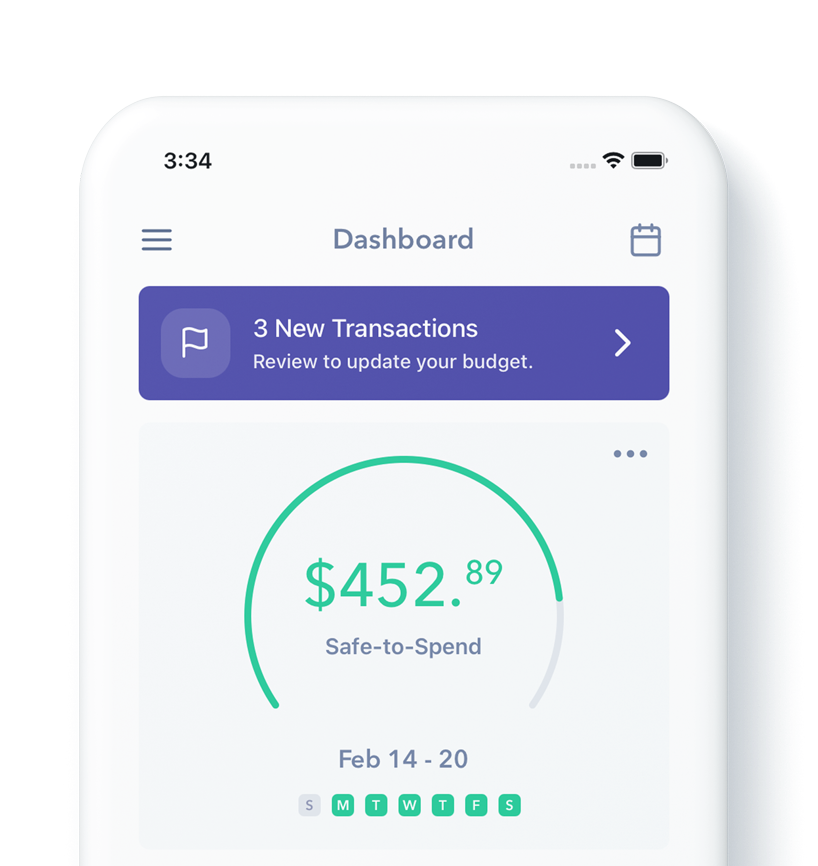

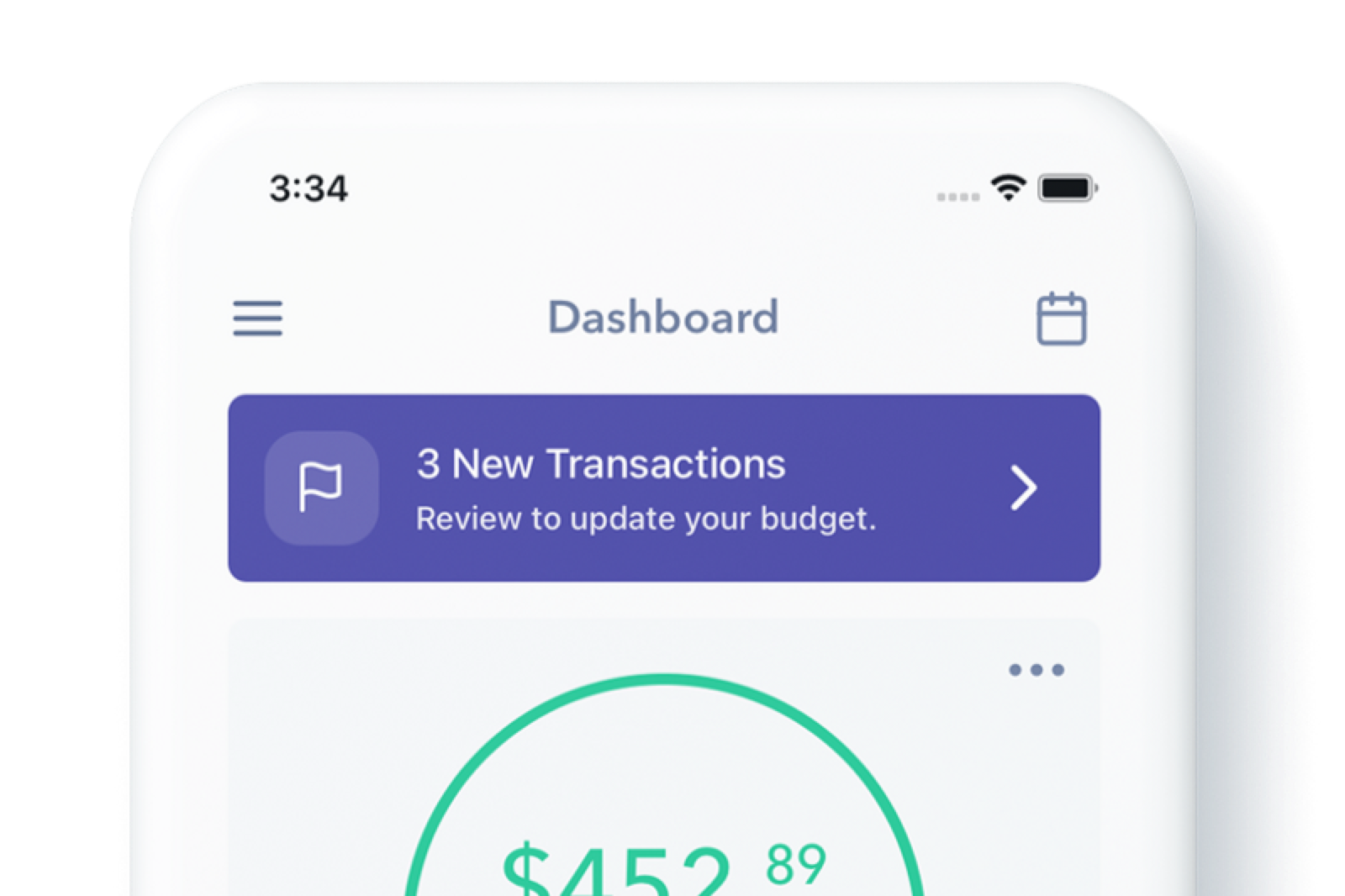

New Dashboard & Reports. Be in Control in 2023.

