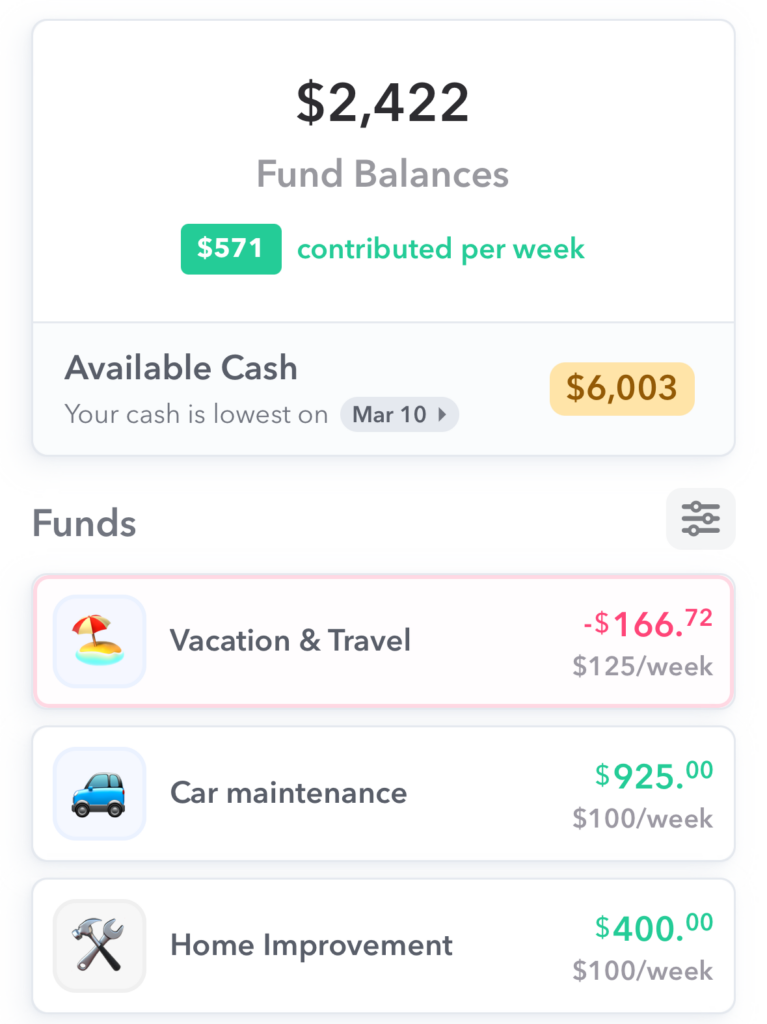

Funds keep track of money you have saved for specific purposes. You might have funds for things like vacations, birthday spending or downpayment on a car. In a Fund you can contribute automatically and those contributions reduce your Weekly Spending limit. Funds allow you to track and spend from your balances.

Savings on the other hande does not track a balance, instead it allows you to set aside money to grow a cash cushion. The savings amount reduces your Weekly Spending Limit so more money is left in your bank account. This is reflected in an increase to your Available Cash.

Funds

- Money for specific purposes

- Track balances

- Contributions reduce your Weekly Spending Limit

- Contributions increase Fund balances and Available Cash each time you start a week

Savings

- Grows your cash cushion

- Do not track balances

- Contributions reduce your Weekly Spending Limit

- Contributions increase your Available Cash