Available Cash is how much money you have in the bank for savings and funds after your upcoming bills and day-to-day spending are accounted for. It is the same number as the Cash Low Point on the Cash Forecast Report.

Setting Up Available Cash

Weekly calculates your Available Cash based on your bank account balances. To find your starting cash balance, Weekly will add your checking and savings account balances and subtract any credit card debt. Weekly then calculates your future daily balances by forecasting your income, bills, and daily Safe-to-Spend spending.

It’s important to connect all your checking, savings, and credit card accounts to make sure your Available Cash is accurate.

Next you want to make sure each recurring income and bill includes a next transaction date. Items without a date will not be included on the Cash Forecast report and won’t affect your Available Cash. If any items are missing a next transaction date you’ll see a warning under the Available Cash section on the Funds page.

Calculating Available Cash

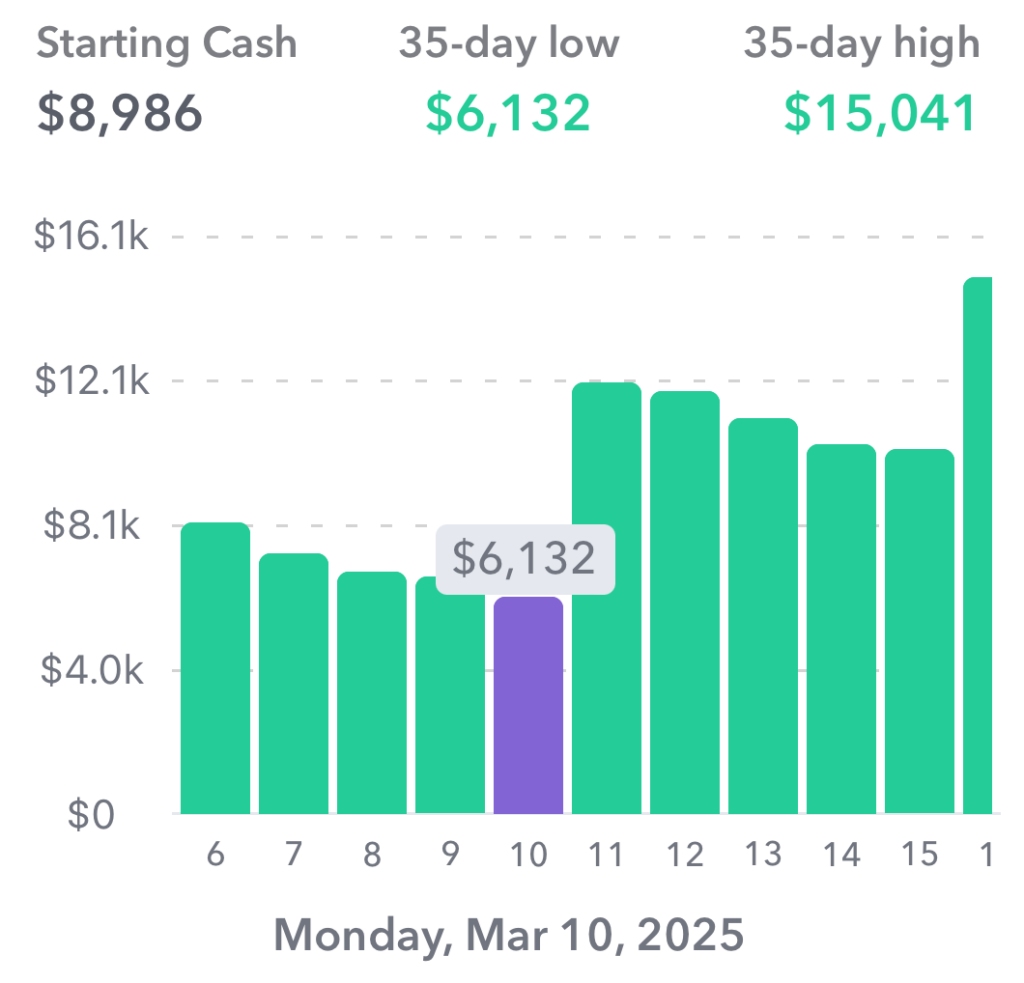

To find how much available cash you have, Weekly forecasts all your income and spending over the next 35 days to find what day you’ll have the lowest balance. This number is your Available Cash.