Weekly's new dashboard gives quick insights into day-to-day spending, upcoming bills and the amount of money in your accounts. The new dashboard also lets you see the changes in [...]

Rainy Day Fund: How to Tell if You Are Prepared for a Rainy Day

Do you keep track of your finances so you know how much money you can reasonably spend each week? You’re on your way to a healthy budget! You understand [...]

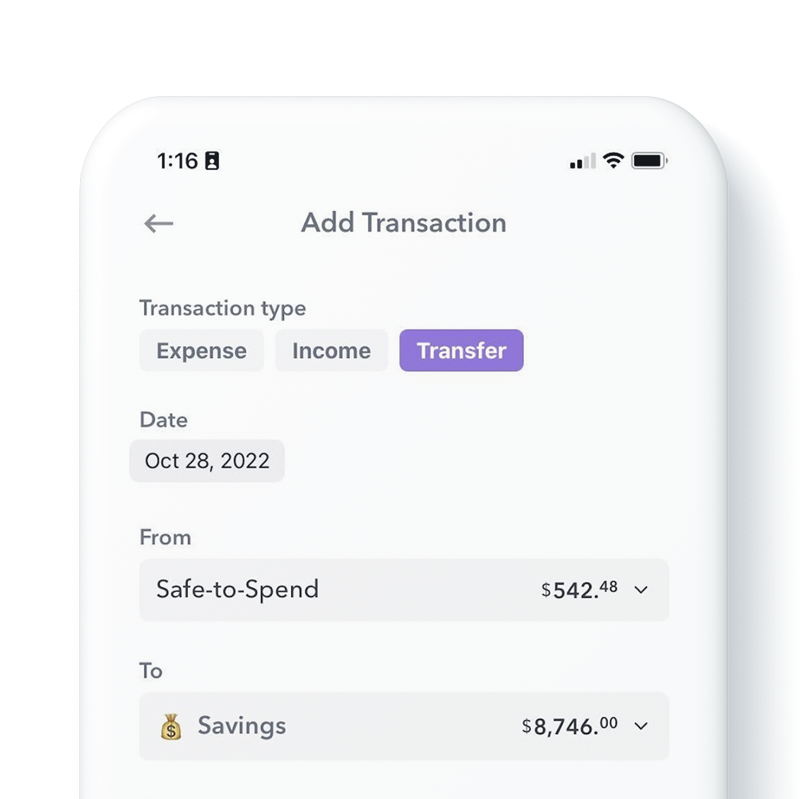

Transferring Money between Funds (and Funds and Safe-to-Spend)

The fun of budgeting is to see your funds grow and feeling more confident and secure in your spending habits and lifestyle. As you move through your weeks you [...]

The Safe-to-Spend Widget

Your Safe-to-Spend is important to keep close. It keeps you in touch with how much money can spend as you move through your daily life. It’s like your financial [...]

Variable vs Fixed Expenses: What’s The Difference?

What Are the Differences Between Variable Expenses & Fixed Expenses? Have you ever decided that it was time to be smarter about your spending? One of the first steps [...]

8 Tips to Stop Impulse Buying & Control Your Spending Habits

Do you find yourself purchasing a chocolate bar when you pass it at the grocery store checkout? Do you click on links to purchase items when you’re browsing social [...]

