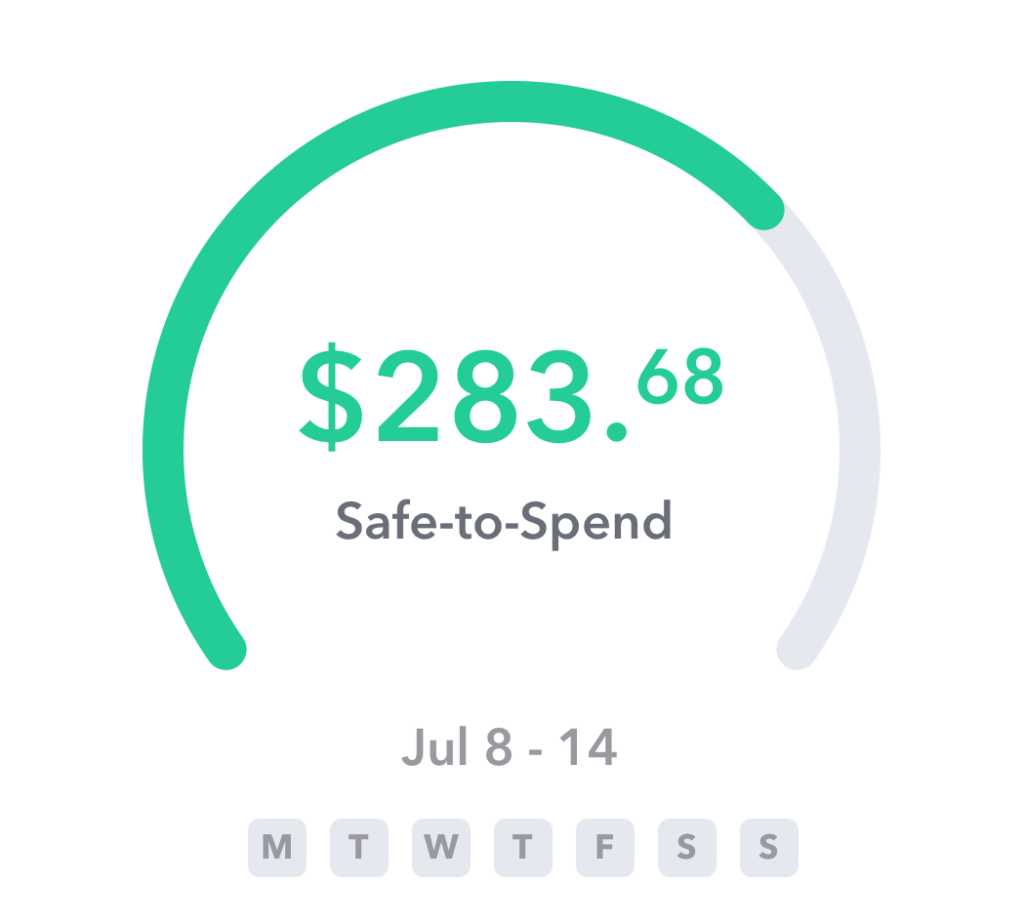

Your Safe-to-Spend is where your budget get puts into action. It’s the main number you will focus on when planning your day-to-day spending and it’s based on your Weekly Spending Limit. Your Safe-to-Spend is the large number at the top of the dashboard and it show’s the amount still available for day-to-day spending during the current week.

How is Your Safe-to-Spend Calculated?

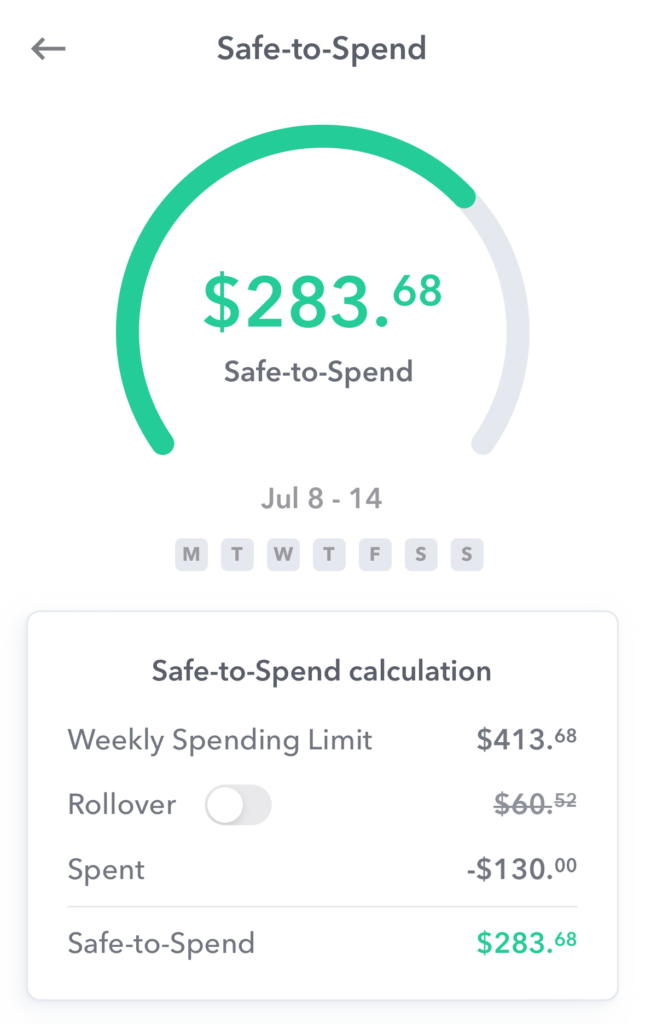

The calculation for the Safe-to-Spend is as follows:

- Weekly Spending Limit

- +/- Rollover from previous week

- – Current week transactions

- = Safe-to-Spend

Your Safe-to-Spend starts with your current Weekly Spending Limit. If your Weekly Spending Limit changes during the week your Safe-to-Spend will immediately update. From there we add or subtract the ending Safe-to-Spend balance from the previous week (if rollover is enabled for the week). Then we subtract any spending transactions from the current week. If you have any income transactions marked as Safe-to-Spend those will increase your Safe-to-Spend. (Typically income is handled as recurring).

You can see exactly how your Safe-to-Spend is calculated on the detail page. Tap the Safe-to-Spend card at the top of the dashboard to get to this page.

Safe-to-Spend is not Cash

Your Safe-to-Spend is not related to your checking account balance. It’s a calculated number based primarily on your Weekly Spending Limit. Weekly intentionally separates your Safe-to-Spend from your bank account balance to give you a consistent amount to spend each week. Learn more about our philosophy in the Using Averages article.

Conclusion

Your Safe-to-Spend is the most important number to focus one when managing day-to-day spending. Having one number to concentrate on helps reduce the need for categorization and makes budgeting easier.