You can see exactly how this is forecasted by looking at the Cash Forecast report on the Reports page under the Cash tab. Each day on that report will have:

- Any recurring income or bills scheduled for that day

- Your expected day-to-day spending

- Fund contributions (one the first day of each week)

The recurring income and bills are the building blocks of your budget and can be found under the Income & Bills tab on the Reports page.

Weekly forecasts that you will spend your entire Safe-to-Spend each week. To find a daily spending amount we divide your Weekly Spending Limit by seven and use that for the daily expense on the Cash Forecast. For the current week, Weekly calculates the daily spending by taking your remaining Safe-to-Spend and dividing it by the number of days left in the week.

Fund contributions are also included in the Cash Forecast. On the first day of each week we include an expense for any fund contributions you have set up. When the week starts the fund contributions for that week are removed from the forecast and are added to your funds. This will increase both your fund balances and your Available Cash.

Handling Negative Available Cash

If your Available Cash is negative then you may be carrying credit card debt, or you may not have enough money to cover your coming bills and daily expenses. Let’s walk through each scenario and explain the options.

If you don’t have enough money to pay off your credit cards each month then your Available Cash may be negative. In this case the negative Available Cash is a good estimate of how much credit card debt you’re carrying. We have an entire article for walking through how to pay down credit card debt in Weekly.

If you don’t use credit cards and your Available Cash is negative, it means that your upcoming bills and daily spending are expected to exceed your cash in the bank and upcoming income. To fix this you will need to decrease your Weekly Spending Limit. You can do this by increasing your Savings amount. Go to the Budget tab and tap on the Savings row in the budget breakdown. This will open the Weekly Savings contribution page. You can set your savings amount which will decrease your Weekly Spending Limit and increase your Available Cash

Safe-to-Spend Rollover and Available Cash

The way you handle your ending Safe-to-Spend when starting a new week may affect your Available Cash. If you’ve overspent your Safe-to-Spend your Available Cash will have already been reduced. You can catch back up by rolling over the negative amount and reducing your spending the following week.

If your ending Safe-to-Spend is positive you can either roll it into the next week (which has no impact on the Available Cash) or you can turn off the rollover and the Available Cash will be increased by the remaining balance.

Available Cash and Fund Balances

Since your Available Cash is the money available to cover your fund balances, it should be higher than your fund balances. If it is then you can safely use the money in your funds. If the Available Cash is lower than your fund balances Weekly will give you a warning under the Available Cash and give you some options to fix it.

The simplest way to resolve this is to lower your fund balances. You can do that by tapping the slider icon above the list of funds and selecting “Adjust Fund Balances”. This will give you a list of your funds where you can adjust the balances. Funds are not directly tied to savings accounts or real dollars so their balances can be adjusted directly.

Another option is to increase the Available Cash by contributing to Savings. This will lower your Weekly Spending Limit by the contribution amount which increases your Available Cash over time.

Negative Funds

The total Fund Balances number only includes the balance from positive funds. This makes it easy to see how much is available in your funds and compare it to your Available Cash. If you’ve overspent a fund then your Available Cash has already been reduced and Weekly does not expect that you’re going to continue spending from this fund. If you do plan to continue spending from a fund with a negative balance, we recommend adjusting the fund balance to match what you expect to spend so that amount can be included in the total Fund Balances.

Spending and Available Cash

The way that transactions are categorized affects how they impact your Available Cash. Let’s go through each transaction destination.

Safe-to-Spend

If a spending transaction is categorized as Safe-to-Spend and you have enough money in your Safe-to-Spend to cover it, your Available Cash will not change. If the transaction exceeds the available Safe-to-Spend then your Available Cash will go down by the extra spending.

Income & Bills

When your recurring income and bills match what’s set up in your budget there is no change to your Available Cash.

If your income and/or bill does not match the expected date or amount, Weekly will make adjustments based on how you handle the transaction. If you update the recurring item amount, this will adjust your Weekly Spending Limit. There will likely be a small change to your Available Cash since the full transaction amount occurred today and the Weekly Spending Limit will average that over the coming weeks.

Funds

Since the Available Cash is the amount available for funds, your Available Cash will always be lower when you spend from Funds. Likewise if you have extra income you put into a fund, this will increase your Available Cash.

Ignore

Ignoring a transaction will directly impact your Available Cash since it will affect your bank account balance and it’s not part of the forecasted income or expenses. If you ignore an income transaction your Available Cash will go up. If you ignore an expense your Available Cash will go down.