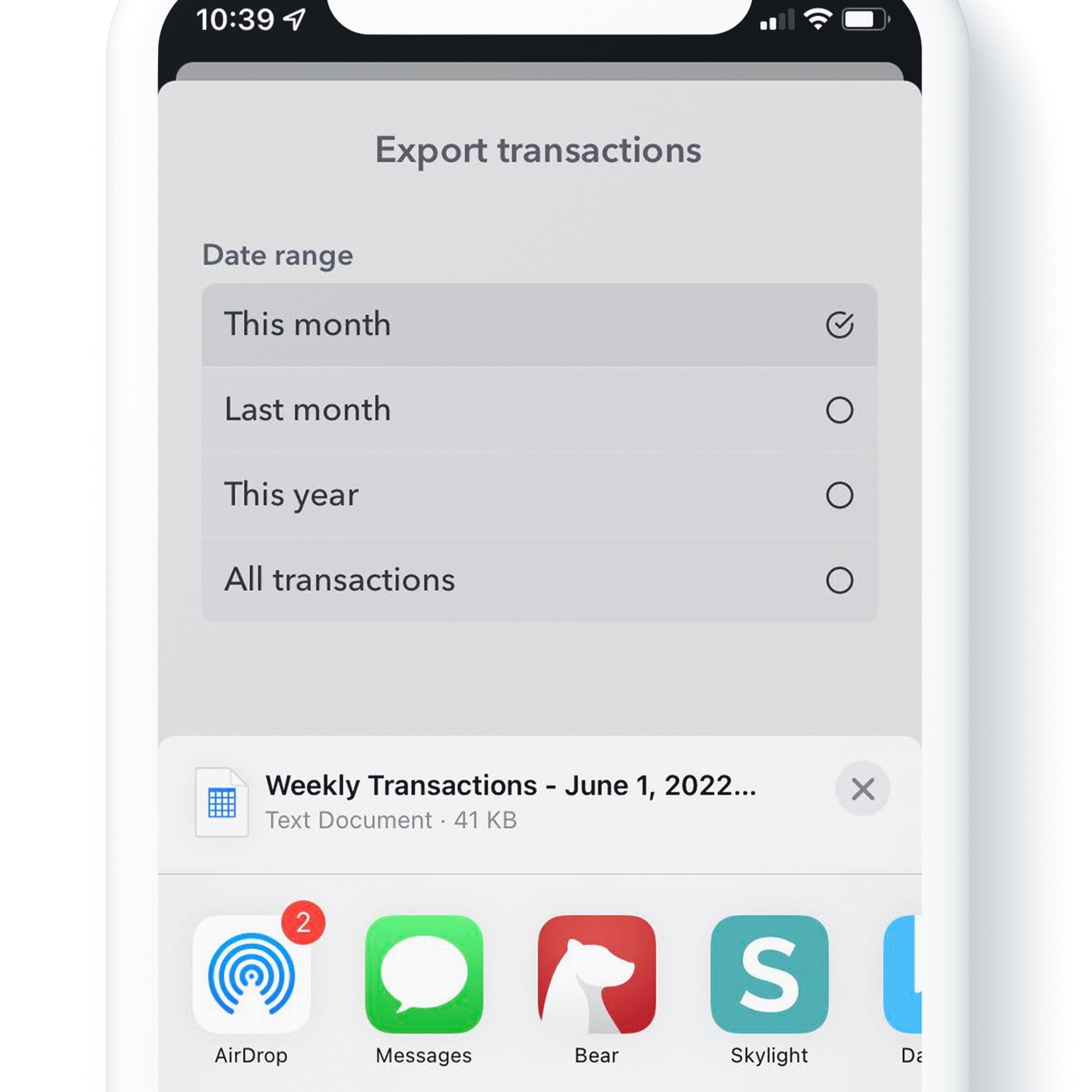

Export Transactions to a CSV to Do Your Own Analysis

Who loves spreadsheets? In our latest release (version 2.5.0) we have added the ability to export your transactions to a .csv file to use with your favorite spreadsheet program. [...]

How To Keep More of Your Paycheck: 11 Easy Tips

You work hard and your money should work just as hard for you. But if you’re finding that the money disappears before you can even bring it home, don’t [...]

Transaction Update Notifications

Sometimes after a transaction has been posted to your bank account and downloaded into Weekly, the amount will increase. Weekly allows you to review transactions as soon as they [...]

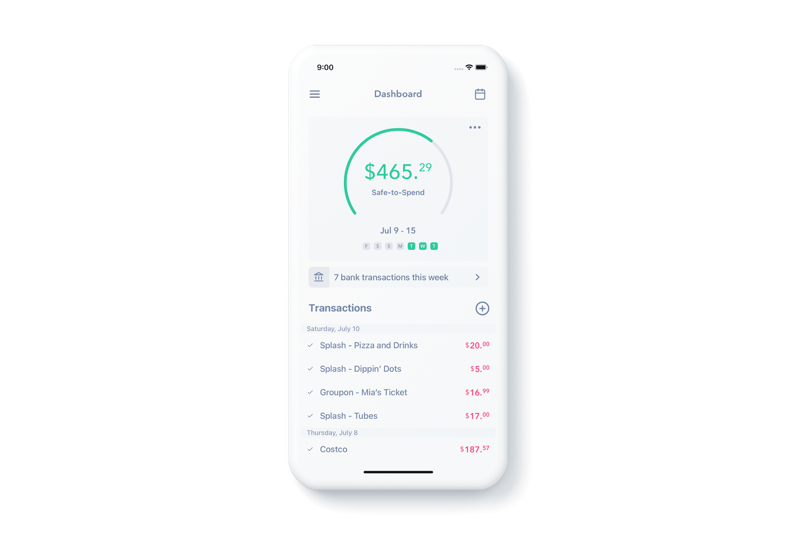

Two Ways to Add Day-to-Day Transactions into Weekly

So you are all setup with Weekly, and you have determined your Safe-to-Spend amount and started your first week. Congrats! On the main tracker page you will see your [...]

4 Critical Mistakes Couples Make When Budgeting and How to Fix Them

Relationships can be tricky at the best of times. Financial issues that can surface when you’re budgeting with your partner can put a serious strain on domestic bliss. [...]

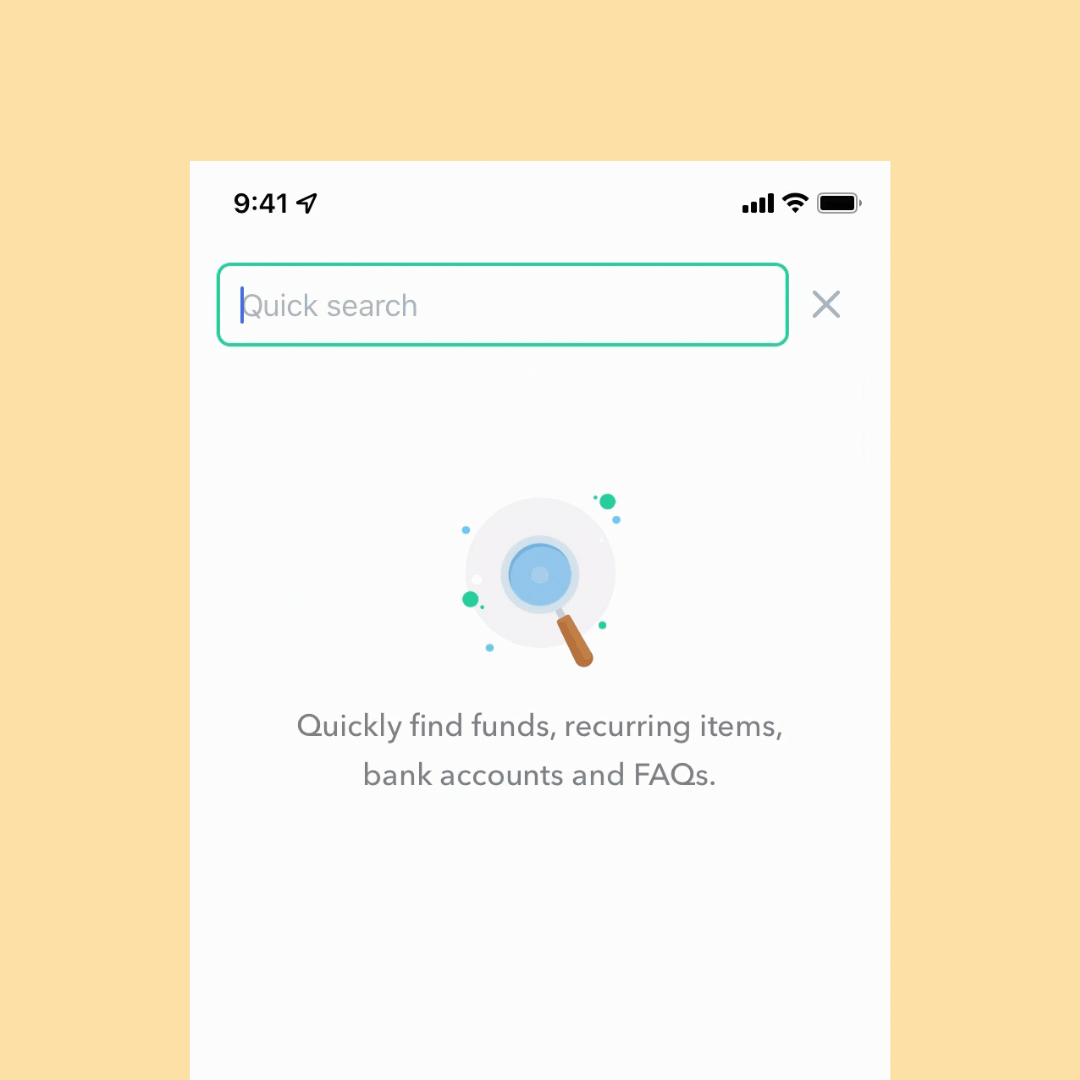

Quickly Navigate and Find Things with Global Search

Did you know inside of Weekly, you can access a global search? Weekly's Global Search allows you to find funds, recurring items, bank accounts and even answers to [...]

7 Money Saving Tips You May Never Have Thought of Before

Saving money can come in many forms. It can mean a whole lifestyle change but it can also mean finding small ways to save a [...]

Budgeting with Your Spouse as A Couple

Put an end to “Doomsday” meetings. Budgeting with a spouse or partner? Is there anything more fraught? No one likes to face the limits of their money and doing [...]

5 Essential Budgeting Tips for 2022

Budgeting is about focusing our spending on things that truly bring value to our lives. With all the demands of daily life, it can sometimes get confusing to make [...]

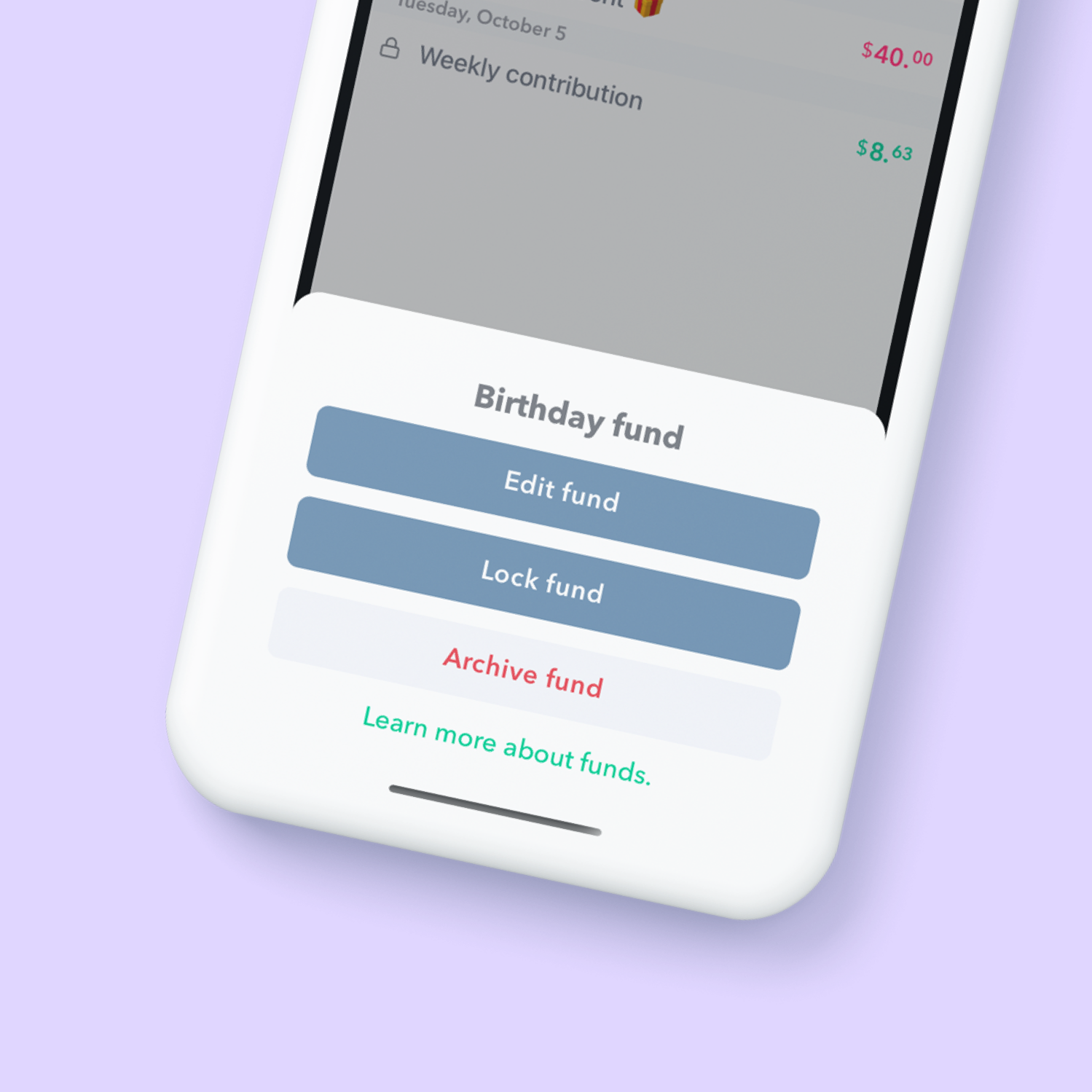

Lock and Archive Funds to Manage Their Availability

As you are building up your funds inside of Weekly, you may want to keep them out of sight until it's time to spend money out of them [...]

Track Your Savings with Funds

Track Your Savings with Funds Saving money is a lot easier when you know exactly what it’s for. That’s where Funds come in. Funds in Weekly help you set [...]

Choose your own emoji for “Income & Expenses”

JUST LAUNCHED: when adding/updating a recurring income or expense, you can now pick your own emoji and background color. Also the "Income & Expenses" screen has a new look. [...]

Support for OAuth and Capital One

Weekly connects to your bank to download your transactions to make it easy to stay on top of your Safe-To-Spend. Up until now, Weekly - via Plaid - has used [...]

How To Create A Weekly Budget in 6 Steps

No matter how often you're paid - once a month, twice a month, or every other week - weekly budgeting works. Budgeting on a weekly basis makes it easier [...]

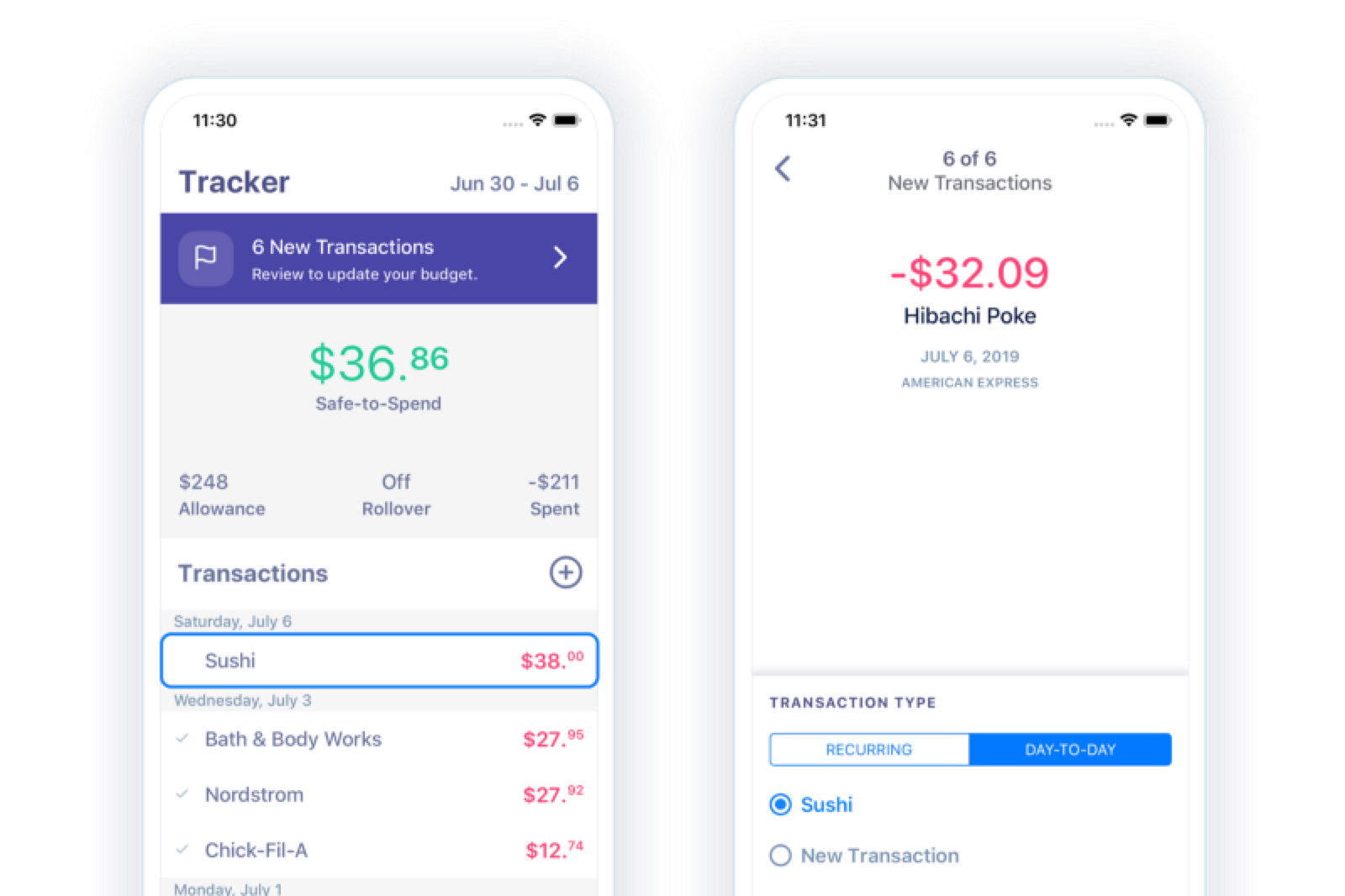

Bank Transaction Review

Weekly is designed to keep you focused on one number: your Safe-To-Spend. To make sure your Safe-To-Spend number is up-to-date and accurate, Weekly pulls in your purchases from your bank [...]

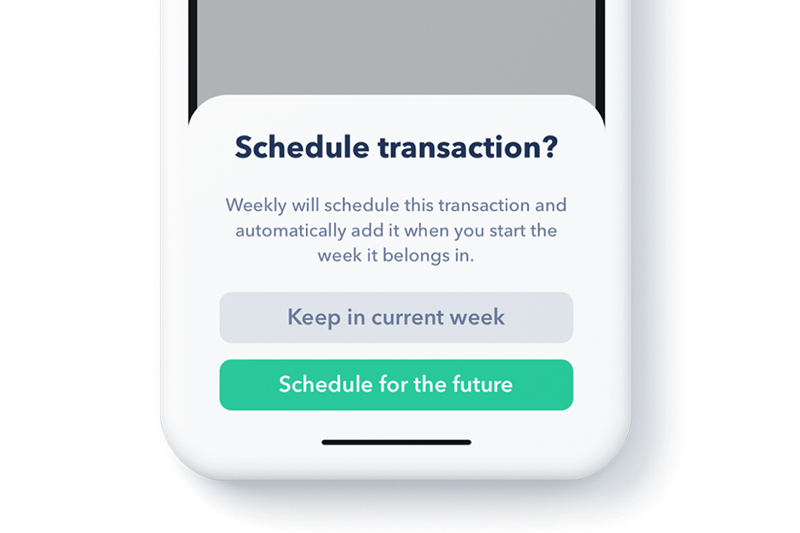

Scheduling Transactions

The latest launch of Weekly brings the ability to schedule transactions in the future. This comes in handy when you spend money but don’t want to count it against your [...]

Stop the Shame!

As financial coach, Amanda Clayman says, budgets are not supposed to be “a form of punishment for past mistakes.” But how do we shift budgets from being tools of [...]

Do You Feel Anxious About Money?

Do you feel anxious about money? That’s okay! Financial therapists say that it’s completely normal. Being unclear on what whether we are overspending or if our spending aligns with [...]

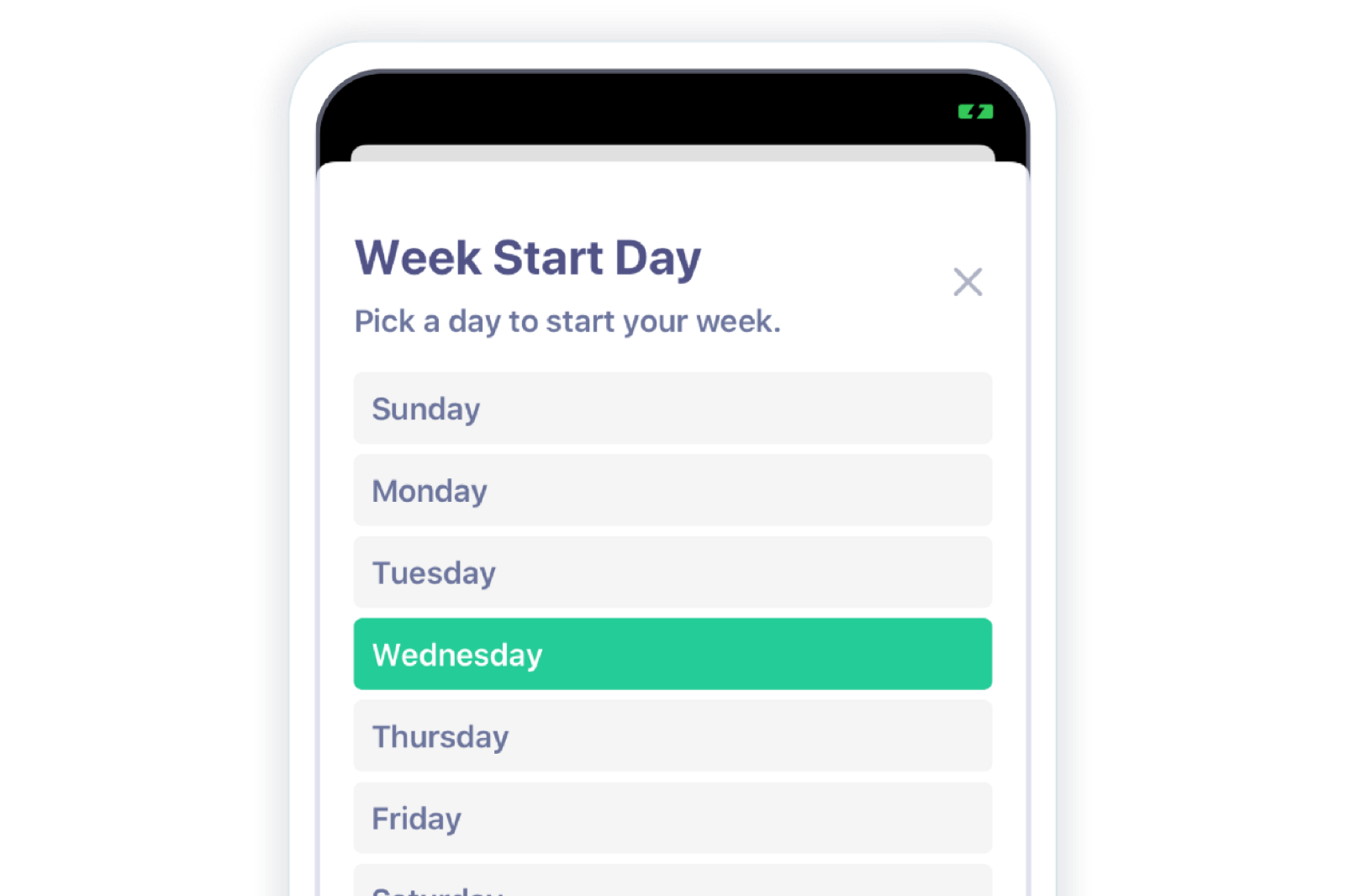

Choose Your Week Start Date

The idea of behind Weekly is to budget your money on a weekly basis and not focus on when cash comes in or out of your bank account. But your [...]

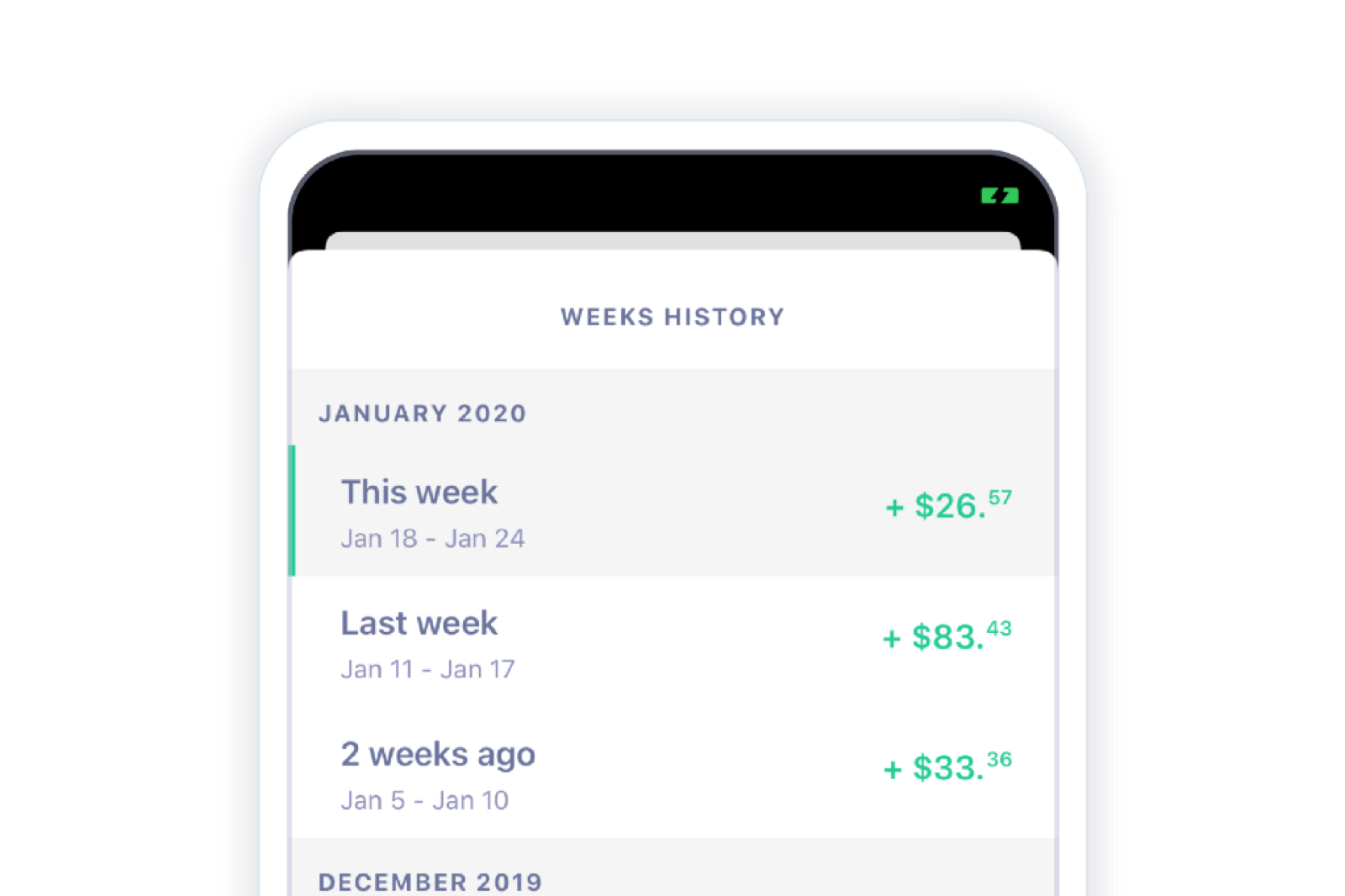

Viewing Past Transactions

What’s in the past is in the past, but if you wanna take a look — we got you! It’s Weekly’s aim to declutter the process of keeping track of your money and [...]

App Notifications and Viewing Bank Transactions

App Notifications and Viewing Bank Transactions Getting your transactions automatically downloaded from your bank helps take away the headache of manually entering transactions. Now, with automatic notifications, you can be [...]

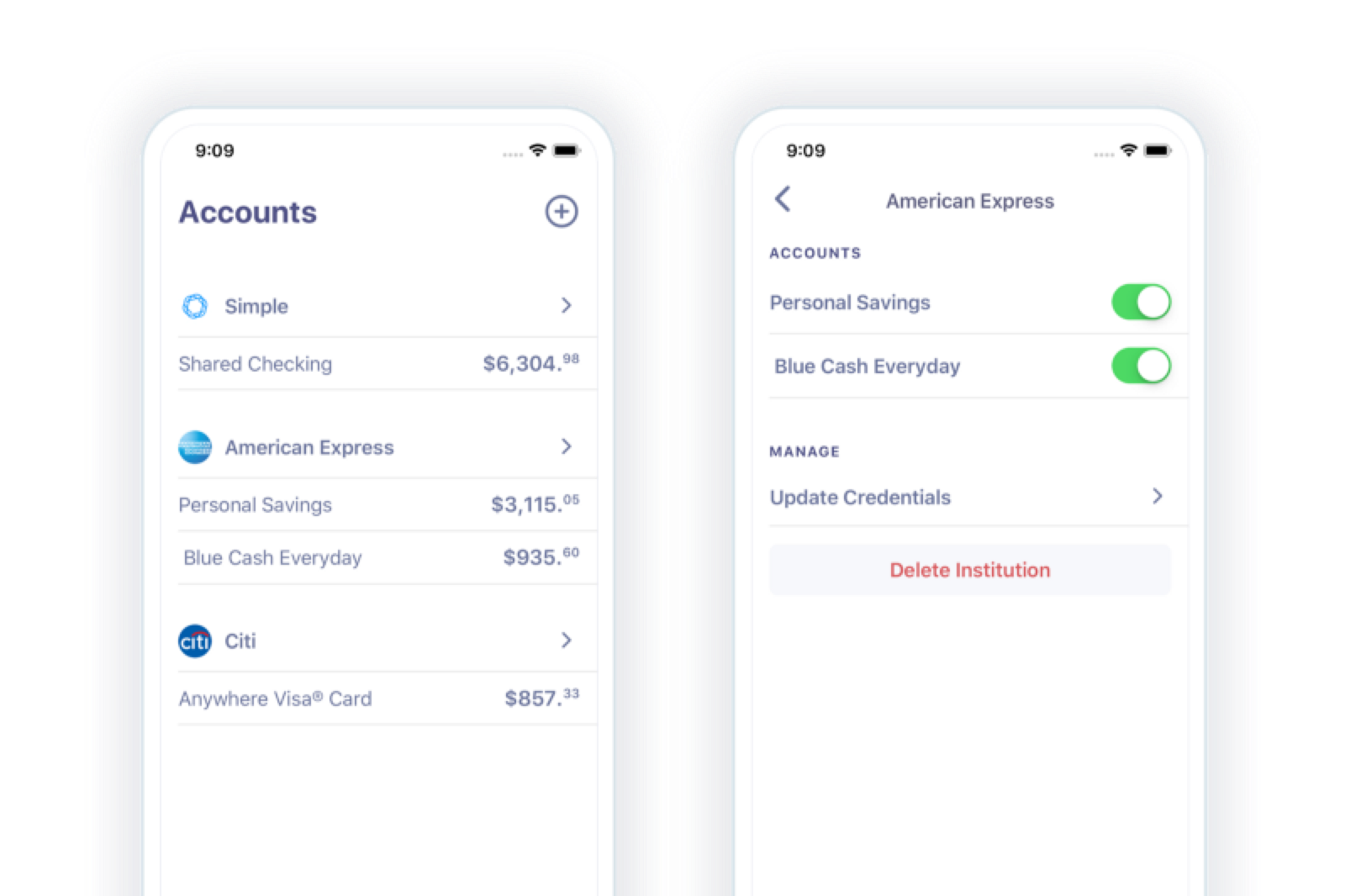

Account Management

Account Management When you connect your financial institutions to Weekly, your transactions are automatically downloaded to help keep your budget up to date. This week’s release adds the ability to [...]

Transaction Review Enhancements

At Weekly we believe reviewing bank and credit card transactions is a critical step in managing your spending. Seeing each transaction individually increases your mindfulness and helps ensure your money [...]

Automatic Transaction Importing — How It Works and Why We Built It

So, you have bought into the benefits of weekly budgeting. You’ve downloaded Weekly and are using it to keep track of your spending — woohoo! But as you go on with [...]

Tracking Daily Expenses

Weekly is designed to change behavior. It does this by giving you one financial number to concentrate on: your Safe-to-Spend amount. Your Safe-to-Spend amount is the amount of money [...]

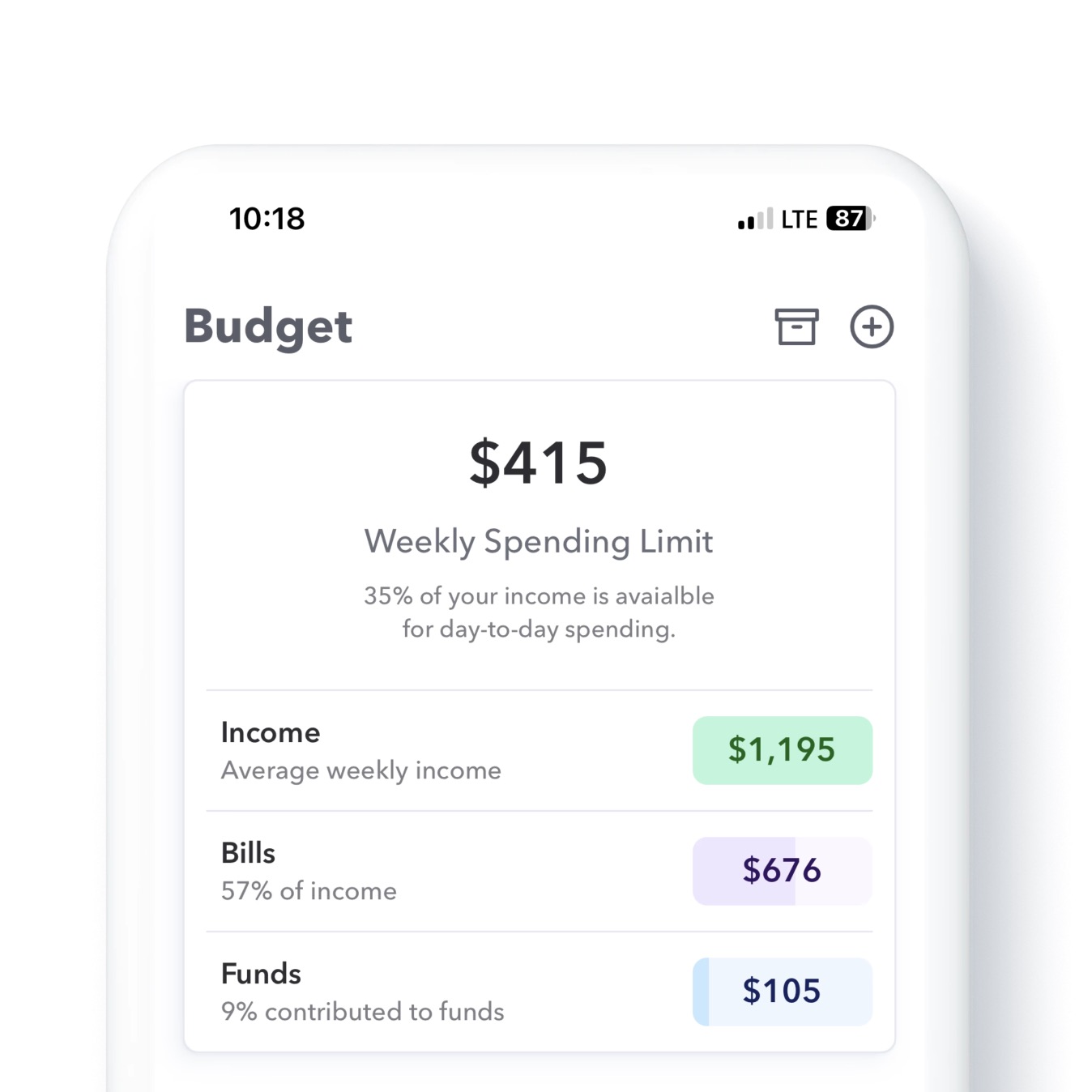

Your Weekly Spending Limit

One of the problems with traditional budgeting is it’s hard to know what number to concentrate on. One approach is to give everything dollar a job and track all [...]

Building A Budget That Works For You

Budgeting should be simple — just spend less than you earn, right? Unfortunately, most budgeting tools overcomplicate things and lose their focus on making things as easy as possible for you, [...]

Trend Reports

Trend Reports The Trend Report is a bar graph of your spending and income over time. There is a Trend Report in three places: Safe-to-Spend Categories, Funds or [...]